Stock Analysis

- Sweden

- /

- Aerospace & Defense

- /

- OM:CTT

Swedish Growth Leaders With High Insider Stakes June 2024

Reviewed by Simply Wall St

As global markets experience mixed signals with regions showing varied economic data, Sweden's market remains a point of interest for investors looking for growth opportunities. In this environment, companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those closest to the business in its growth prospects and governance.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| BioArctic (OM:BIOA B) | 35.1% | 50.5% |

| Sileon (OM:SILEON) | 33.3% | 109.3% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| InCoax Networks (OM:INCOAX) | 17.9% | 104.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 53% |

| Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

| edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

| Yubico (OM:YUBICO) | 37.5% | 42.5% |

| SaveLend Group (OM:YIELD) | 24.9% | 103.4% |

Let's uncover some gems from our specialized screener.

CTT Systems (OM:CTT)

Simply Wall St Growth Rating: ★★★★★★

Overview: CTT Systems AB, based in Sweden, specializes in designing, manufacturing, and selling humidity control systems for aircraft globally, with a market capitalization of SEK 4.82 billion.

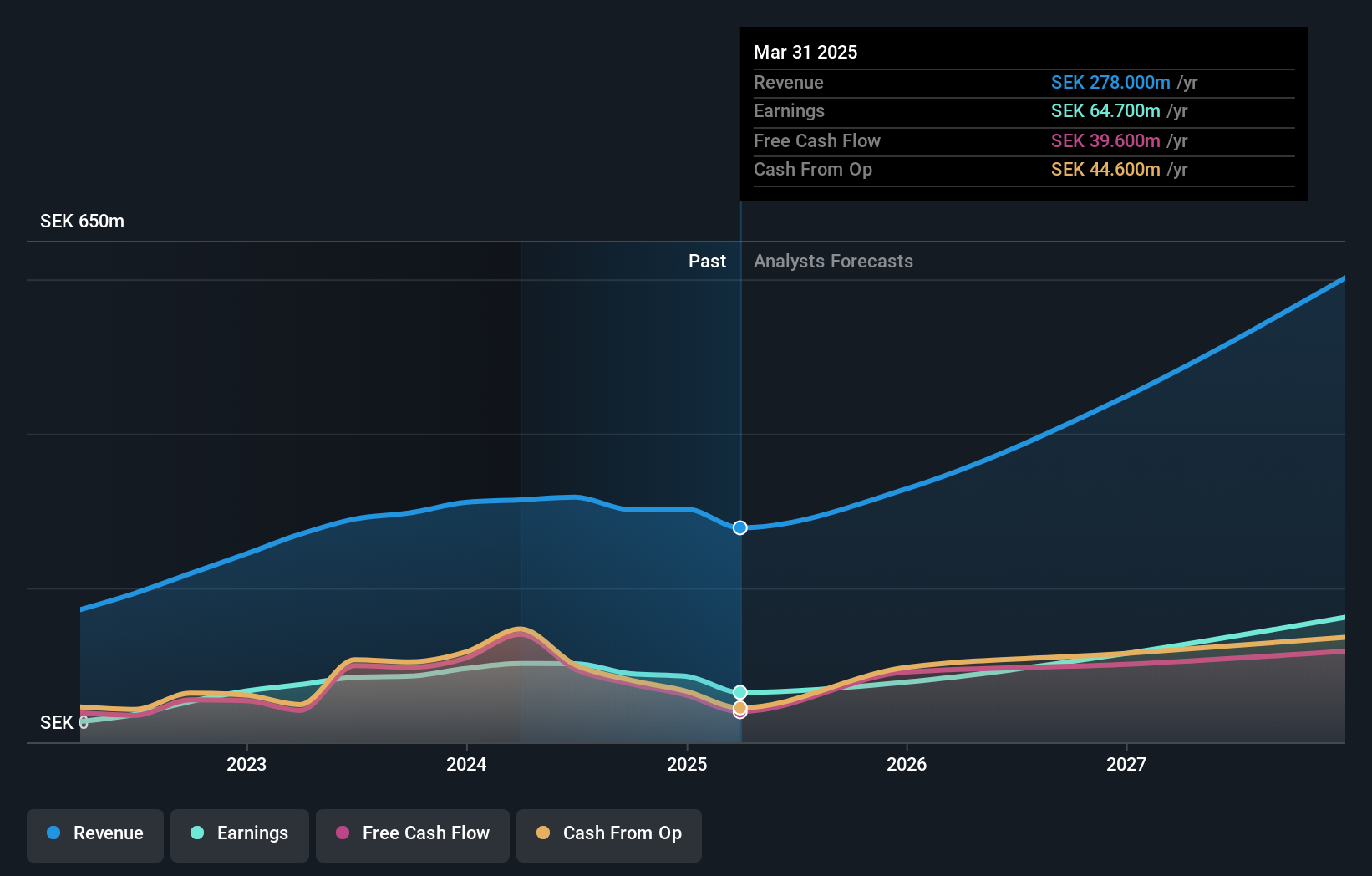

Operations: The company generates its revenue primarily from the Aerospace & Defense segment, totaling SEK 314.20 million.

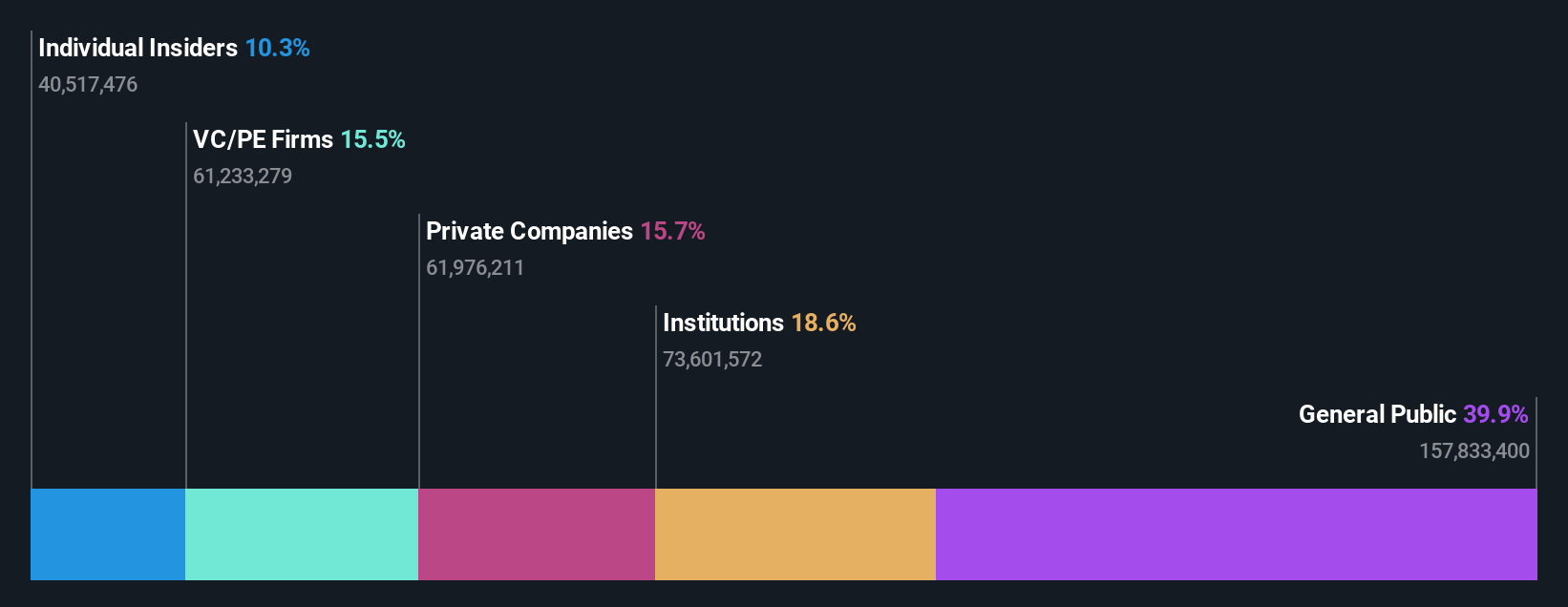

Insider Ownership: 16.9%

Return On Equity Forecast: 44% (2027 estimate)

CTT Systems, a leader in aircraft cabin humidification systems, recently showcased strong market interest at the 2024 Aircraft Interiors Show. With exclusive agreements to supply Airbus and Boeing, CTT confirmed new orders for its Humidifier Onboard Business class from several airlines. Despite an unstable dividend track record, CTT's revenue and earnings are expected to grow significantly above the Swedish market average. Insider transactions over the last three months also reflect more buying than selling by company insiders, indicating confidence in CTT's future performance.

- Unlock comprehensive insights into our analysis of CTT Systems stock in this growth report.

- Our valuation report unveils the possibility CTT Systems' shares may be trading at a premium.

Egetis Therapeutics (OM:EGTX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Egetis Therapeutics AB, a Swedish pharmaceutical company, specializes in advancing late-stage development projects aimed at treating serious diseases within the orphan drug segment, with a market capitalization of SEK 2.65 billion.

Operations: The company generates revenue primarily from its Emcitate segment, which brought in SEK 62.90 million.

Insider Ownership: 17.6%

Return On Equity Forecast: 39% (2027 estimate)

Egetis Therapeutics, amidst a challenging financial landscape with a recent net loss of SEK 75 million, continues to show promise with significant insider ownership and strategic amendments to its bylaws favoring long-term incentive plans. The company's revenue has notably increased to SEK 12.1 million this quarter and is projected to grow at an impressive rate annually. Despite shareholder dilution over the past year, Egetis is poised for profitability within three years, supported by robust participation in major industry conferences.

- Click here to discover the nuances of Egetis Therapeutics with our detailed analytical future growth report.

- The analysis detailed in our Egetis Therapeutics valuation report hints at an inflated share price compared to its estimated value.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) specializes in medical IT and cybersecurity solutions across Sweden, the United Kingdom, the Netherlands, and other European countries, with a market capitalization of approximately SEK 46.55 billion.

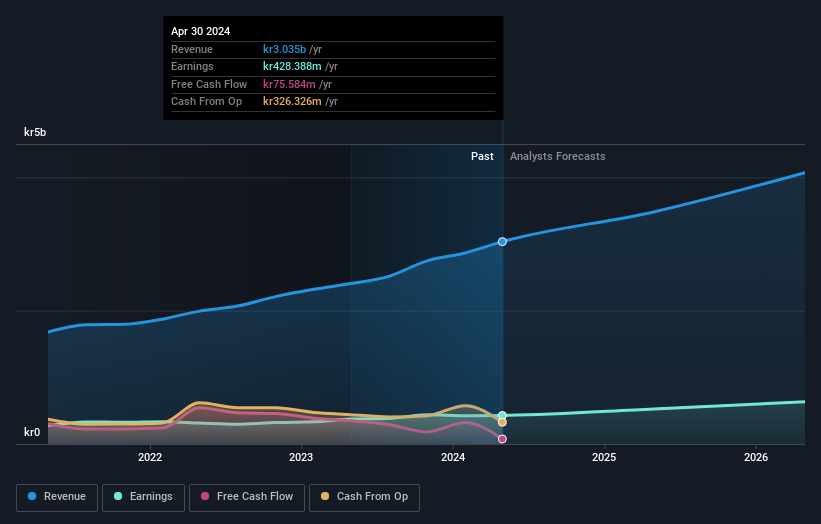

Operations: The company generates revenue primarily through its Imaging IT Solutions and Secure Communications segments, which contributed SEK 2.55 billion and SEK 367.40 million respectively, along with a smaller contribution from Business Innovation at SEK 89.90 million.

Insider Ownership: 30.3%

Return On Equity Forecast: 30% (2027 estimate)

Sectra, a Swedish company with substantial insider ownership, reported a significant increase in annual and quarterly earnings, showcasing its robust financial health. The company's revenue and net income have shown impressive growth, with recent innovations like a genomic diagnostics IT module developed with the University of Pennsylvania Health System highlighting its commitment to advancing medical technology. This innovation is expected to enhance cancer patient care significantly, demonstrating Sectra's strategic focus on integrating cutting-edge technology into healthcare.

- Dive into the specifics of Sectra here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Sectra is trading beyond its estimated value.

Next Steps

- Discover the full array of 82 Fast Growing Swedish Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether CTT Systems is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CTT

CTT Systems

Engages in the design, manufacture, and sale of humidity control systems for aircraft in Sweden, Denmark, France, the United States, and internationally.

Exceptional growth potential with flawless balance sheet.