- Sweden

- /

- Auto Components

- /

- OM:BULTEN

3 Swedish Dividend Stocks Yielding Up To 5.3%

Reviewed by Simply Wall St

As the European market shows signs of optimism with hopes for interest rate cuts, Sweden's Riksbank has already taken steps to reduce borrowing costs, aiming to stimulate economic growth. In this favorable environment, dividend stocks can offer a reliable income stream and potential capital appreciation. When considering dividend stocks in such a dynamic market, it's crucial to focus on companies with strong financial health and consistent payout histories.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.32% | ★★★★★★ |

| Betsson (OM:BETS B) | 5.60% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.68% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 4.01% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.13% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.92% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.52% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.46% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.74% | ★★★★★☆ |

| Bahnhof (OM:BAHN B) | 3.85% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our Top Swedish Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

BioGaia (OM:BIOG B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BioGaia AB (publ) is a healthcare company that provides probiotic products worldwide and has a market cap of SEK12.91 billion.

Operations: BioGaia AB (publ) generates revenue primarily from its Pediatrics segment, which accounts for SEK1.07 billion, and its Adult Health segment, contributing SEK288.68 million.

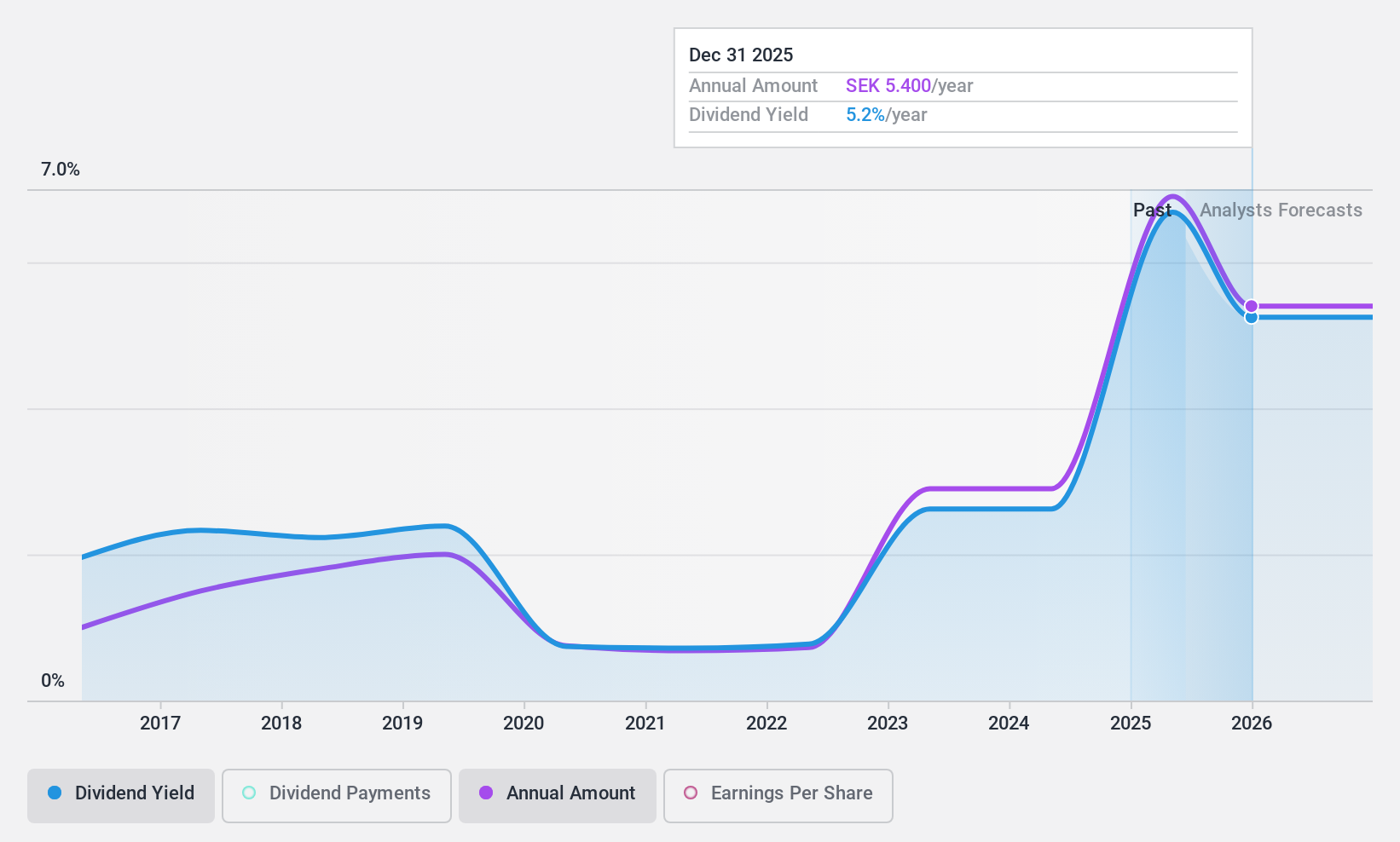

Dividend Yield: 5.4%

BioGaia's dividend yield of 5.4% places it in the top 25% of Swedish dividend payers, but its dividends have been volatile over the past decade and are not well covered by free cash flows, with a high cash payout ratio of 193.5%. Despite trading at a favorable P/E ratio (32.1x) compared to industry peers, recent earnings reports show strong growth in sales and net income, suggesting potential future stability.

- Get an in-depth perspective on BioGaia's performance by reading our dividend report here.

- Our valuation report here indicates BioGaia may be undervalued.

Bulten (OM:BULTEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bulten AB (publ) manufactures and distributes fasteners and related services for various industries including automotive and consumer electronics, with a market cap of approximately SEK1.63 billion.

Operations: Bulten AB (publ) generates SEK5.95 billion in revenue from manufacturing and distributing fasteners and related solutions across various industries, including automotive and consumer electronics.

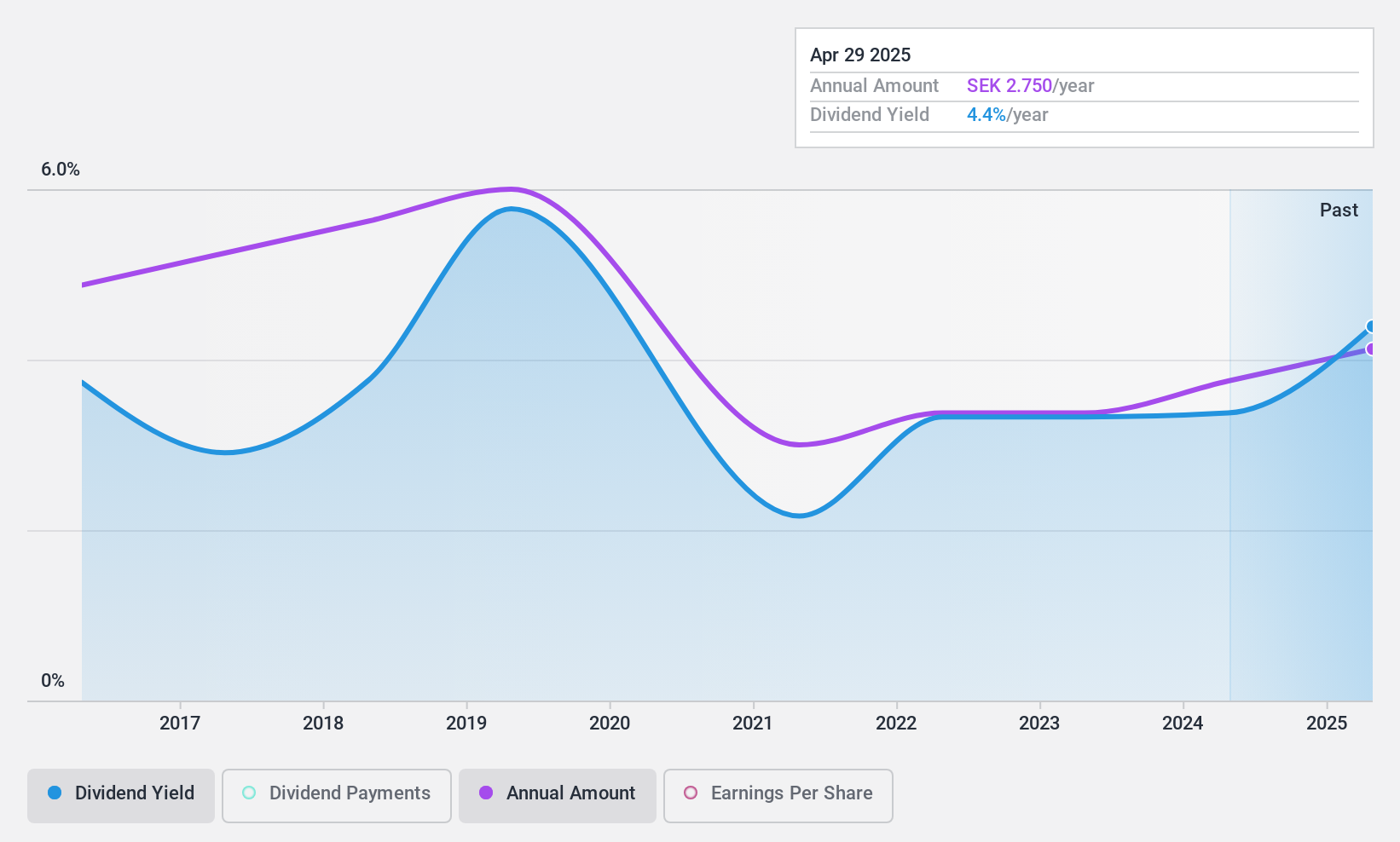

Dividend Yield: 3.2%

Bulten's dividend payments, covered by both earnings (57% payout ratio) and cash flows (30.9% cash payout ratio), offer some assurance despite a volatile track record over the past decade. The dividend yield of 3.22% is lower than the top 25% of Swedish dividend payers. Recent earnings showed modest growth in sales to SEK 1.47 billion but a slight decline in net income to SEK 34 million, indicating potential challenges ahead for sustained dividends.

- Take a closer look at Bulten's potential here in our dividend report.

- According our valuation report, there's an indication that Bulten's share price might be on the expensive side.

HEXPOL (OM:HPOL B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HEXPOL AB (publ) develops, manufactures, and sells polymer compounds and engineered products across Sweden, Europe, the Americas, and Asia with a market cap of SEK39.16 billion.

Operations: HEXPOL's revenue segments include HEXPOL Compounding, generating SEK20.18 billion, and HEXPOL Engineered Products, contributing SEK1.61 billion.

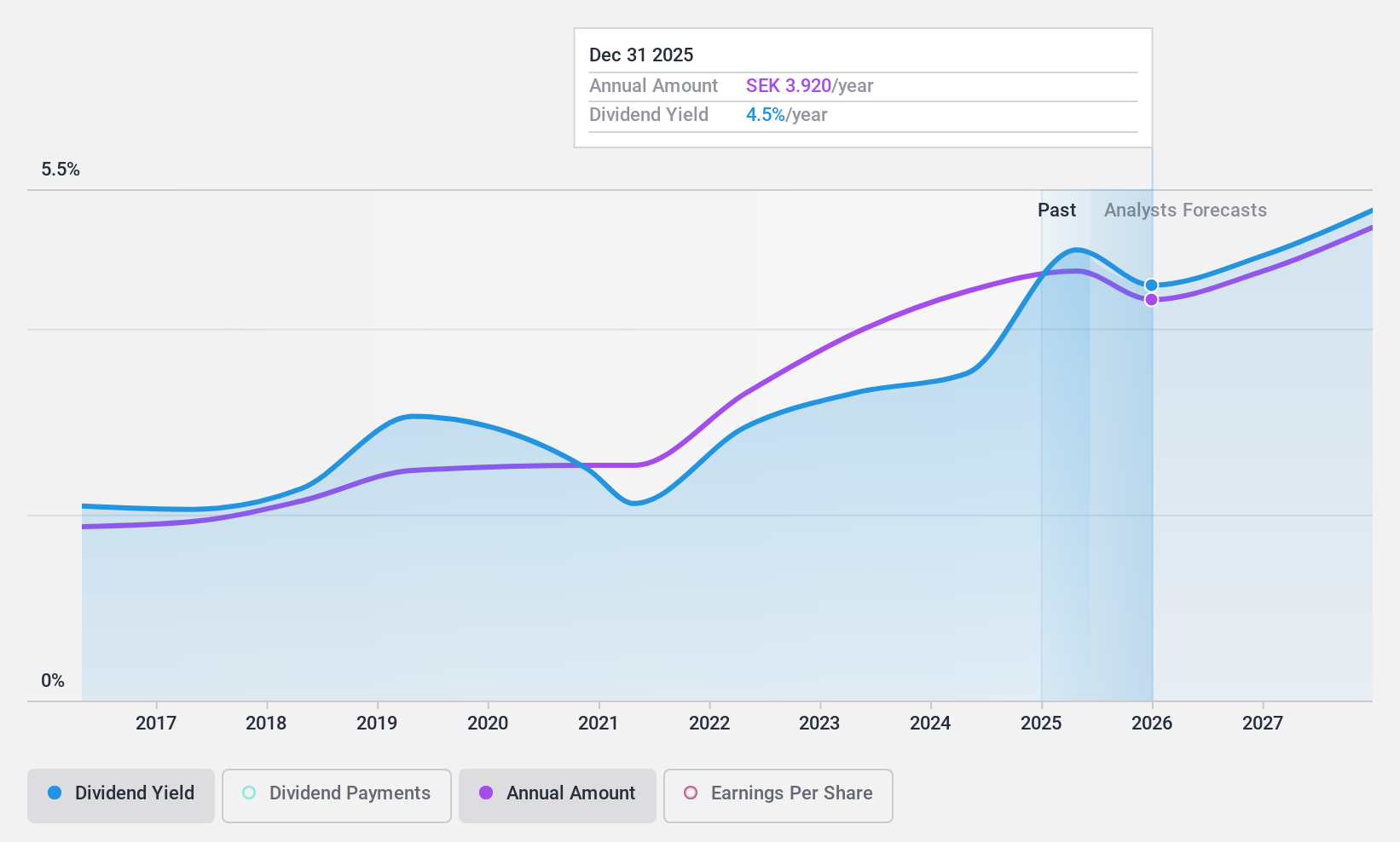

Dividend Yield: 3.5%

HEXPOL pays a reliable dividend of 3.52%, with stable and growing payments over the past decade. Its payout ratio of 55.4% and cash payout ratio of 57.8% suggest dividends are well-covered by earnings and cash flows, though the yield is below top-tier Swedish dividend payers. Recent earnings showed slight declines, with Q2 sales at SEK 5.45 billion and net income at SEK 654 million, potentially impacting future payouts under new CEO Klas Dahlberg's leadership.

- Dive into the specifics of HEXPOL here with our thorough dividend report.

- The valuation report we've compiled suggests that HEXPOL's current price could be quite moderate.

Key Takeaways

- Delve into our full catalog of 22 Top Swedish Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bulten might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BULTEN

Bulten

Manufactures and distributes fasteners and related services and solutions for light vehicles, heavy commercial vehicles, automotive suppliers, consumer electronics, and other industries in Sweden, Poland, Germany, the United Kingdom, rest of Europe, the United States, China, Taiwan, and internationally.

Excellent balance sheet average dividend payer.