- Turkey

- /

- Auto Components

- /

- IBSE:BFREN

Undiscovered Gems in the Middle East to Watch This November 2025

Reviewed by Simply Wall St

The Middle East market has recently experienced a downturn, with UAE shares declining due to weaker oil prices and uncertainty surrounding potential rate cuts. Despite these challenges, the region continues to present opportunities for investors who can identify stocks with strong fundamentals and resilience in the face of fluctuating economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Terminal X Online | 14.88% | 12.11% | 41.14% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 0.97% | 38.36% | 57.78% | ★★★★★☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Amlak Finance PJSC (DFM:AMLAK)

Simply Wall St Value Rating: ★★★★★★

Overview: Amlak Finance PJSC, along with its subsidiaries, operates in real estate financing and investment across the Middle East with a market capitalization of AED2.46 billion.

Operations: Amlak derives its revenue primarily from real estate financing and investment activities. The company reported a net profit margin of 15% in the latest financial period, reflecting its ability to manage costs effectively relative to its revenue streams.

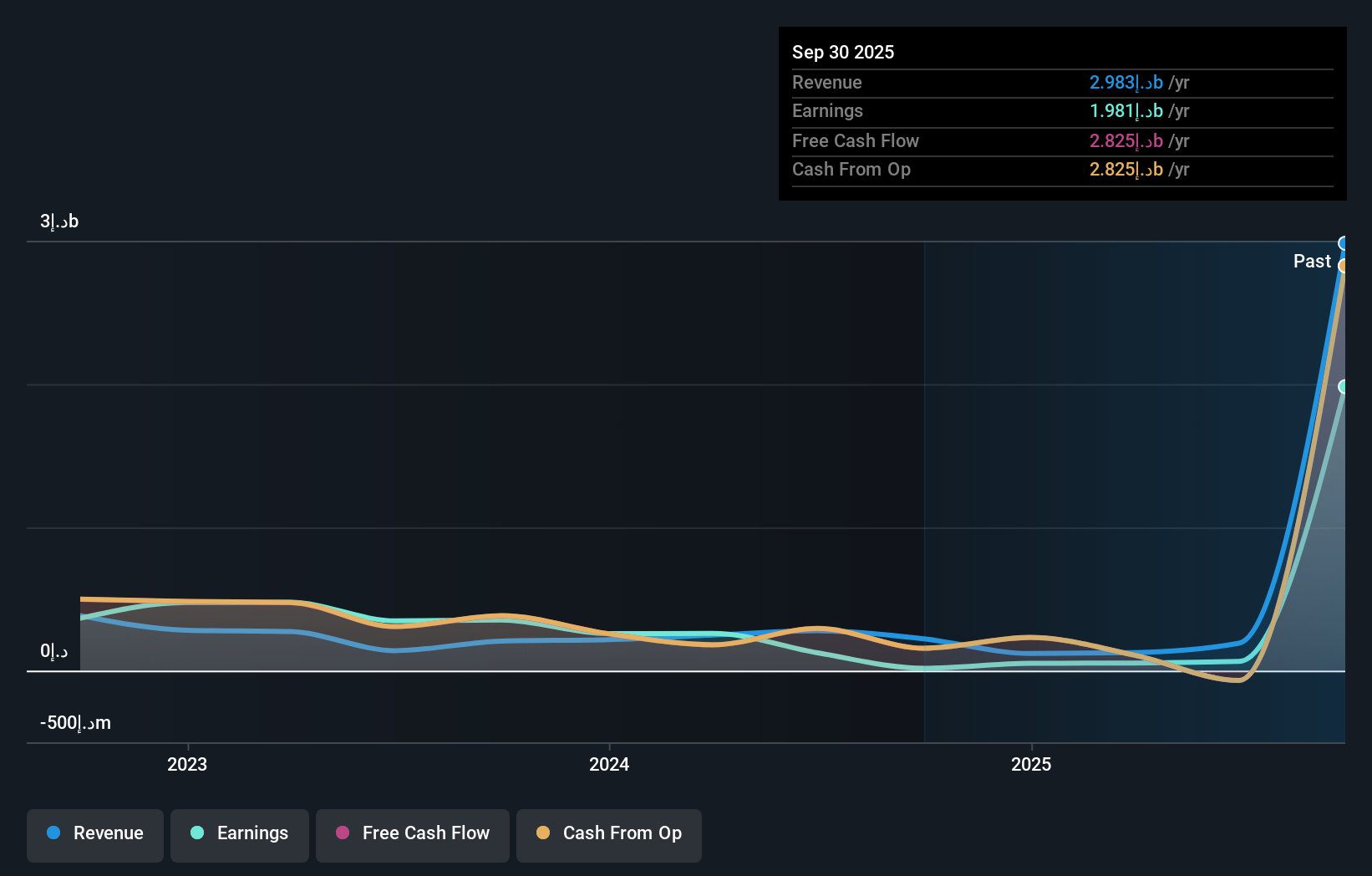

Amlak Finance PJSC, a notable player in the Middle East's financial sector, has shown remarkable earnings growth of 12,195.9% over the past year, far surpassing the industry average of 13.9%. This debt-free entity boasts high-quality earnings and demonstrates strong financial health with its price-to-earnings ratio at 1.2x compared to the AE market's 11.7x. Recent results highlight a net income of AED 1,932.85 million for Q3 2025 against AED 8.93 million last year, reflecting significant profitability improvements and suggesting robust operational performance despite slightly lower sales figures this quarter at AED 5.05 million from AED 5.41 million previously.

- Click to explore a detailed breakdown of our findings in Amlak Finance PJSC's health report.

Evaluate Amlak Finance PJSC's historical performance by accessing our past performance report.

Bosch Fren Sistemleri Sanayi ve Ticaret (IBSE:BFREN)

Simply Wall St Value Rating: ★★★★★★

Overview: Bosch Fren Sistemleri Sanayi ve Ticaret A.S. is a company engaged in the production and sale of braking systems, with a market capitalization of TRY20.46 billion.

Operations: Bosch Fren Sistemleri generates revenue primarily through the production and sale of braking systems. The company's financial performance is highlighted by a gross profit margin trend that has shown variability over recent periods, indicating fluctuations in cost management or pricing strategies.

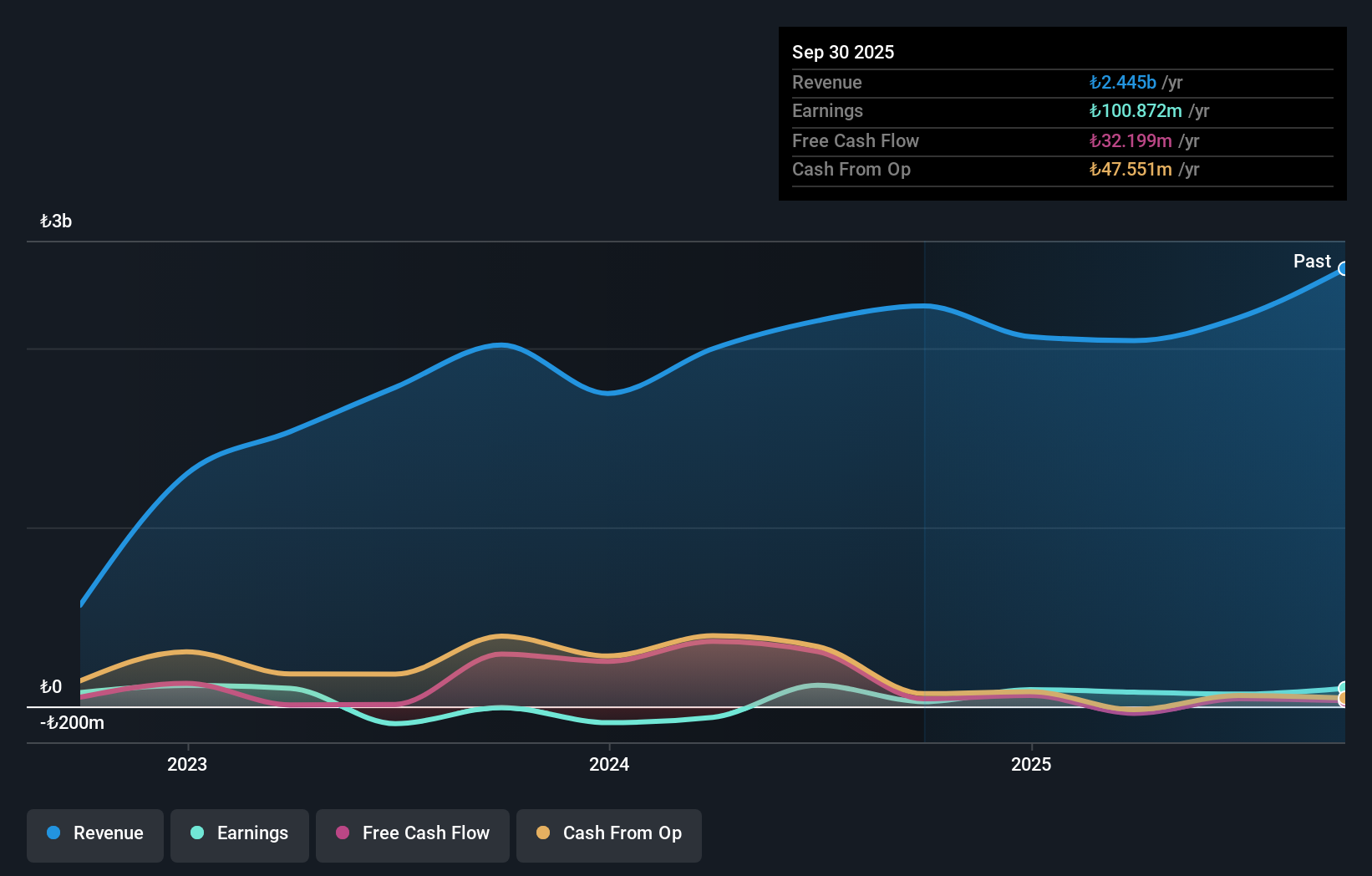

Bosch Fren Sistemleri Sanayi ve Ticaret, a compact player in the auto components sector, has shown remarkable growth with earnings surging by 281.9% over the past year, outpacing industry growth of 5.3%. This robust performance was partly influenced by a significant one-off gain of TRY20.4 million. The company reported third-quarter sales of TRY666.28 million and net income of TRY51.43 million, up from TRY653.33 million and TRY27.7 million respectively from the previous year, despite shareholder dilution concerns recently noted in its financials. Operating debt-free for five years now bolsters its financial stability further enhancing investor confidence in this resilient entity amidst market volatility.

City Cement (SASE:3003)

Simply Wall St Value Rating: ★★★★★★

Overview: City Cement Company, along with its subsidiaries, engages in the manufacturing and sale of cement within the Kingdom of Saudi Arabia and has a market capitalization of SAR1.83 billion.

Operations: City Cement generates revenue primarily from the manufacturing and sale of cement within Saudi Arabia. The company's financial performance includes a focus on its net profit margin, which has shown notable fluctuations over recent periods.

City Cement, a compact player in the Middle Eastern market, has shown mixed financial performance recently. Despite being debt-free for five years and trading at 63.8% below its estimated fair value, earnings have decreased by an average of 11.9% annually over this period. However, the company's earnings growth of 7% last year outpaced the Basic Materials industry's -4.2%. For Q3 2025, sales were SAR 96.49 million with net income at SAR 8.75 million compared to SAR 33.66 million a year prior; yet nine-month sales increased to SAR 385.25 million from SAR 361.22 million last year, indicating some resilience in challenging conditions.

- Get an in-depth perspective on City Cement's performance by reading our health report here.

Examine City Cement's past performance report to understand how it has performed in the past.

Summing It All Up

- Explore the 191 names from our Middle Eastern Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bosch Fren Sistemleri Sanayi ve Ticaret might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:BFREN

Bosch Fren Sistemleri Sanayi ve Ticaret

Bosch Fren Sistemleri Sanayi ve Ticaret A.S.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives