Drop in Net Interest Income Might Change the Case for Investing in Swedbank (OM:SWED A)

Reviewed by Sasha Jovanovic

- Swedbank AB reported its third-quarter 2025 results, with net interest income of SEK10.82 billion and net income of SEK8.51 billion, both lower than the prior year period.

- This decrease in quarterly earnings comes at a time when analysts have been debating the sustainability of Swedbank’s revenue growth and profit margins.

- We’ll take a closer look at how the lower net interest income influences Swedbank’s current investment narrative and future outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Swedbank Investment Narrative Recap

To own Swedbank stock, investors need confidence in the bank’s ability to grow profitably despite pressures on net interest income, particularly as regional rate cuts and softer demand weigh on recent results. The third-quarter earnings miss underscores persistent margin compression, which remains the biggest near-term risk, but the quarterly drop in net interest income does not fundamentally alter the main catalyst: Swedbank’s push for efficiency and digital transformation to protect earnings power.

Among recent developments, the September launch of SB1 Markets, a joint investment banking venture, stands out, offering diversification beyond traditional lending and potential new revenue streams. While this move is a step toward strengthening Swedbank’s business mix, the most immediate test for investors remains how management can offset margin pressure through ongoing operational efficiency and cost control.

However, before assuming these risks are contained, investors should be aware of the potential effects that margin pressure could continue to have on...

Read the full narrative on Swedbank (it's free!)

Swedbank's narrative projects SEK68.6 billion revenue and SEK27.6 billion earnings by 2028. This requires a 1.7% annual revenue decline and a SEK6.3 billion decrease in earnings from the current SEK33.9 billion.

Uncover how Swedbank's forecasts yield a SEK278.33 fair value, a 4% downside to its current price.

Exploring Other Perspectives

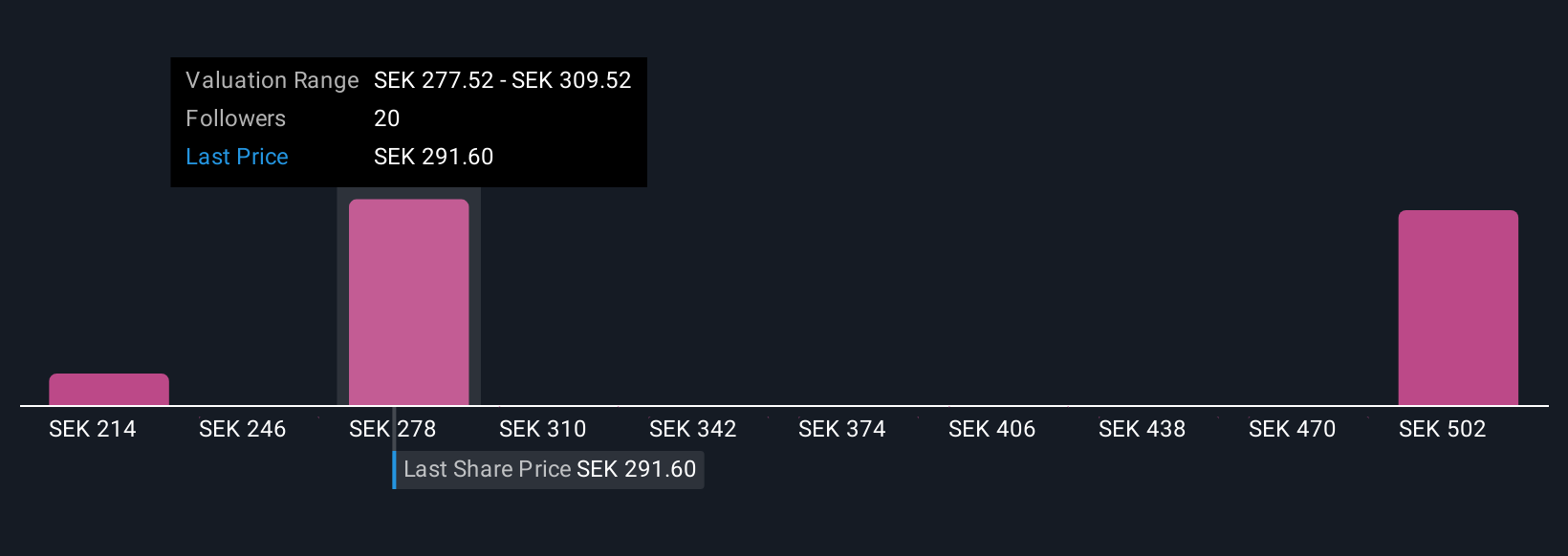

Seven members of the Simply Wall St Community assessed Swedbank’s fair value, with estimates ranging from SEK213.52 to SEK513.08 per share. While margin compression is front of mind, the range shows just how much perceptions of Swedbank’s future earnings power can vary among thoughtful investors.

Explore 7 other fair value estimates on Swedbank - why the stock might be worth 26% less than the current price!

Build Your Own Swedbank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Swedbank research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Swedbank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Swedbank's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SWED A

Swedbank

Provides various banking products and services to private and corporate customers in Sweden, Estonia, Latvia, Lithuania, Norway, the United States, Finland, Denmark, Luxembourg, and China.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives