- Saudi Arabia

- /

- Chemicals

- /

- SASE:2170

Alujain Corporation's (TADAWUL:2170) Subdued P/S Might Signal An Opportunity

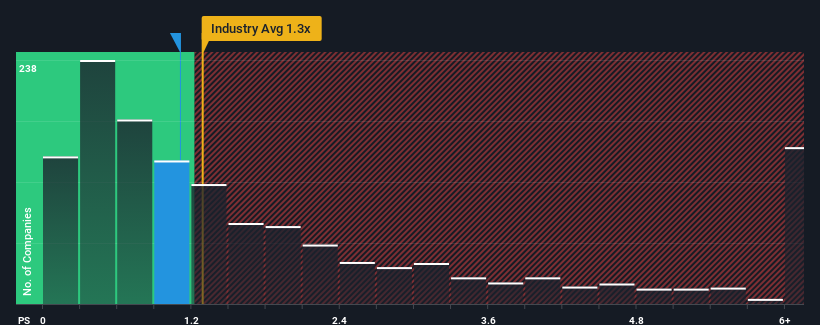

When close to half the companies operating in the Chemicals industry in Saudi Arabia have price-to-sales ratios (or "P/S") above 1.9x, you may consider Alujain Corporation (TADAWUL:2170) as an attractive investment with its 1.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Alujain

How Alujain Has Been Performing

Recent times have been pleasing for Alujain as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. Those who are bullish on Alujain will be hoping that this isn't the case and the company continues to beat out the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Alujain.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Alujain's is when the company's growth is on track to lag the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The latest three year period has seen an incredible overall rise in revenue, in spite of this mediocre revenue growth of late. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it has slowed to such an extent.

Looking ahead now, revenue is anticipated to climb by 15% per annum during the coming three years according to the dual analysts following the company. That's shaping up to be materially higher than the 2.9% each year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Alujain's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Alujain's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You always need to take note of risks, for example - Alujain has 2 warning signs we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2170

Alujain

Produces and sells propylene and polypropylene products in the Kingdom of Saudi Arabia and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives