As global markets grapple with economic uncertainties, the Swedish market has shown resilience, driven by strong fundamentals and strategic insider investments. In this context, high insider ownership can be a key indicator of confidence in a company's growth prospects, making it an important factor for investors to consider.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Biovica International (OM:BIOVIC B) | 18.7% | 73.8% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| Yubico (OM:YUBICO) | 37.5% | 43.8% |

| InCoax Networks (OM:INCOAX) | 18.1% | 104.9% |

| BioArctic (OM:BIOA B) | 34% | 104.2% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| edyoutec (NGM:EDYOU) | 13.4% | 63.1% |

| SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Absolent Air Care Group (OM:ABSO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Absolent Air Care Group AB (publ) designs, develops, sells, installs, and maintains air filtration units with a market cap of SEK3.66 billion.

Operations: The company generates revenue primarily from two segments: Industrial (SEK1140.20 million) and Commercial Kitchen (SEK281.66 million).

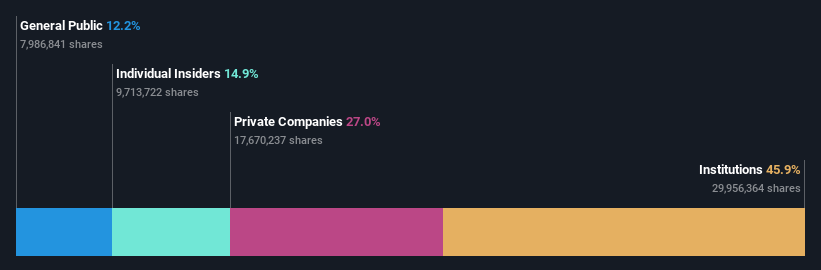

Insider Ownership: 13.8%

Earnings Growth Forecast: 18.8% p.a.

Absolent Air Care Group, a Swedish growth company with high insider ownership, is experiencing moderate earnings growth and robust revenue expansion. The company's revenue is forecast to grow at 10% annually, outpacing the Swedish market's 1.1%. Despite recent CEO resignation news, Absolent reported solid financials for Q2 2024 with SEK 367.44 million in sales and SEK 40.35 million net income. Insiders have substantially bought more shares than sold over the past three months.

- Click here to discover the nuances of Absolent Air Care Group with our detailed analytical future growth report.

- Our expertly prepared valuation report Absolent Air Care Group implies its share price may be too high.

CTT Systems (OM:CTT)

Simply Wall St Growth Rating: ★★★★★★

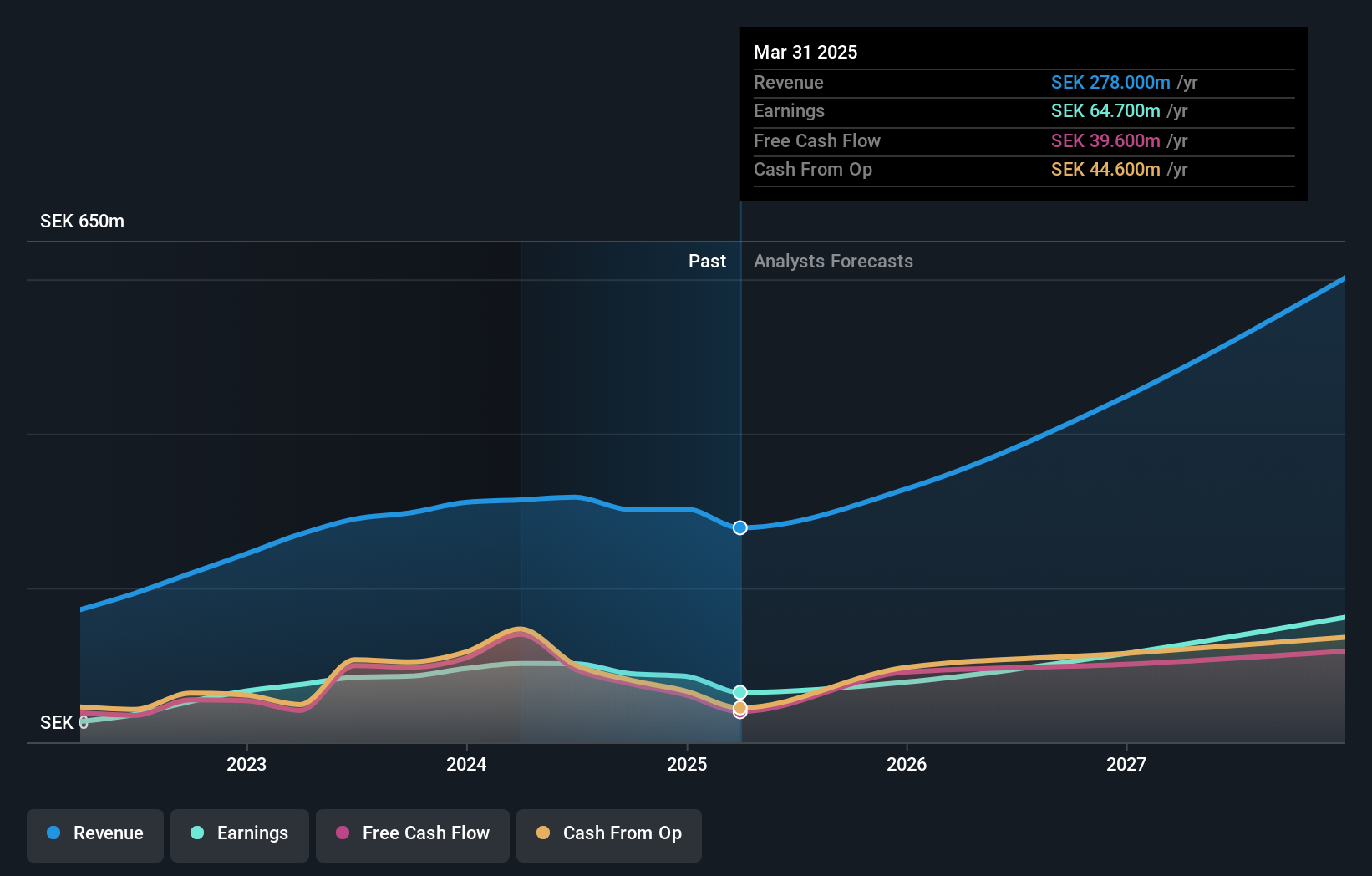

Overview: CTT Systems AB (publ) designs, manufactures, and sells humidity control systems for aircraft in Sweden, Denmark, France, the United States, and internationally with a market cap of SEK3.31 billion.

Operations: The company's revenue segment includes Aerospace & Defense, which generated SEK317.70 million.

Insider Ownership: 16.9%

Earnings Growth Forecast: 24.8% p.a.

CTT Systems, a Swedish growth company with high insider ownership, is forecast to achieve significant earnings growth of 24.8% annually and revenue expansion of 21.9% per year, outpacing the Swedish market. Recent Q2 results showed net income of SEK 24.6 million on sales of SEK 83.1 million. The company received substantial airline orders for its humidifiers at the Aircraft Interiors Show, reinforcing its strong market position in aviation technology solutions.

- Click here and access our complete growth analysis report to understand the dynamics of CTT Systems.

- Our valuation report unveils the possibility CTT Systems' shares may be trading at a discount.

Scandi Standard (OM:SCST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Scandi Standard AB (publ) produces and sells chilled, frozen, and ready-to-eat chicken products across Sweden, Norway, Ireland, Denmark, Finland, Germany, the United Kingdom, rest of Europe, and internationally with a market cap of SEK5.23 billion.

Operations: Scandi Standard's revenue segments include Ready-To-Cook products at SEK9.70 billion and Ready-To-Eat products at SEK2.61 billion.

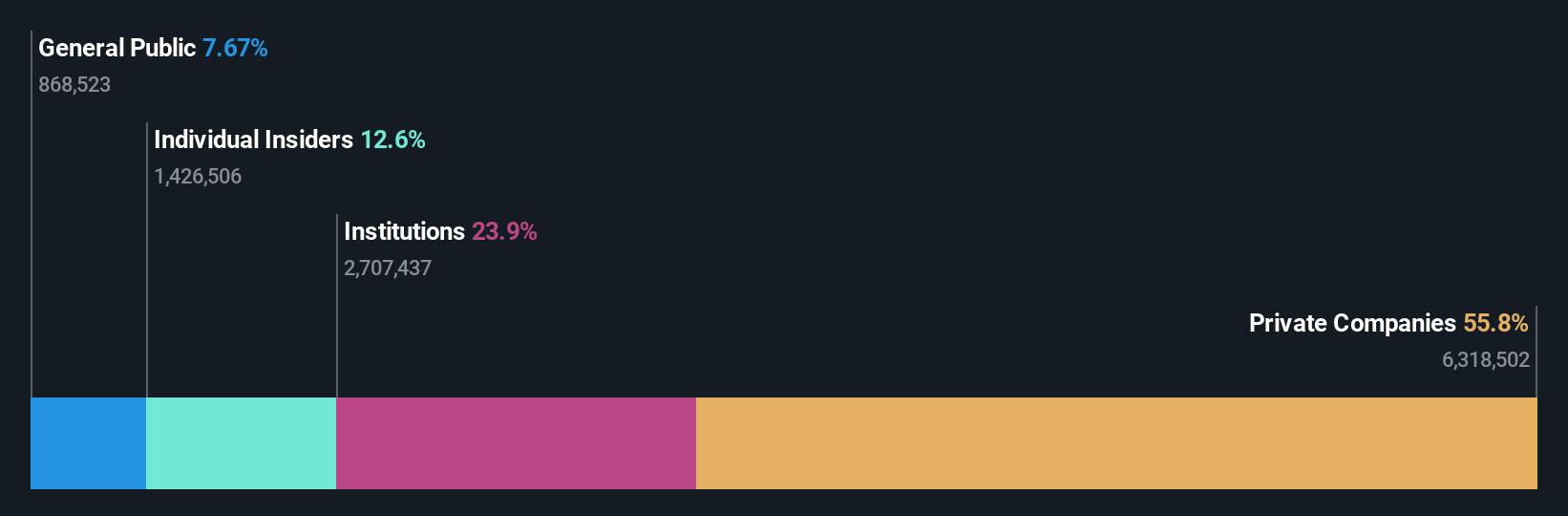

Insider Ownership: 14.6%

Earnings Growth Forecast: 20.4% p.a.

Scandi Standard, with substantial insider buying in the past three months, is trading at 50.5% below its estimated fair value. The company recently secured a SEK 3,200 million sustainability-linked bank loan to support its growth ambitions. Despite a high level of debt, earnings are forecast to grow significantly at 20.39% annually over the next three years, outpacing the Swedish market's growth rate of 15.8%. Recent Q2 results showed stable net income and earnings per share compared to last year.

- Click to explore a detailed breakdown of our findings in Scandi Standard's earnings growth report.

- Our comprehensive valuation report raises the possibility that Scandi Standard is priced lower than what may be justified by its financials.

Key Takeaways

- Click through to start exploring the rest of the 85 Fast Growing Swedish Companies With High Insider Ownership now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SCST

Scandi Standard

Produces and sells chilled, frozen, and ready-to-eat chicken products in Sweden, Norway, Ireland, Denmark, Finland, Germany, the United Kingdom, rest of Europe, and internationally.

Good value with reasonable growth potential.