Volvo Cars (OM:VOLCAR B): Valuation Insights Following Strong Q3 Profit and EV Expansion Efforts

Reviewed by Simply Wall St

Volvo Car AB (publ.) (OM:VOLCAR B) delivered a stronger-than-expected third quarter profit, even as sales dipped. This result highlights the impact of its turnaround efforts and continued demand for the XC60 SUV.

See our latest analysis for Volvo Car AB (publ.).

Volvo Cars’ upbeat third-quarter profit has been echoed by a rapid rally in its share price, climbing over 65% in the past month alone, with a 39% year-to-date share price return. The combination of successful cost reductions, the buzz around new hybrid and electric models, and positive momentum in key markets has shifted market sentiment, although the longer-term three-year total shareholder return is still down. Momentum is clearly building as investors weigh the company’s efforts to reinvent itself for an electric future.

If Volvo’s recent burst of activity has sparked your curiosity, consider exploring other leaders in the automotive space. See the full list here: See the full list for free.

The question now is whether Volvo’s impressive rally signals an undervalued opportunity, or if the market has already priced in the company’s turnaround strategy and ambitious electric vehicle rollout plans.

Most Popular Narrative: 39.5% Overvalued

Volvo Car AB (publ.)’s last close price remains well above what the most popular narrative determines as a fair value, signaling a significant gap between current market optimism and underlying expectations. As the company races to lead in electric vehicles and boost profitability, the debate is heating up on whether this momentum is justified or fleeting.

"Heavy investment needs and Chinese market exposure heighten risks to earnings stability and capital allocation. Aggressive cost optimization, local EV production, regional expansion, and strategic partnerships are boosting margins, growth potential, and resilience against regulatory and global trade challenges."

What critical forecasts power this bold valuation? This narrative rests on a dramatic transformation that projects a turnaround in margins, soaring profits, and a sharply lower future earnings multiple. Discover which pivotal assumptions separate today’s price from the narrative’s fair value—it may surprise you.

Result: Fair Value of $23.63 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected strength in new EV launches or successful cost-saving initiatives could quickly challenge skeptics and drive upside beyond current market expectations.

Find out about the key risks to this Volvo Car AB (publ.) narrative.

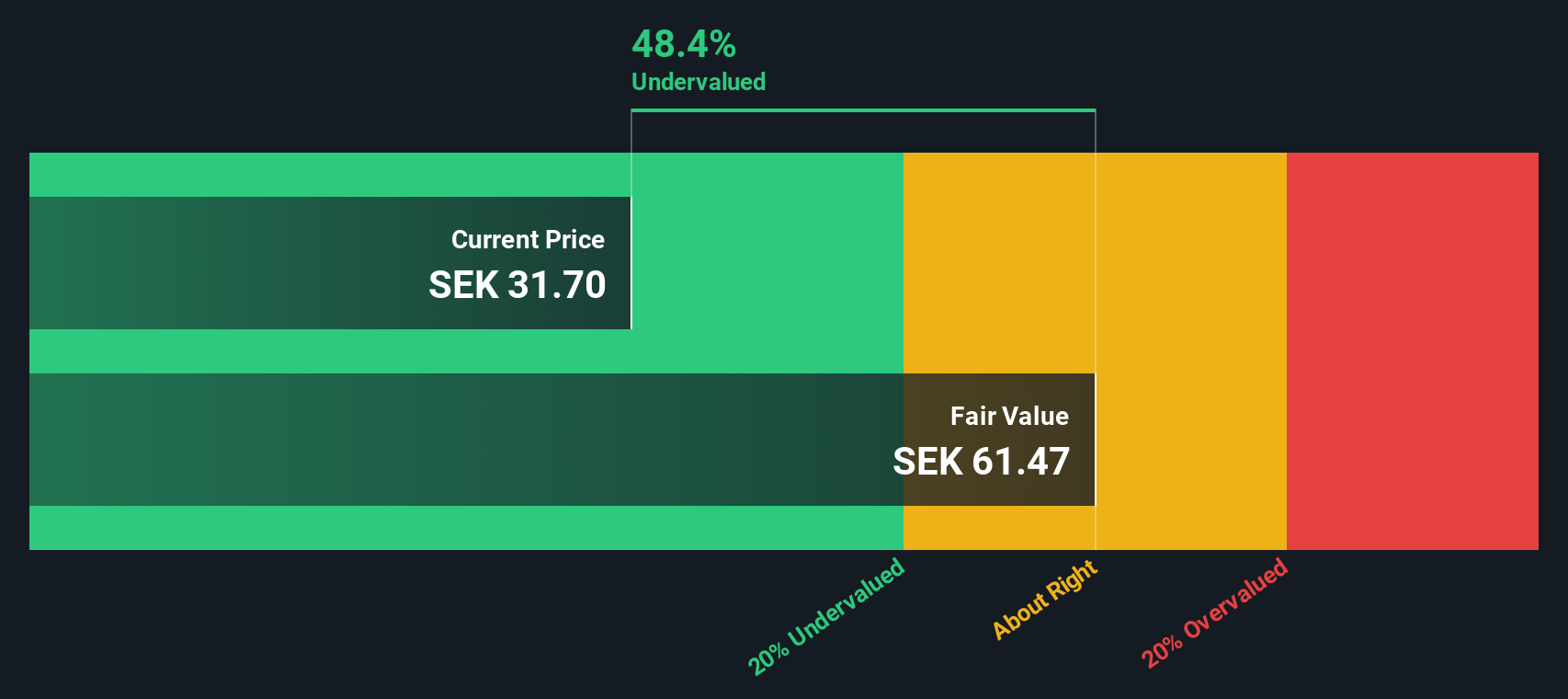

Another View: SWS DCF Model Shows Undervaluation

While analysts suggest Volvo Car AB (publ.) is overvalued based on future earnings estimates, our DCF model paints a different picture. According to the SWS DCF approach, the current share price is actually trading below its estimated fair value. Are analysts too cautious? Is the market missing hidden potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Volvo Car AB (publ.) for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Volvo Car AB (publ.) Narrative

If you want to dig into the numbers for yourself or have a different perspective, you can build your own valuation narrative in just a few minutes. Do it your way

A great starting point for your Volvo Car AB (publ.) research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know the best opportunities rarely wait. Supercharge your portfolio by checking out these tailored stock ideas, each designed to spark your next winning move.

- Capture tomorrow’s AI leaders before the crowd by tapping into these 26 AI penny stocks built for fast growth and cutting-edge innovation.

- Power your returns with secure, inflation-busting income by starting with these 22 dividend stocks with yields > 3% yielding over 3%, backed by proven fundamentals.

- Stay ahead of the next market wave by targeting these 832 undervalued stocks based on cash flows packed with potential for strong upside based on solid cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VOLCAR B

Volvo Car AB (publ.)

Designs, develops, manufactures, markets, and sells cars in Sweden and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives