- Saudi Arabia

- /

- Retail Distributors

- /

- SASE:9537

Why It Might Not Make Sense To Buy Amwaj International Company (TADAWUL:9537) For Its Upcoming Dividend

Amwaj International Company (TADAWUL:9537) stock is about to trade ex-dividend in three days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. Meaning, you will need to purchase Amwaj International's shares before the 22nd of December to receive the dividend, which will be paid on the 1st of January.

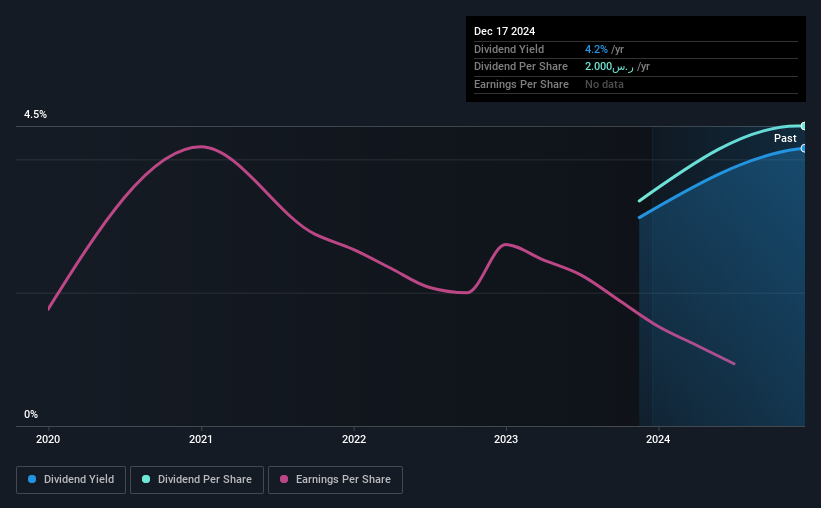

The company's next dividend payment will be ر.س1.00 per share, and in the last 12 months, the company paid a total of ر.س2.00 per share. Looking at the last 12 months of distributions, Amwaj International has a trailing yield of approximately 4.2% on its current stock price of ر.س48.00. If you buy this business for its dividend, you should have an idea of whether Amwaj International's dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for Amwaj International

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Amwaj International distributed an unsustainably high 151% of its profit as dividends to shareholders last year. Without more sustainable payment behaviour, the dividend looks precarious. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Luckily it paid out just 19% of its free cash flow last year.

It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Amwaj International fortunately did generate enough cash to fund its dividend. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Very few companies are able to sustainably pay dividends larger than their reported earnings.

Click here to see how much of its profit Amwaj International paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Readers will understand then, why we're concerned to see Amwaj International's earnings per share have dropped 12% a year over the past five years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

Unfortunately Amwaj International has only been paying a dividend for a year or so, so there's not much of a history to draw insight from.

To Sum It Up

Is Amwaj International an attractive dividend stock, or better left on the shelf? It's not a great combination to see a company with earnings in decline and paying out 151% of its profits, which could imply the dividend may be at risk of being cut in the future. Yet cashflow was much stronger, which makes us wonder if there are some large timing issues in Amwaj International's cash flows, or perhaps the company has written down some assets aggressively, reducing its income. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with Amwaj International. For instance, we've identified 6 warning signs for Amwaj International (2 can't be ignored) you should be aware of.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:9537

Amwaj International

Engages in distributing and selling electronic and home appliances.

Medium-low risk with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth