Absolent Air Care (OM:ABSO) Margin Miss Challenges Bullish Growth Narrative Ahead of Earnings Season

Reviewed by Simply Wall St

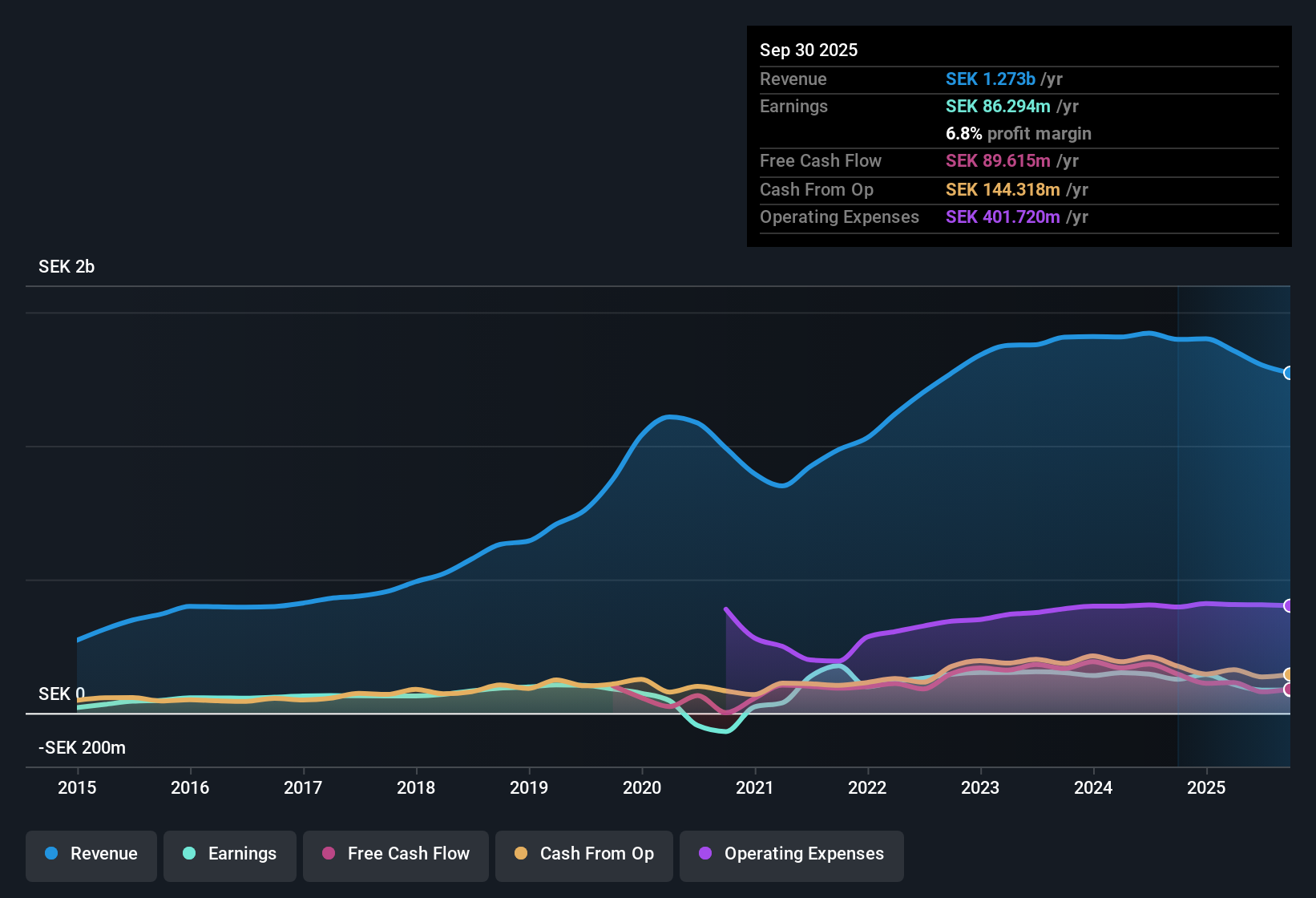

Absolent Air Care Group (OM:ABSO) posted a net profit margin of 6.8%, down from 9% last year, as annual earnings declined after five years of steady 12.1% per year growth. While the company's price-to-earnings ratio stands at 27.9x, topping both the European Building industry and peer averages, market optimism is evident as forecasts point to robust profit growth of 43.6% per year and revenue expansion of 11.2% per year, outpacing local industry estimates. Investors are weighing the strong growth outlook and good value characteristics against a premium valuation as earnings season approaches.

See our full analysis for Absolent Air Care Group.Now, we will see how these headline numbers stack up to the big-picture narratives circulating in the community and where the story might challenge expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Compress Despite High-Quality Track Record

- Absolent Air Care Group posted a net profit margin of 6.8%, notable for being below last year's margin of 9%. The company remains profitable following five consecutive years of 12.1% annual earnings growth.

- Although the company retains a high-quality earnings history, the prevailing market view stresses that a drop in margins puts pressure on the bullish case for ongoing operational leverage.

- The expected turnaround, with forecasts for 43.6% annual earnings growth, relies on reversing this recent margin weakness.

- Investors watching for a return to prior margin levels may be encouraged by the company’s five-year track record, but near-term performance highlights execution sensitivity.

DCF Signals Undervalued, But Premium to Peers

- Absolent's current share price of 213.00 trades well below its DCF fair value estimate of 464.74. Its 27.9x price-to-earnings ratio is higher than both the European Building industry average (26.9x) and peer group (18.1x).

- This contrast, per the prevailing market view, heavily supports investors questioning whether recent premium multiples are justified or if the company offers hidden value overlooked by the market.

- High valuation multiples show optimism but may also limit further share price upside unless growth materializes as projected.

- Trading below estimated fair value, however, could flag the stock as a potential opportunity for value-focused investors willing to look past industry comparables.

Growth Outlook Outpaces Industry Trends

- Looking forward, Absolent is forecast to grow revenue 11.2% and earnings 43.6% annually, well ahead of expected Swedish market growth rates in the sector.

- The prevailing market view draws attention to the fact that while aggressive forecasts may justify higher multiples, the actual delivery on this guidance will be closely watched by investors seeking proof of lasting competitive advantage.

- Sustained outperformance relies on capturing market share as competitors ramp up innovation, especially amid strengthening ESG and regulatory tailwinds.

- Execution risks remain. Future stock moves hinge not on momentum alone but on whether management can consistently convert robust forecasts into tangible results.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Absolent Air Care Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Absolent’s premium valuation and compressed margins create concerns about sustaining future growth, investors face execution risks and possible limited upside if forecasts are missed.

If you want more consistency and fewer surprises, use our stable growth stocks screener (2083 results) to focus on companies that are steadily growing revenue and earnings across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ABSO

Absolent Air Care Group

Designs, develops, sells, installs, and maintains air filtration units.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives