As global markets exhibit mixed signals with tech sectors showing strength in the U.S. and broader economic uncertainties persisting, Sweden's market offers a unique perspective on growth-oriented companies. Particularly, those with high insider ownership stand out as they often demonstrate a strong alignment between management’s interests and shareholder values, which is crucial in navigating through current economic landscapes.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| Spago Nanomedical (OM:SPAGO) | 16.1% | 52.1% |

| BioArctic (OM:BIOA B) | 35.1% | 50.5% |

| Sileon (OM:SILEON) | 33.3% | 109.3% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 50.3% |

| Dignitana (OM:DIGN) | 34.6% | 139% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

| Yubico (OM:YUBICO) | 37.5% | 42.5% |

| SaveLend Group (OM:YIELD) | 24.9% | 106.8% |

We'll examine a selection from our screener results.

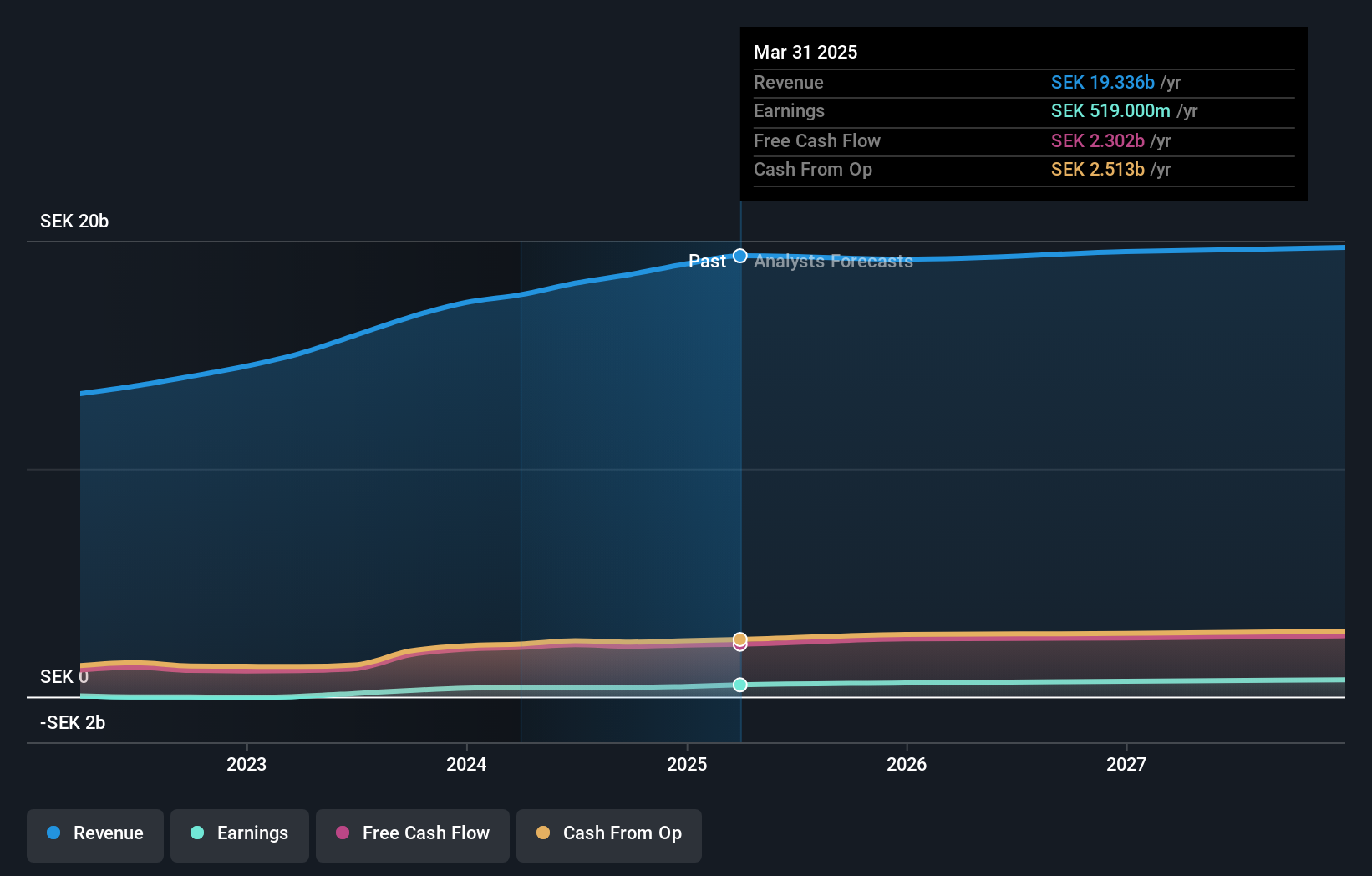

Attendo (OM:ATT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Attendo AB operates in the health and care services sector primarily in Scandinavia and Finland, with a market capitalization of approximately SEK 6.83 billion.

