Alfa Laval (OM:ALFA) Valuation in Focus After Raised Guidance and Strong 2025 Results

Reviewed by Simply Wall St

Alfa Laval (OM:ALFA) just delivered higher sales and net income for both the third quarter and year to date in 2025. The company also raised its annual sales growth guidance, which signals optimism for continued progress.

See our latest analysis for Alfa Laval.

Alfa Laval’s recent mix of strong earnings, upgraded sales guidance, and a new innovation-focused partnership with Lund University have kept investors focused on the company’s growth potential. While the share price has dipped 3.6% year-to-date, its three-year total shareholder return of 71% paints a much stronger long-term picture. Momentum remains firmly in play for those looking beyond daily moves.

If you’re curious what other companies might have similar growth stories, now is a great opportunity to explore fast growing stocks with high insider ownership.

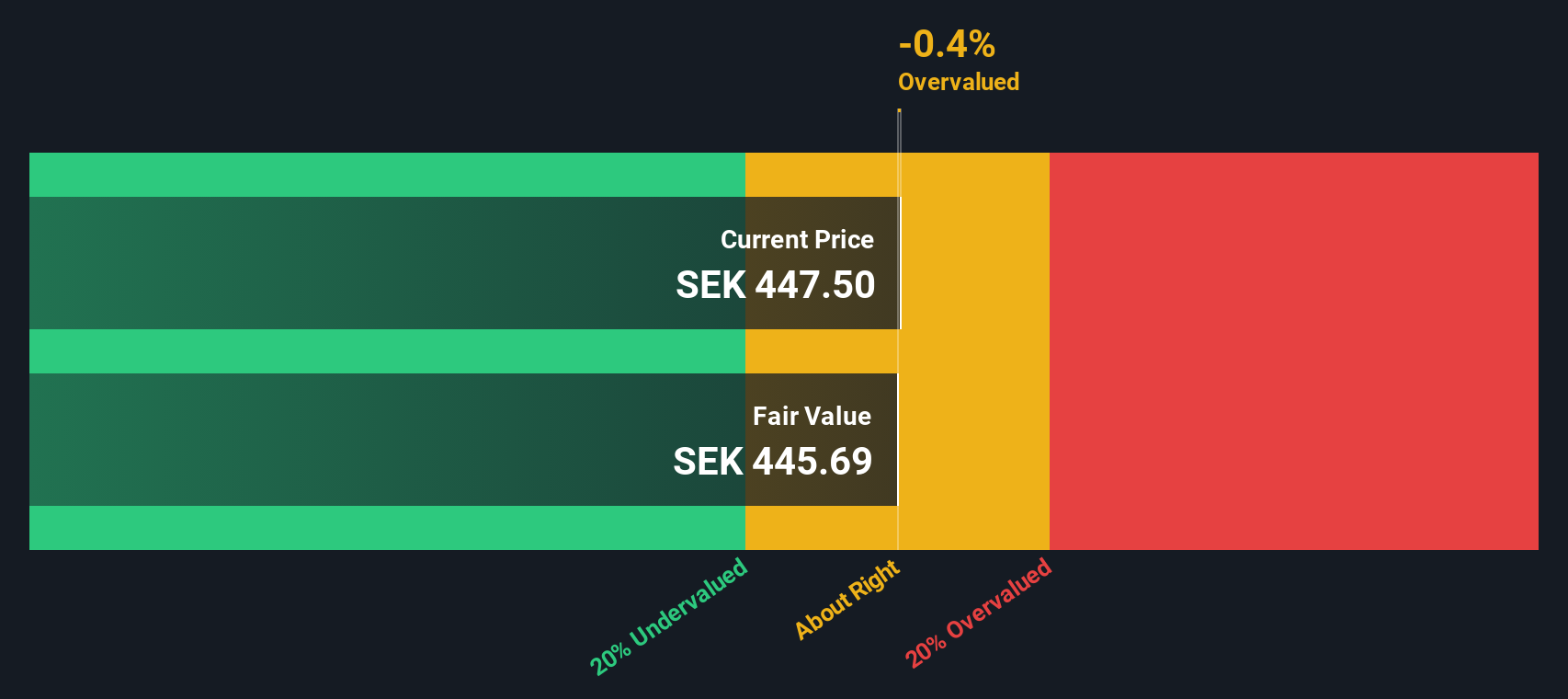

The key question now is whether Alfa Laval’s recent momentum and improved forecasts are truly reflected in its current valuation, or if there is still room for investors to benefit from further upside in the period ahead.

Most Popular Narrative: 0% Overvalued

With Alfa Laval’s widely followed narrative fair value at SEK 452.29 and the last close at SEK 454.00, there is nearly no gap between price and perceived worth. This close alignment draws attention to the fine line between upside potential and current expectations.

The strategic shift towards service-oriented offerings is delivering all-time-high service order intake, now above 30% of group sales and 40% in Marine. This is structurally increasing the stable, high-margin, recurring revenue base, thereby supporting long-term margin expansion and greater earnings resilience.

Curious what assumptions power this razor-thin fair value? The narrative builds its outlook on future profit margins and a premium earnings multiple. Which bold forecasts turn today’s price into a story of operational transformation and growth potential? The full breakdown is just a click away.

Result: Fair Value of SEK 452.29 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks such as macroeconomic uncertainty and supply chain issues could challenge Alfa Laval’s optimistic forecasts in the coming quarters.

Find out about the key risks to this Alfa Laval narrative.

Another View: Discounted Cash Flow Offers a New Angle

While market multiples show Alfa Laval as fairly valued next to industry peers, our DCF model points in a different direction. The SWS DCF model values Alfa Laval at SEK 514.23, which suggests the stock might actually be undervalued by 11.7%. Could this model be seeing hidden upside that others are missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Alfa Laval Narrative

If you see the story unfolding differently or would rather dig into the numbers yourself, creating your own Alfa Laval narrative takes just minutes. Do it your way.

A great starting point for your Alfa Laval research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Now is the time to take charge of your investing journey and seize opportunities that match your strategy. Do not let the next breakthrough pass you by.

- Tap into potential market leaders by browsing these 836 undervalued stocks based on cash flows that are poised for strong returns, supported by robust fundamentals and attractive entry points.

- Unlock the future of medicine by reviewing these 33 healthcare AI stocks which are shaping tomorrow’s healthcare through AI-driven diagnostics and innovative treatments.

- Fuel your portfolio’s growth with income-generating powerhouses among these 20 dividend stocks with yields > 3% featuring yields above 3 percent and solid track records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ALFA

Alfa Laval

Provides heat transfer, separation, and fluid handling products and solutions worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives