- Sweden

- /

- Electric Utilities

- /

- OM:DE

Undiscovered European Gems with Promising Potential June 2025

Reviewed by Simply Wall St

As the European markets experience a boost with the STOXX Europe 600 Index climbing 0.90% and major stock indexes across Germany, Italy, France, and the UK showing gains, investors are increasingly optimistic about the potential for small-cap stocks amid easing inflation and supportive monetary policies. In this environment of renewed economic growth and strategic central bank actions, identifying stocks with strong fundamentals and innovative business models can be key to uncovering promising opportunities in Europe's dynamic market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Dekpol | 63.20% | 11.06% | 13.37% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

CTT Systems (OM:CTT)

Simply Wall St Value Rating: ★★★★★★

Overview: CTT Systems AB (publ) specializes in providing humidity control systems for aircraft across various international markets, with a market capitalization of approximately SEK2.88 billion.

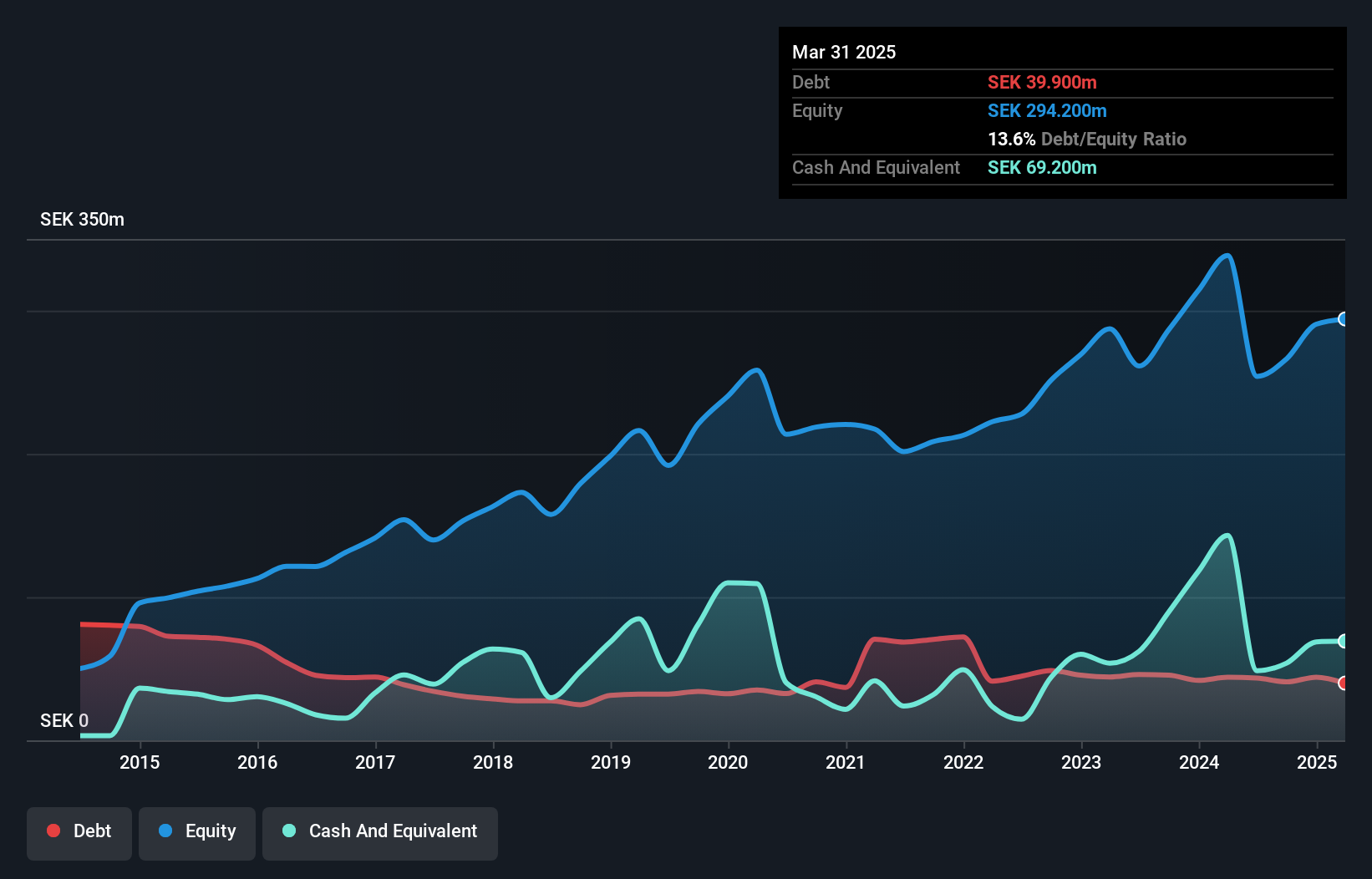

Operations: The company generates revenue primarily from its Aerospace & Defense segment, amounting to SEK278 million.

CTT Systems, a small player in the Aerospace & Defense sector, has been navigating some choppy waters recently. Despite having high-quality earnings and being profitable, its recent performance shows a dip with net income at SEK 3.7 million compared to SEK 24.5 million last year. Trading at 43% below its estimated fair value suggests potential upside if it can capitalize on future growth prospects, with earnings forecasted to grow by 34% annually. The company’s debt is well-managed as it holds more cash than total debt and interest payments are covered 18 times by EBIT, indicating solid financial health amidst industry challenges.

- Take a closer look at CTT Systems' potential here in our health report.

Explore historical data to track CTT Systems' performance over time in our Past section.

Dala Energi (OM:DE)