Operations: The company generates SEK 17.63 billion from its care and health care services segment.

Insider Ownership: 14.9%

Attendo, a Swedish growth company with high insider ownership, trades at a favorable price-to-earnings ratio of 16.6x compared to the Swedish market average of 23x, suggesting good value relative to its peers. While its revenue growth forecast of 6.8% per year is modest compared to the industry benchmark of 20%, it outpaces the broader Swedish market's 2.1% expected growth. Earnings have surged by a very large percentage over the past year and are projected to grow at an annual rate of 21.74%. However, Attendo's return on equity is expected to remain low at 9.4% in three years, and its dividend track record is unstable despite recent affirmations and share buybacks totaling SEK 86.29 million representing a modest stake increase by insiders.

- Get an in-depth perspective on Attendo's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Attendo is priced lower than what may be justified by its financials.

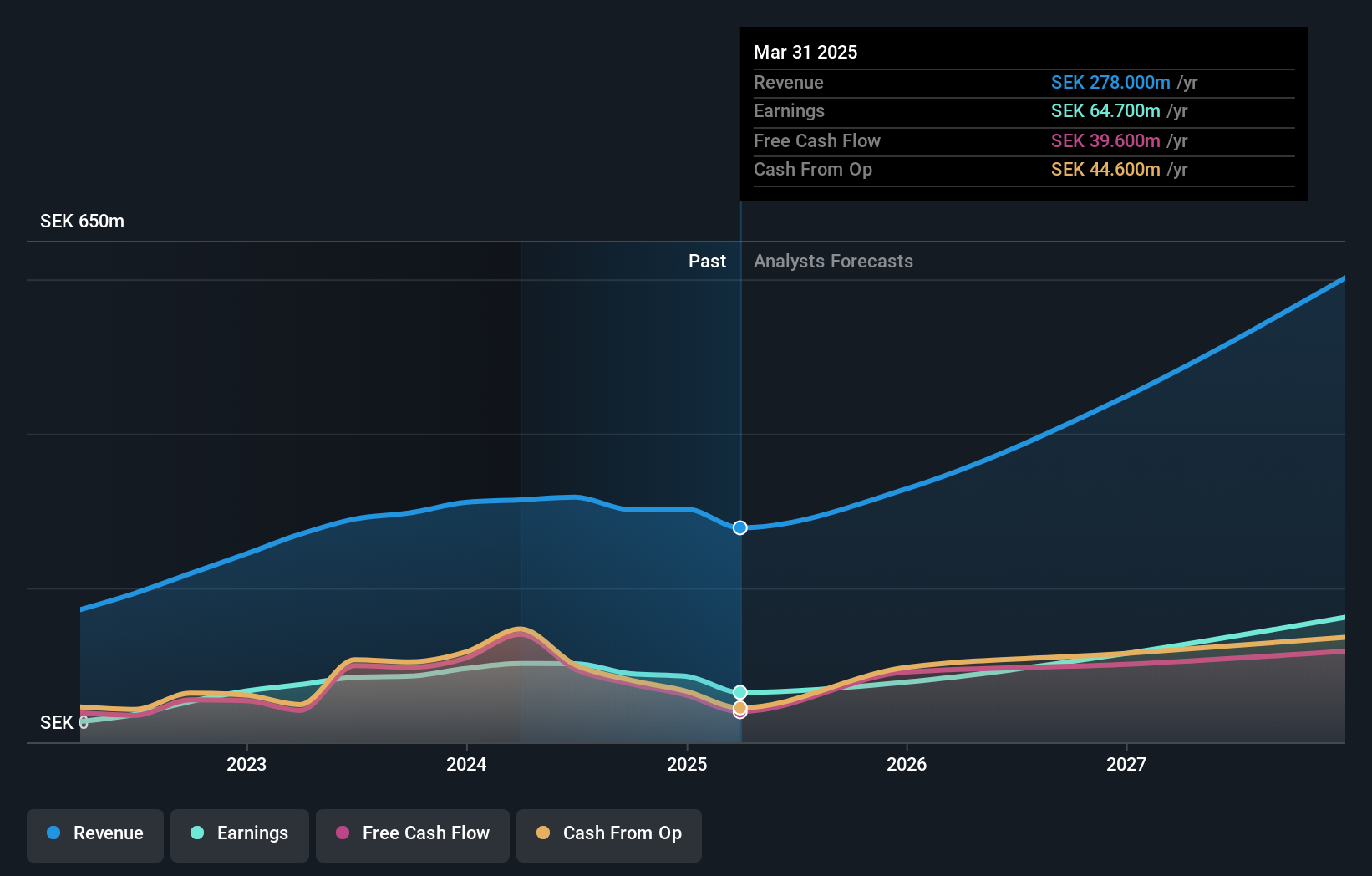

CTT Systems (OM:CTT)

Simply Wall St Growth Rating: ★★★★★★

Overview: CTT Systems AB specializes in designing, manufacturing, and selling aircraft humidity control systems across various countries including Sweden, Denmark, France, and the United States, with a market capitalization of approximately SEK 4.66 billion.

Operations: The company generates its revenue primarily from the aerospace and defense sector, totaling SEK 314.20 million.

Insider Ownership: 16.9%

CTT Systems, a Swedish growth company, exhibits promising financial trends with forecasted annual revenue and earnings growth surpassing the market average. Despite an unstable dividend track record, insider transactions show more buying than selling activity in recent months, albeit not in significant volumes. The company's Return on Equity is expected to be very high at 44.2% in three years. Recent events include dividend increases and executive board changes, indicating active corporate governance and shareholder return focus.

- Navigate through the intricacies of CTT Systems with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report CTT Systems implies its share price may be too high.

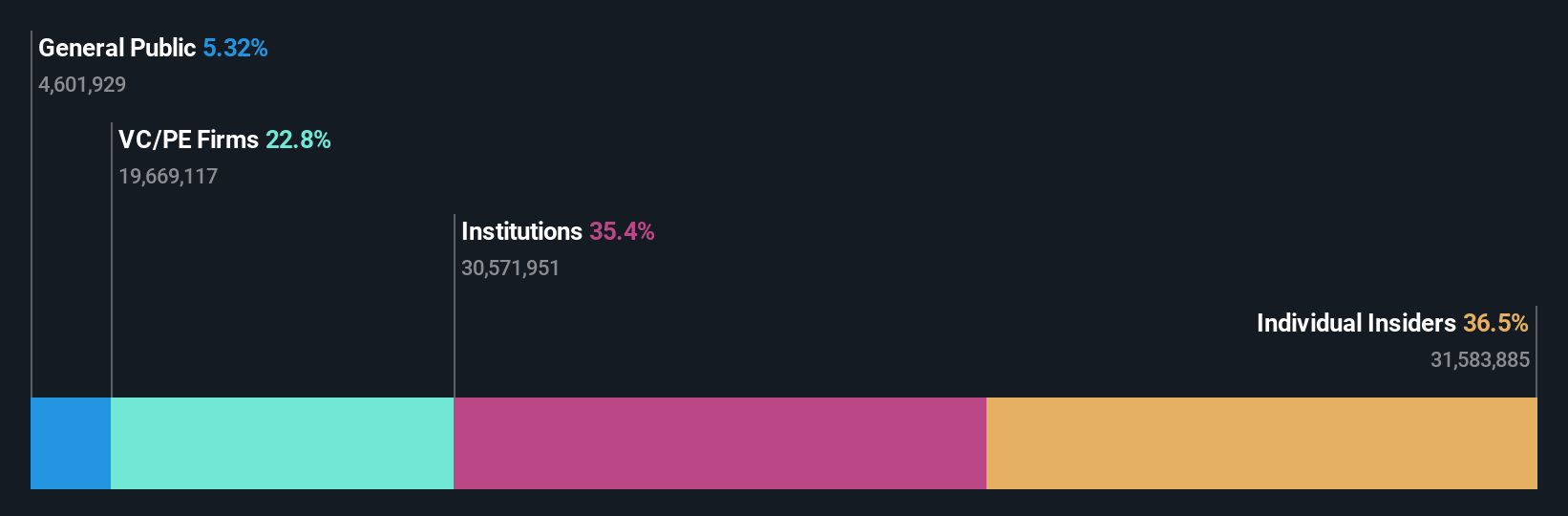

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB specializes in authentication solutions for computers, networks, and online services, with a market capitalization of approximately SEK 20.50 billion.

Operations: The company generates SEK 1.93 billion from its Security Software & Services segment.

Insider Ownership: 37.5%

Yubico, a Swedish growth company, is trading 11.4% below its estimated fair value with substantial earnings and revenue growth forecasts outpacing the market. Despite recent insider selling and shareholder dilution over the past year, Yubico's Return on Equity is expected to reach a high of 27.5% in three years. The firm recently reported strong quarterly results with significant year-over-year sales and net income increases and announced promising product updates enhancing enterprise security solutions.

- Click to explore a detailed breakdown of our findings in Yubico's earnings growth report.

- The analysis detailed in our Yubico valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Unlock more gems! Our Fast Growing Swedish Companies With High Insider Ownership screener has unearthed 84 more companies for you to explore.Click here to unveil our expertly curated list of 87 Fast Growing Swedish Companies With High Insider Ownership.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:YUBICO

Yubico

Provides authentication solutions for use in computers, networks, and online services.

Exceptional growth potential with excellent balance sheet.