Does ASSA ABLOY’s Digital Expansion Signal a Good Entry Point in 2025?

Reviewed by Bailey Pemberton

- Curious about whether ASSA ABLOY is a bargain or overpriced in today’s market? Let’s dive straight into what you need to know, especially if you’re searching for quality stocks at the right price.

- ASSA ABLOY’s share price has climbed 88.5% over the past five years and is up 7.5% year to date, with smaller moves of 0.2% this week and a dip of -2.6% in the past month. These recent movements hint at some market uncertainty.

- Recently, ASSA ABLOY has caught attention from investors after securing strategic acquisitions in the access solutions sector and expanding its digital and security offerings. This activity has sparked conversations about the company’s ability to capture growth in both mature and emerging markets, which may be contributing to the latest price movements.

- According to our checks, ASSA ABLOY scores a 4 out of 6 on key undervaluation measures, so it is neither an obvious bargain nor completely overvalued. In the next sections, we will break down the usual valuation approaches and at the end, introduce a different way of tying it all together for smarter stock decisions.

Approach 1: ASSA ABLOY Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and discounting them back to today’s value. This approach helps determine whether a stock’s current price reflects its expected long-term performance based on underlying cash generation.

For ASSA ABLOY, the latest twelve months' free cash flow was SEK 18.8 billion. Analysts forecast steady growth, with projections reaching SEK 25.4 billion by 2029. After five years, projections shift from analyst estimates to Simply Wall St’s own extrapolations, reflecting the uncertainty inherent in longer-term outlooks.