Simply Wall St Value Rating: ★★★★★★

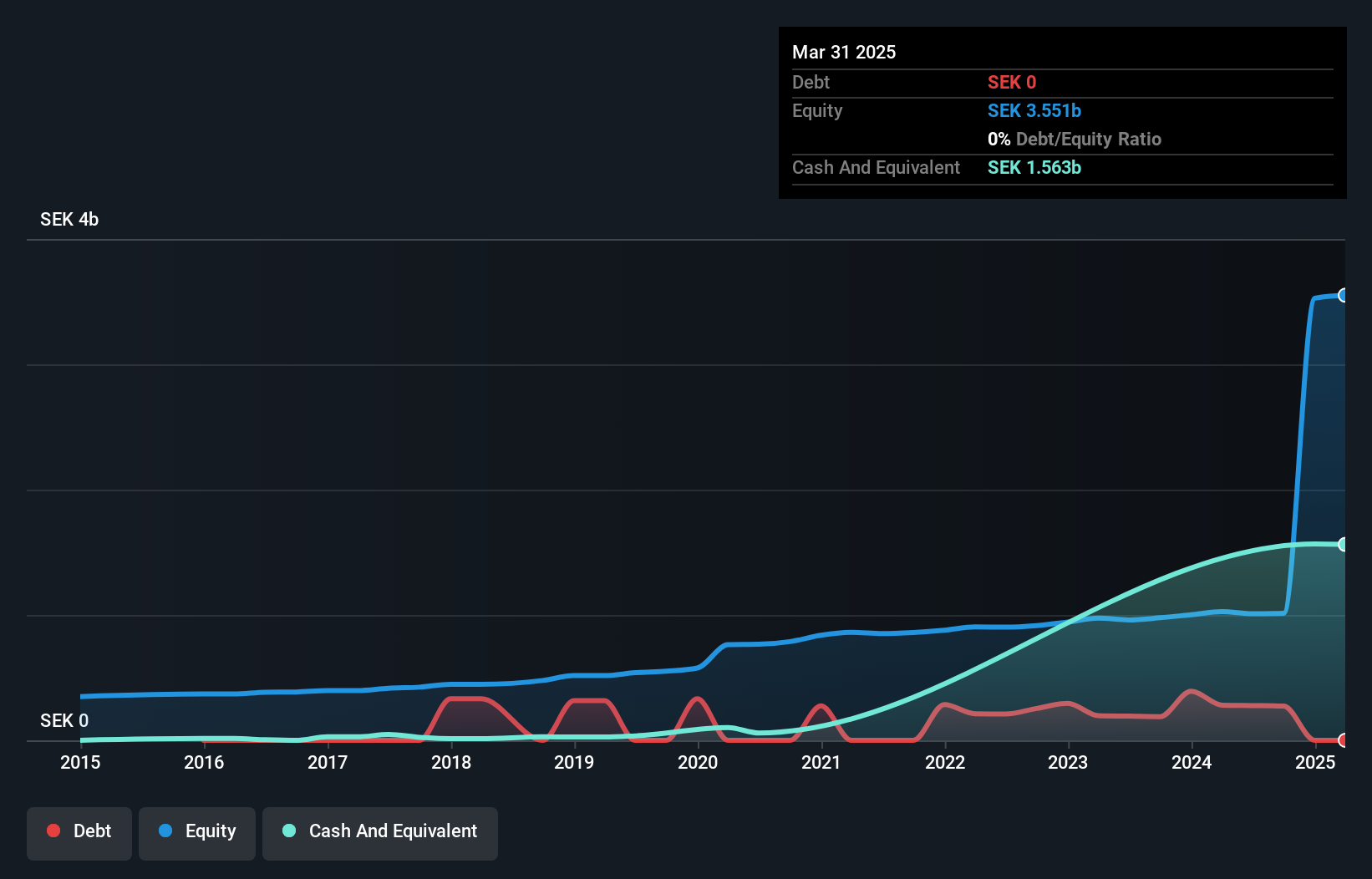

Overview: Dala Energi AB (publ) is a Swedish company that supplies electricity, heating, and fiber networks with a market cap of SEK2.68 billion.

Operations: Dala Energi generates revenue primarily from supplying electricity, heating, and fiber networks in Sweden. The company's market capitalization stands at SEK2.68 billion.

Dala Energi, a smaller player in the energy sector, recently reported a significant one-off gain of SEK 2.5 billion that skewed its financial outcomes for the year ending March 2025. Despite this boost, their earnings are expected to decrease by an average of 110% annually over the next three years. The company remains debt-free and has shown an impressive earnings growth rate of 3238% last year compared to the industry’s negative performance. With a price-to-earnings ratio of just 1x against Sweden's market average of 22.8x, it presents an intriguing valuation scenario for investors considering its recent dividend increase to SEK 2.30 per share.

- Navigate through the intricacies of Dala Energi with our comprehensive health report here.

Evaluate Dala Energi's historical performance by accessing our past performance report.

innoscripta (XTRA:1INN)

Simply Wall St Value Rating: ★★★★★☆

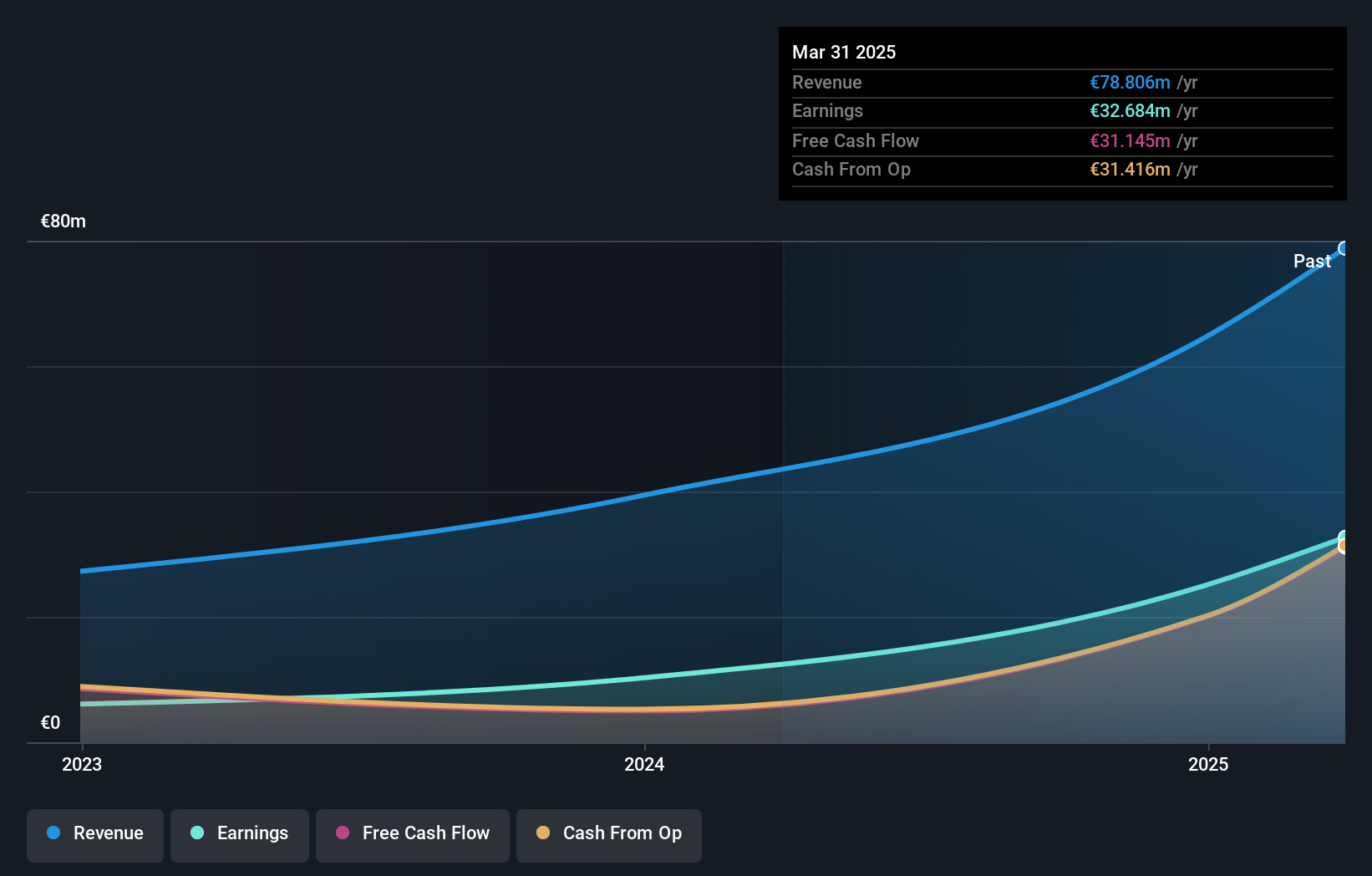

Overview: innoscripta SE offers software-as-a-service solutions focused on managing R&D tax incentives and project management consulting in Germany, with a market capitalization of €999 million.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to €78.81 million. The focus on software-as-a-service for R&D tax incentives and project management consulting forms the core of its financial operations.

Innoscripta, a burgeoning player in the software industry, has recently completed an IPO raising €223.60 million with shares priced at €120 each. This company is trading at 57.8% below its estimated fair value and boasts impressive earnings growth of 134.2% over the past year, significantly outpacing the industry average of 27.2%. With high-quality earnings and more cash than total debt, Innoscripta’s financial health appears robust despite its highly illiquid shares. The firm also generated a levered free cash flow of €31.14 million as of March 2025, indicating strong operational efficiency amidst rapid expansion efforts.

- Dive into the specifics of innoscripta here with our thorough health report.

Review our historical performance report to gain insights into innoscripta's's past performance.

Seize The Opportunity

- Click through to start exploring the rest of the 326 European Undiscovered Gems With Strong Fundamentals now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:DE

Dala Energi

Operates as a supplier of electricity, heating, and fiber networks in Sweden.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives