Is Beijer Alma (OM:BEIA B) Trading Margin Growth for Revenue Expansion?

Reviewed by Sasha Jovanovic

- Beijer Alma AB reported its third quarter and nine-month earnings for 2025, with sales rising to SEK 1,886 million in Q3 but net income dropping to SEK 176 million compared to last year.

- This combination of higher revenues but sharply lower profitability highlights pressure on the company’s margins and operational efficiency despite top-line growth.

- We’ll now examine how declining net income alongside sales growth may shape Beijer Alma’s broader investment narrative and future outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Beijer Alma Investment Narrative Recap

To believe in Beijer Alma as a shareholder is to have confidence that the company's niche in precision components and its expansion into growth sectors can offset cyclical pressures and margin headwinds, particularly in the Nordics and US. The recent Q3 results, with growing sales but sharply reduced net income, have amplified concerns about profit margins. These results do not appear to materially change the major short-term catalysts, such as ongoing automation projects, though they do heighten attention to risks from operational concentration and earnings volatility. Of the recent announcements, Beijer Alma’s executive transition, specifically the appointment of Oscar Fredell as CEO by Q4 2025, stands out as most relevant. A new leadership team could shape how the company adapts to pressing margin challenges and capitalizes on automation and sustainability trends, both key to its short-term and long-term goals. In contrast, investors should be aware of the ongoing struggles integrating Alcomex, as these restructuring costs could continue to...

Read the full narrative on Beijer Alma (it's free!)

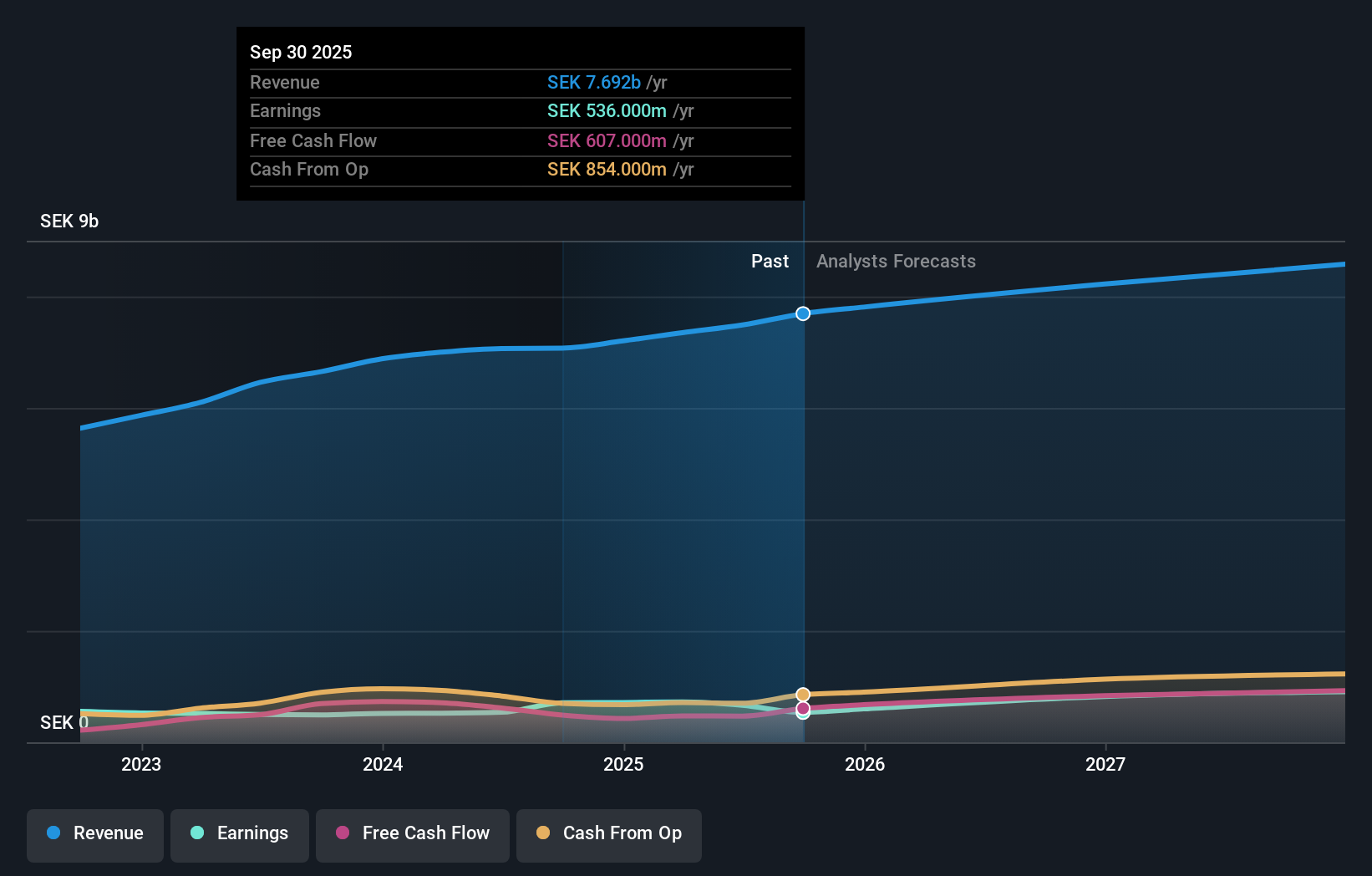

Beijer Alma's outlook anticipates SEK 8.7 billion in revenue and SEK 1.0 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 5.2% and a SEK 336 million increase in earnings from the current SEK 664 million.

Uncover how Beijer Alma's forecasts yield a SEK305.00 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Private members of the Simply Wall St Community have published two fair value estimates for Beijer Alma AB, ranging from SEK305 to SEK343 per share. While opinions differ widely, many participants point to ongoing margin pressure from integration difficulties as a key theme influencing the company's future earnings profile.

Explore 2 other fair value estimates on Beijer Alma - why the stock might be worth just SEK305.00!

Build Your Own Beijer Alma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Beijer Alma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Beijer Alma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Beijer Alma's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijer Alma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BEIA B

Beijer Alma

Engages in component manufacturing and industrial trading businesses in Sweden, rest of Nordic Region, rest of Europe, North America, Asia, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives