Can Margin Pressures at engcon (OM:ENGCON B) Reshape the Long-Term Growth Narrative?

Reviewed by Sasha Jovanovic

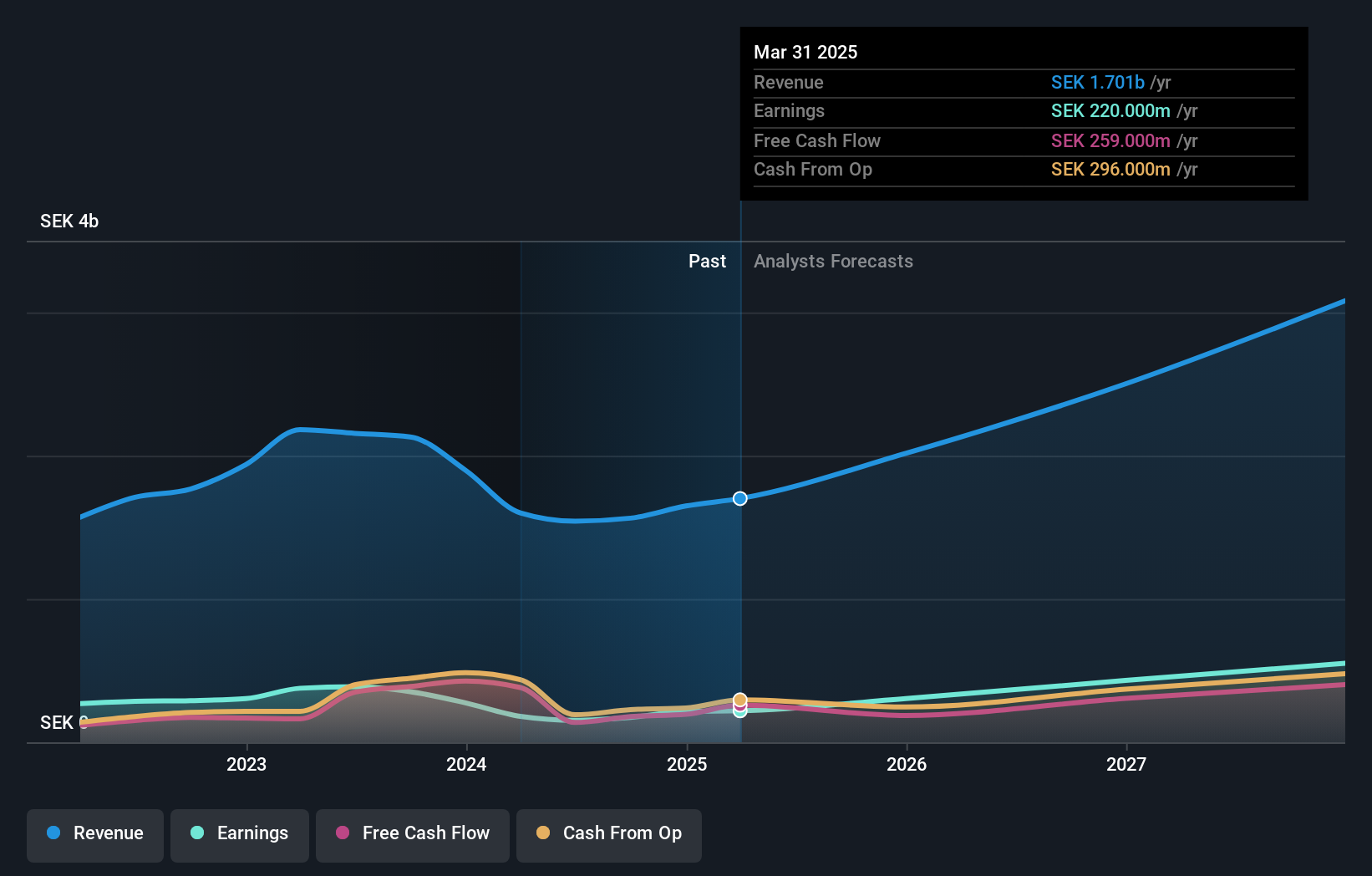

- In late October 2025, engcon AB released its third quarter and nine-month earnings, reporting SEK 415 million in sales and SEK 50 million net income for the third quarter, with annual comparisons showing slight sales growth but a decrease in quarterly net income.

- While nine-month sales and net income increased compared to the previous year, the third quarter's stronger sales were offset by margin pressures, highlighting ongoing challenges for profitability despite overall expansion.

- To assess the ongoing investment outlook, we'll examine how quarterly margin pressures from the latest earnings report impact engcon's long-term growth narrative.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

engcon Investment Narrative Recap

As a shareholder in engcon, the central belief hinges on the company’s sustained ability to drive unit volumes and expand market share through product innovation and geographic growth, while successfully converting initial entry-level sales into higher-margin ecosystem upgrades over time. The latest Q3 results showed continued sales momentum but also underscored ongoing margin pressure, reaffirming that near-term profitability remains the biggest risk and the key short-term catalyst is continued sales growth and upselling in core markets; this update does not materially shift that focus.

Among recent announcements, the integration of engcon’s tiltrotator technology with major OEMs like Develon stands out as highly relevant, as it supports faster market adoption and scale, directly feeding into the strategy of broadening the installed base and enhancing future upselling opportunities. The company’s ability to deepen such partnerships and boost aftermarket revenues will be a critical watchpoint for mitigating risks linked to margin dilution and shifts in sales mix.

Yet in contrast to the optimism around volume growth, investors should be aware that persistent margin pressure from entry-level product sales...

Read the full narrative on engcon (it's free!)

engcon's outlook anticipates SEK3.0 billion in revenue and SEK554.6 million in earnings by 2028. This is based on projected annual revenue growth of 19.3% and reflects an earnings increase of SEK320.3 million from the current level of SEK234.3 million.

Uncover how engcon's forecasts yield a SEK94.00 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Community estimates for engcon’s fair value range from SEK58.80 to SEK94 across just two perspectives on Simply Wall St. With margin pressure surfacing as a recurring concern, readers are invited to consider how differing outlooks may affect expectations for future earnings quality and share performance.

Explore 2 other fair value estimates on engcon - why the stock might be worth 29% less than the current price!

Build Your Own engcon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your engcon research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free engcon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate engcon's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ENGCON B

engcon

Engages in the design, production, and sale of excavator tools in Sweden, Denmark, Norway, Finland, rest of Europe, North and South America, Japan, South Korea, Australia, New Zealand, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives