As global markets navigate the complexities of rising oil prices and geopolitical tensions, European stocks have seen a cautious downturn, with the pan-European STOXX Europe 600 Index ending lower amid these uncertainties. In this environment, Swedish dividend stocks present an intriguing opportunity for investors seeking stability and income, as they can offer attractive yields even in challenging times.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.62% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 3.89% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.26% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.02% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.84% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.63% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.96% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 3.93% | ★★★★☆☆ |

| Afry (OM:AFRY) | 3.10% | ★★★★☆☆ |

| Bahnhof (OM:BAHN B) | 3.78% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our Top Swedish Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Bulten (OM:BULTEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bulten AB (publ) is a company that manufactures and distributes fasteners and related services for various industries, including automotive and consumer electronics, with operations in multiple countries worldwide; it has a market cap of SEK1.46 billion.

Operations: Bulten AB (publ) generates revenue of SEK5.95 billion from its fasteners and related services across various industries globally.

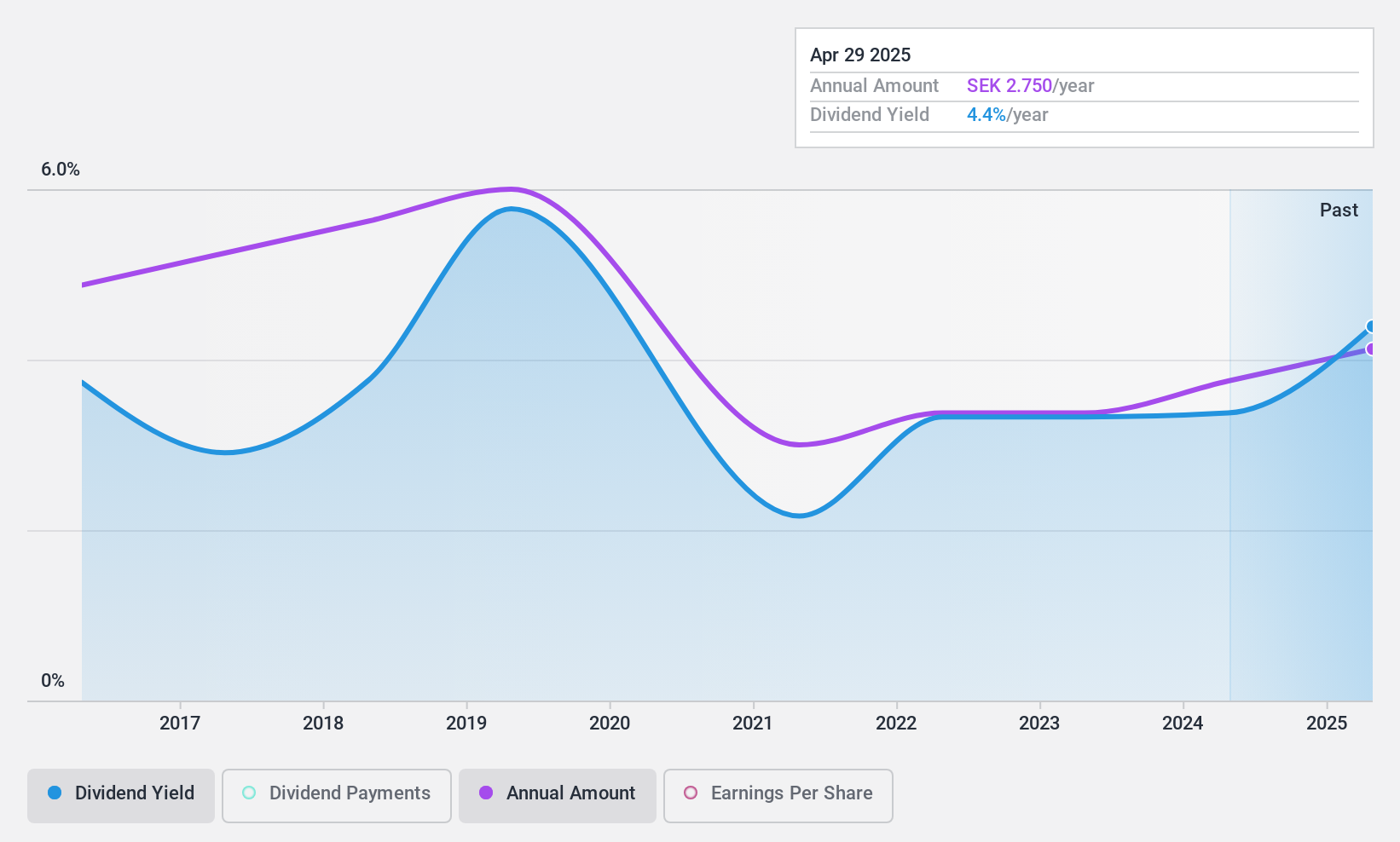

Dividend Yield: 3.6%

Bulten's dividend payments have been volatile over the past decade, with a payout ratio of 57% indicating dividends are covered by earnings. The cash payout ratio is low at 30.9%, suggesting strong cash flow coverage. However, the dividend yield of 3.59% is below the top quartile in Sweden. Bulten's P/E ratio of 15.9x suggests it may be undervalued compared to the market average of 23.5x, despite recent profit margin declines and upcoming leadership changes with Axel Berntsson as CEO in January 2025.

- Take a closer look at Bulten's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Bulten is trading beyond its estimated value.

Investment AB Öresund (OM:ORES)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Investment AB Öresund (publ) is a Swedish investment company focused on asset management, with a market capitalization of SEK5.23 billion.

Operations: Investment AB Öresund (publ) operates as an investment company engaged in asset management activities in Sweden.

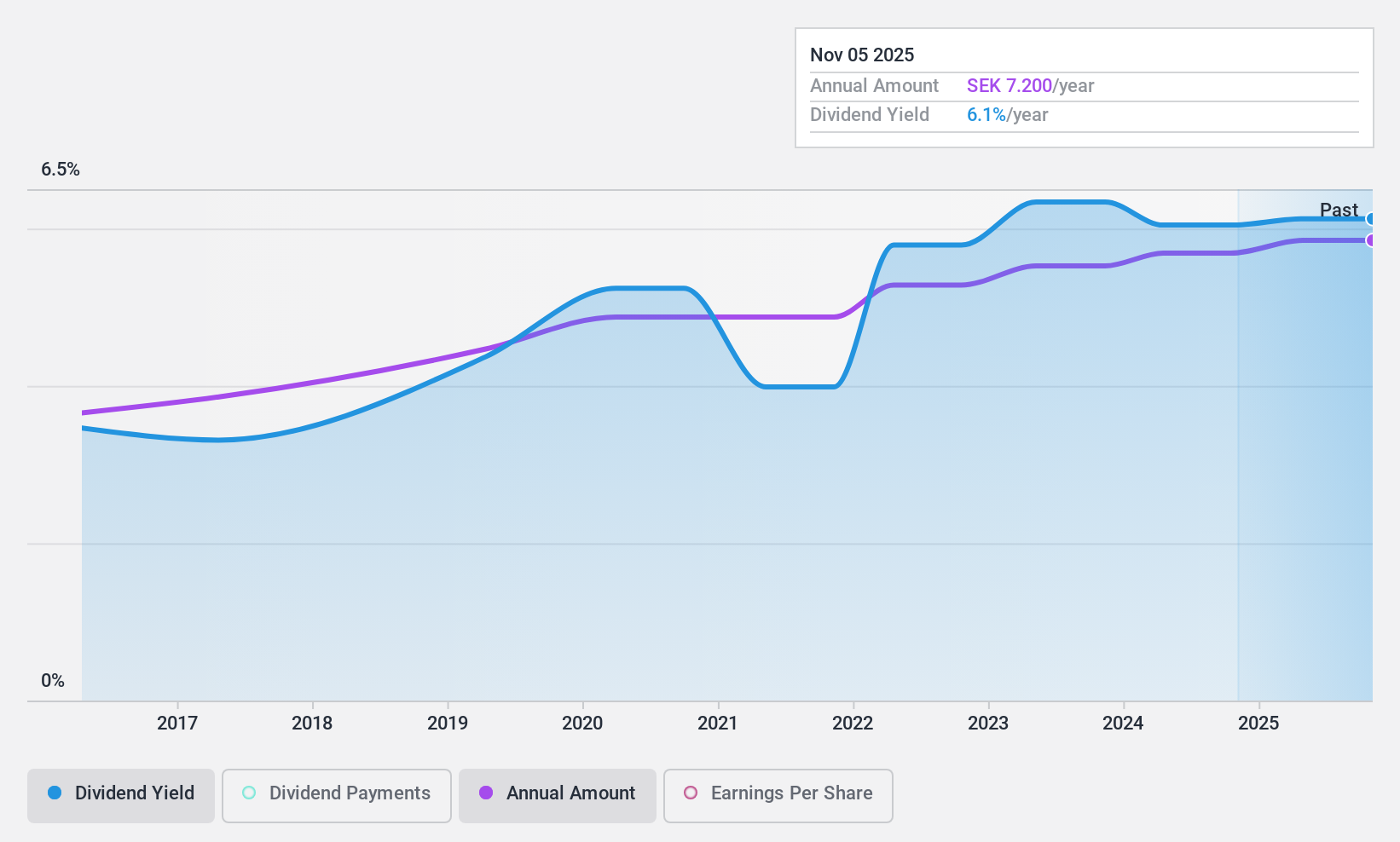

Dividend Yield: 6%

Investment AB Öresund's dividend yield of 5.95% ranks in the top 25% of Swedish dividend payers, though recent earnings results show challenges with negative revenue and a net loss for Q3 2024. Despite becoming profitable this year, dividends are not well covered by cash flows, reflected in a high cash payout ratio of 183.9%. The payout ratio is low at 34%, indicating coverage by earnings. Dividend payments have been volatile but increased over the past decade.

- Dive into the specifics of Investment AB Öresund here with our thorough dividend report.

- Our expertly prepared valuation report Investment AB Öresund implies its share price may be too high.

Skandinaviska Enskilda Banken (OM:SEB A)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Skandinaviska Enskilda Banken AB (publ) offers corporate, retail, investment, and private banking services with a market cap of approximately SEK309.69 billion.

Operations: Skandinaviska Enskilda Banken AB (publ) generates revenue from several segments, including Large Corporates & Financial Institutions (SEK31.90 billion), Corporate & Private Customers excluding Private Wealth Management & Family Office (SEK25.65 billion), Baltic operations (SEK13.82 billion), Private Wealth Management & Family Office (SEK4.56 billion), Life insurance services (SEK3.89 billion), and Asset Management (SEK3.22 billion).

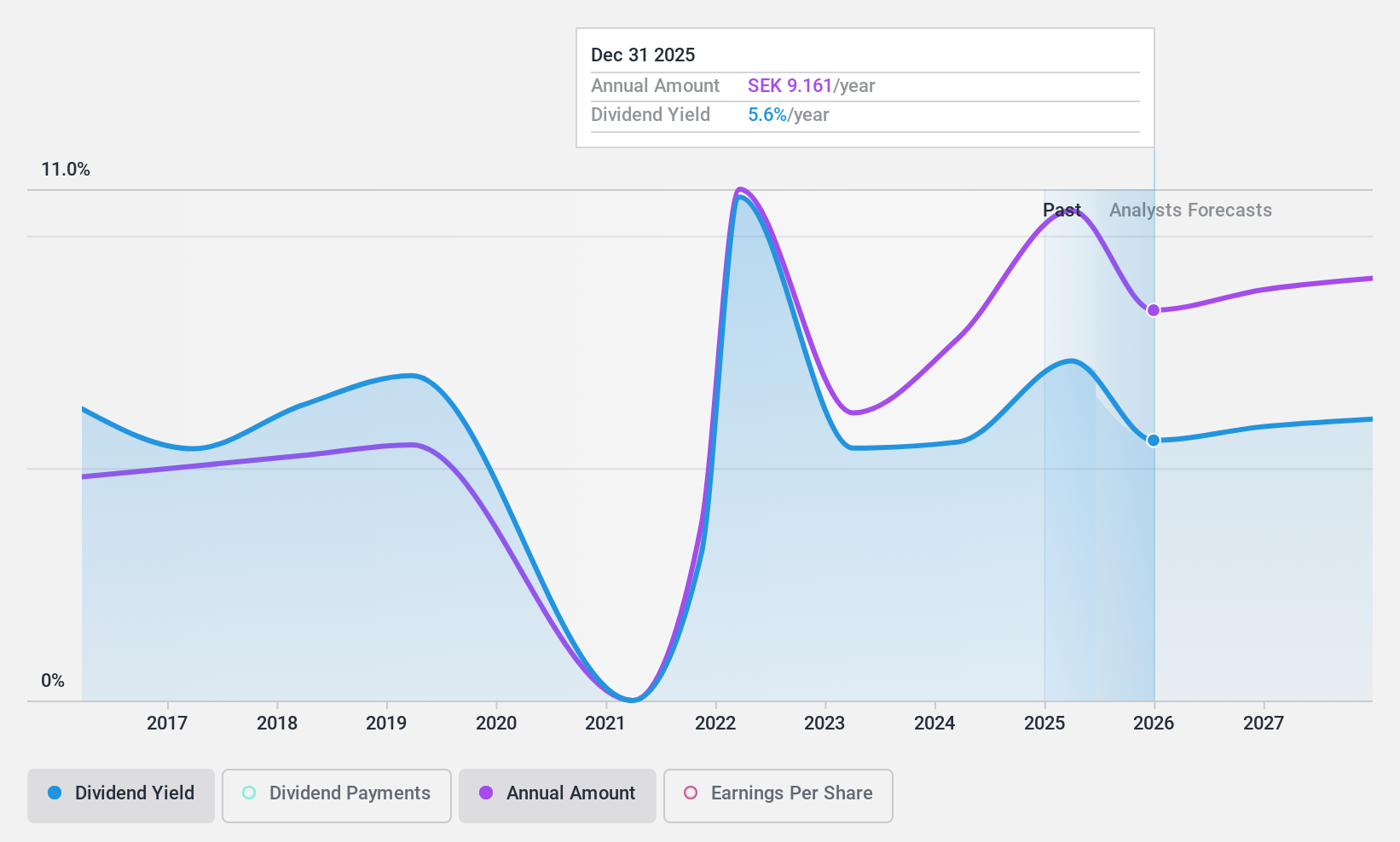

Dividend Yield: 5.6%

Skandinaviska Enskilda Banken's dividend yield of 5.63% is among the top 25% in Sweden, supported by a low payout ratio of 46.5%, indicating dividends are well-covered by earnings and forecasted to remain so. However, the dividend track record has been volatile over the past decade with significant annual drops exceeding 20%. Recent executive changes, including a new CFO, may influence future strategic direction but have not impacted current dividend policies.

- Get an in-depth perspective on Skandinaviska Enskilda Banken's performance by reading our dividend report here.

- Our valuation report unveils the possibility Skandinaviska Enskilda Banken's shares may be trading at a premium.

Key Takeaways

- Discover the full array of 22 Top Swedish Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SEB A

Skandinaviska Enskilda Banken

Provides corporate, retail, investment, and private banking services.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives