- United Arab Emirates

- /

- Diversified Financial

- /

- DFM:AMANAT

Amanat Holdings PJSC Leads These 3 Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

In the Middle East, most Gulf markets have been buoyed by optimism surrounding potential Federal Reserve rate cuts, despite the dampening effect of subdued oil prices. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial, as these factors can help companies thrive even amid broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Terminal X Online | 14.88% | 12.11% | 41.14% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 0.97% | 38.36% | 57.78% | ★★★★★☆ |

| Amir Marketing and Investments in Agriculture | 25.54% | 4.63% | 6.37% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Amanat Holdings PJSC (DFM:AMANAT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Amanat Holdings PJSC is an investment company operating in the education and healthcare sectors both within the United Arab Emirates and internationally, with a market capitalization of AED2.81 billion.

Operations: Amanat Holdings PJSC generates revenue primarily from its investments in the education sector, contributing AED495.94 million, and the healthcare sector, with AED380.40 million.

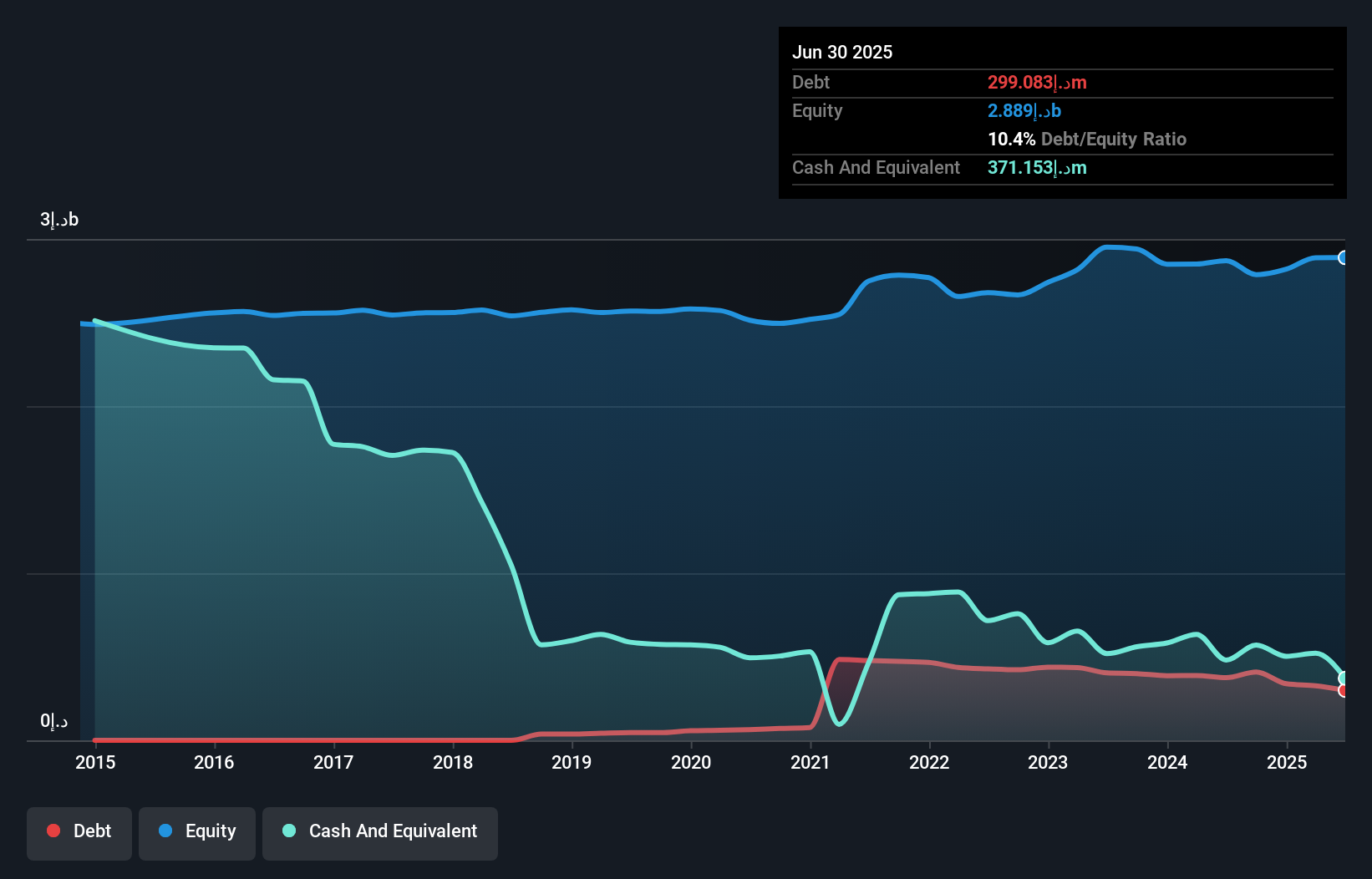

Amanat Holdings PJSC, a notable player in the Middle East's financial landscape, has shown impressive growth with earnings surging by 330.2% over the past year, outpacing its industry peers. The company's recent third-quarter results highlight a net income of AED 29.22 million compared to a loss of AED 11.11 million previously, reflecting strong operational performance and strategic management. Despite an increase in its debt-to-equity ratio from 2.8% to 10.9% over five years, Amanat remains financially robust with more cash than total debt and maintains positive free cash flow at AED 103 million as of September 2025.

- Dive into the specifics of Amanat Holdings PJSC here with our thorough health report.

Understand Amanat Holdings PJSC's track record by examining our Past report.

Alamar Foods (SASE:6014)

Simply Wall St Value Rating: ★★★★★☆

Overview: Alamar Foods Company, with a market cap of SAR1.15 billion, operates and manages quick service restaurants across the Middle East, North Africa, and Pakistan through its subsidiaries.

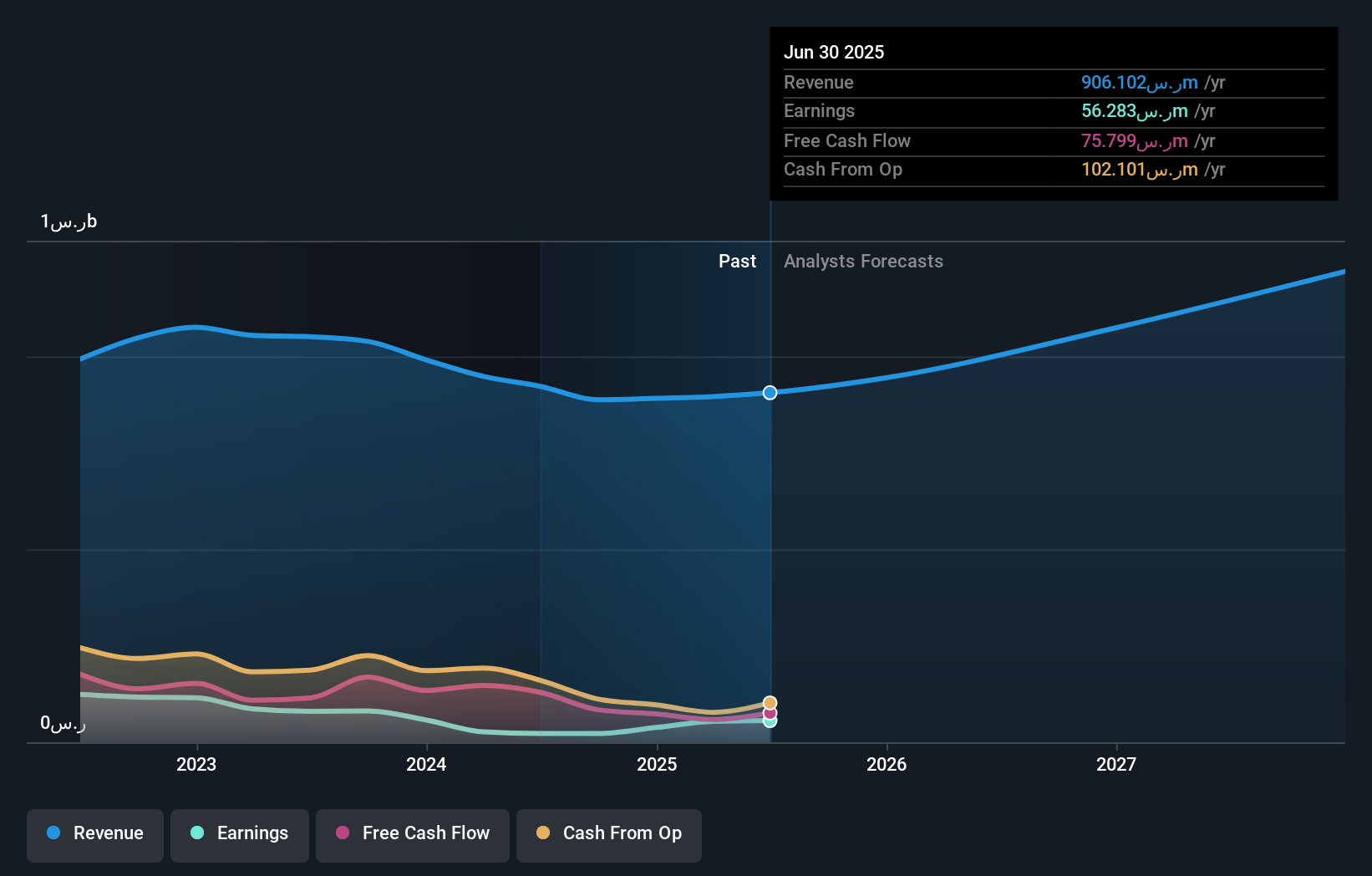

Operations: The company generates revenue primarily from its operations in the Kingdom of Saudi Arabia (SAR608.96 million) and Other GCC and Levant regions (SAR226.19 million). The net profit margin has shown variability, reflecting changes in operational efficiency and cost management strategies.

Alamar Foods has shown a robust performance with earnings growth of 126.5% over the past year, outpacing the Hospitality industry's 9.1%. Despite a decline in net income for Q3 to SAR 15.66 million from SAR 20.28 million last year, the company reported total sales of SAR 236.67 million, up from SAR 229.02 million previously. The company also announced a quarterly dividend of SAR 0.60 per share and appointed an interim CFO following executive changes in October 2025, indicating strategic adjustments amid its ongoing growth trajectory in revenue forecasted at an annual rate of over 13%.

- Take a closer look at Alamar Foods' potential here in our health report.

Gain insights into Alamar Foods' past trends and performance with our Past report.

Etihad Atheeb Telecommunication (SASE:7040)

Simply Wall St Value Rating: ★★★★★☆

Overview: Etihad Atheeb Telecommunication Company offers telecommunication products and services to individuals and businesses both in Saudi Arabia and internationally, with a market capitalization of SAR3.20 billion.

Operations: The company generates revenue primarily from telecommunication services provided to both individual and business clients. Its market capitalization is SAR3.20 billion.

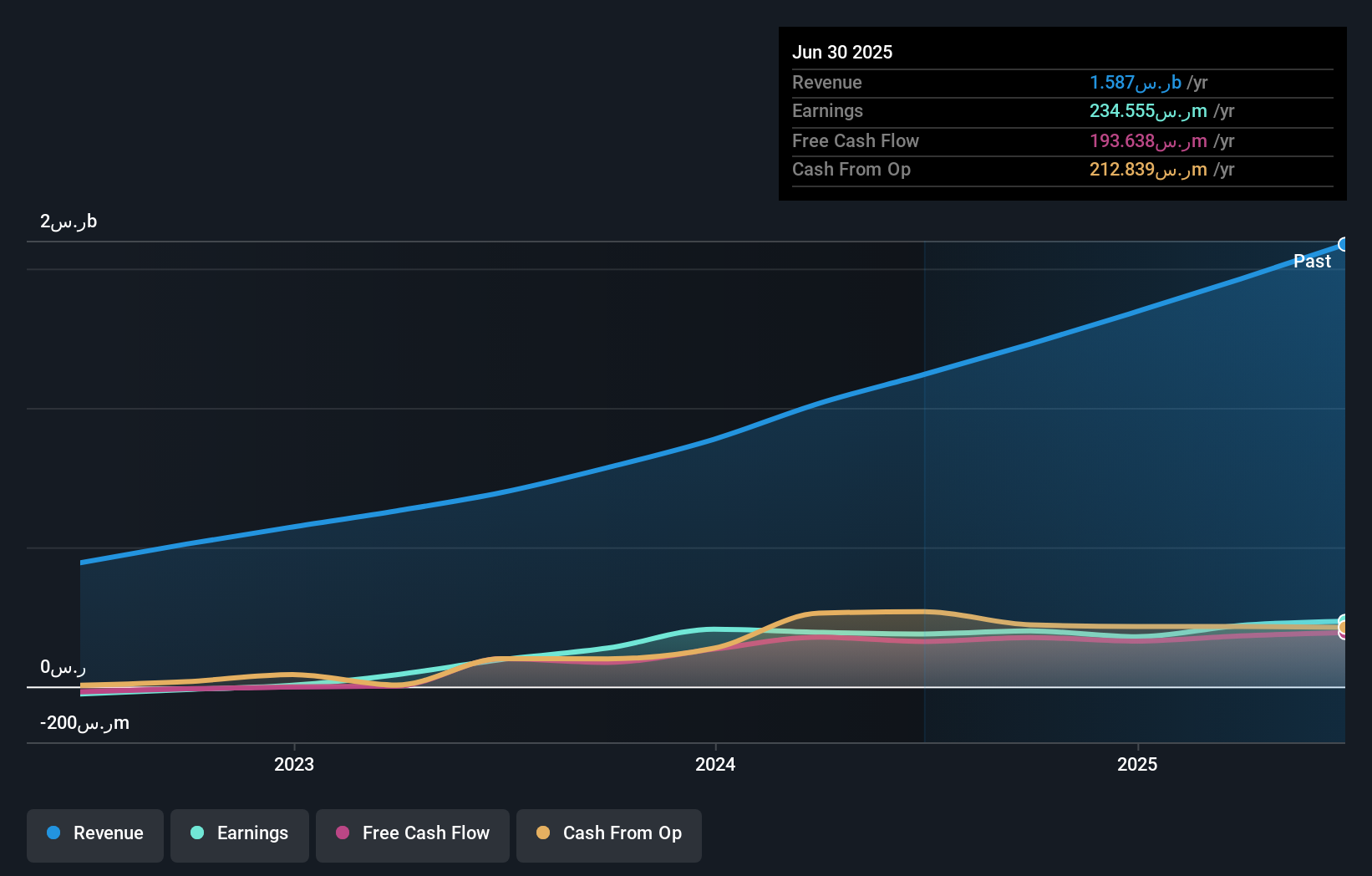

Etihad Atheeb Telecommunication, a promising player in the Middle East's telecom sector, reported sales of SAR 470.14 million for Q2 2025, up from SAR 346.91 million the previous year, with net income reaching SAR 65.03 million. The company's earnings per share increased to SAR 1.91 from SAR 1.72 last year, reflecting robust growth and profitability with a price-to-earnings ratio of 13x below the SA market average of about 18x. Their debt to equity ratio has risen slightly over five years but remains manageable as cash exceeds total debt and interest coverage is strong at nearly 230 times EBIT.

Key Takeaways

- Reveal the 191 hidden gems among our Middle Eastern Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:AMANAT

Amanat Holdings PJSC

Engages in the investment in companies and enterprises in the fields of education and healthcare in the United Arab Emirates and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success