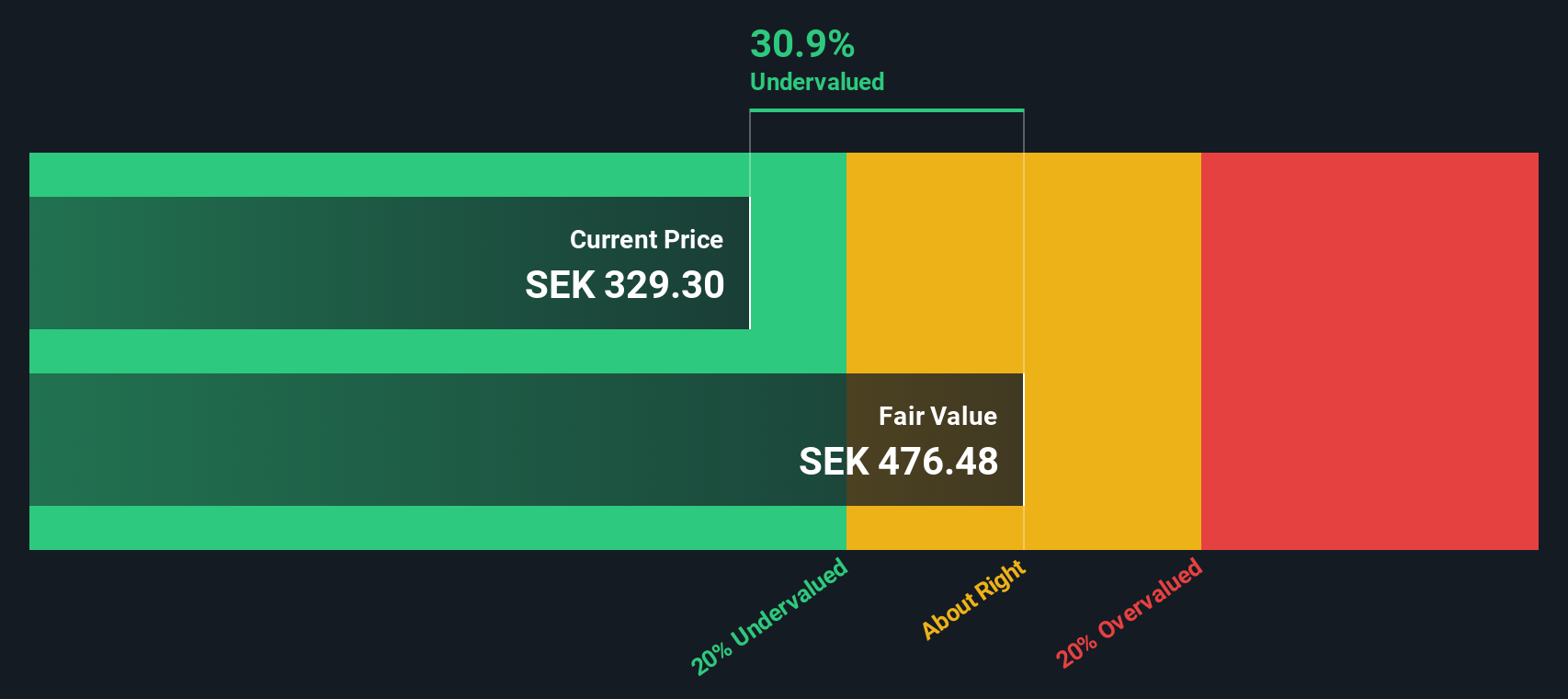

Using this two-stage Free Cash Flow to Equity model, the calculated intrinsic value per share is SEK 479.04. This figure suggests the stock is currently trading at a 26.5% discount to its estimated fair value. Such a margin indicates the DCF view considers ASSA ABLOY to be notably undervalued in the market today.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ASSA ABLOY is undervalued by 26.5%. Track this in your watchlist or portfolio, or discover 924 more undervalued stocks based on cash flows.

Approach 2: ASSA ABLOY Price vs Earnings

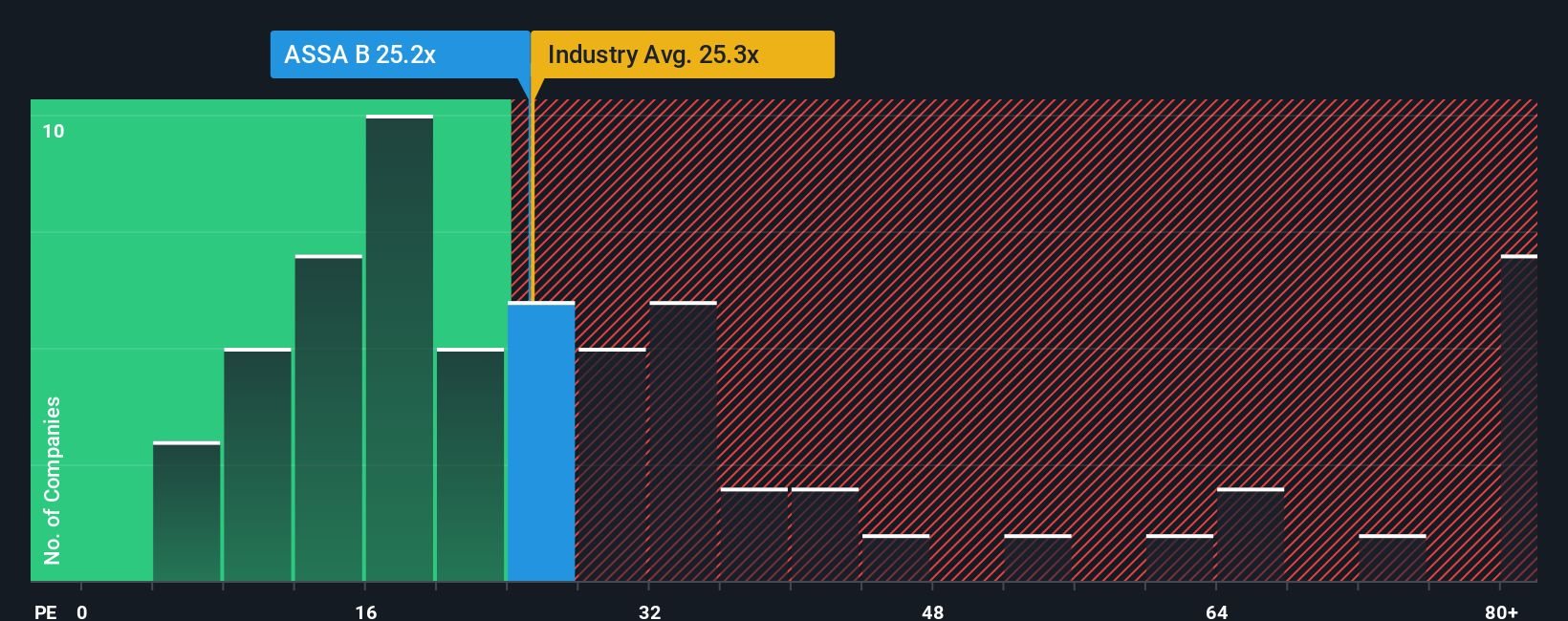

For profitable companies like ASSA ABLOY, the Price-to-Earnings (PE) ratio is a widely used valuation metric. It relates a company’s share price to its earnings per share, providing a quick sense of how much investors are willing to pay for each unit of current profit. A “normal” or “fair” PE will vary based on the company’s growth outlook and risk profile, since higher expected growth or lower risk typically justify a higher multiple.

Currently, ASSA ABLOY trades at a PE ratio of 26.7x. This is below the average for its close peers at 28.2x, but above the broader Building industry average of 19.0x. Such a position suggests that while the market values ASSA ABLOY’s earnings more highly than most of its industry peers, it is not at the upper end of the peer range.

To provide a more nuanced view than simply comparing with industry or peer benchmarks, Simply Wall St’s proprietary “Fair Ratio” estimates what the PE should be given the company’s growth, profit margin, market cap, industry, and risk factors. For ASSA ABLOY, the Fair Ratio is calculated at 29.2x, reflecting those strengths. This approach is more sophisticated than basic comparisons, as it takes into account the company’s unique characteristics and outlook, not just surface-level multiples.

Comparing ASSA ABLOY’s actual PE of 26.7x to its Fair Ratio of 29.2x, the stock trades below what might be expected given its profile. This suggests the market may be underappreciating the company’s true earnings potential relative to its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ASSA ABLOY Narrative

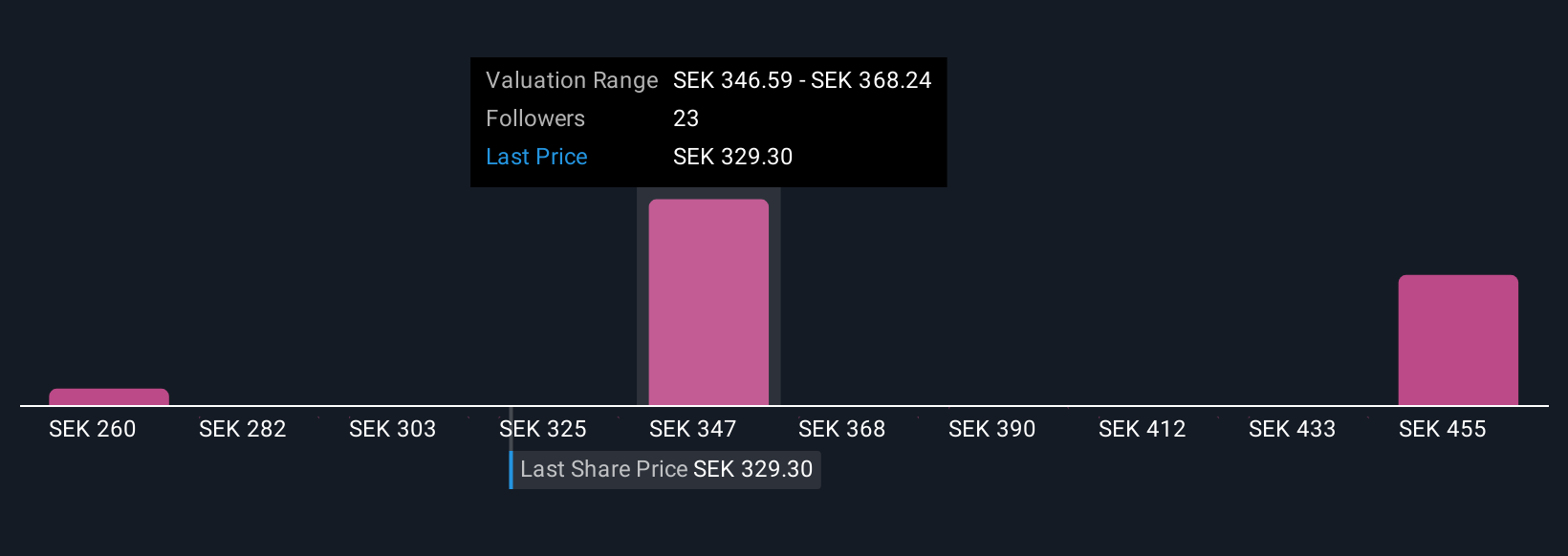

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your own investment story about a company, connecting the “why” behind the numbers you see, and allowing you to embed your assumptions, such as future revenue, margin, or fair value, directly into a personalized forecast.

Narratives link a company’s real-world story to its financial future and then to a fair value, helping you capture your outlook and see at a glance how your expectations compare with the market. On Simply Wall St’s Community page, millions of investors use Narratives as a simple and accessible tool to build and update their own perspectives, with each Narrative updating automatically when new news, earnings, or relevant events occur.

This approach lets you decide when to buy or sell by directly comparing your Narrative’s Fair Value to the current share price, adding a personal dimension to your investment decisions. For ASSA ABLOY, one Narrative may predict strong growth from digital security and see a fair value above SEK 400, while another might be cautious about integration risks and slower digital take-up, estimating a fair value closer to SEK 310.

Ultimately, Narratives allow you to express what you believe, sense check analyst forecasts, and adjust your view quickly as new information emerges. This empowers smarter, story-driven investment choices.

Do you think there's more to the story for ASSA ABLOY? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ASSA B

ASSA ABLOY

Provides door opening and access products for the institutional, commercial, and residential markets.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success