- Saudi Arabia

- /

- Metals and Mining

- /

- SASE:1301

Investors more bullish on United Wire Factories (TADAWUL:1301) this week as stock hikes 12%, despite earnings trending downwards over past five years

Stock pickers are generally looking for stocks that will outperform the broader market. Buying under-rated businesses is one path to excess returns. For example, long term United Wire Factories Company (TADAWUL:1301) shareholders have enjoyed a 47% share price rise over the last half decade, well in excess of the market return of around 20% (not including dividends).

Since it's been a strong week for United Wire Factories shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for United Wire Factories

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, United Wire Factories actually saw its EPS drop 5.4% per year.

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

In contrast revenue growth of 13% per year is probably viewed as evidence that United Wire Factories is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

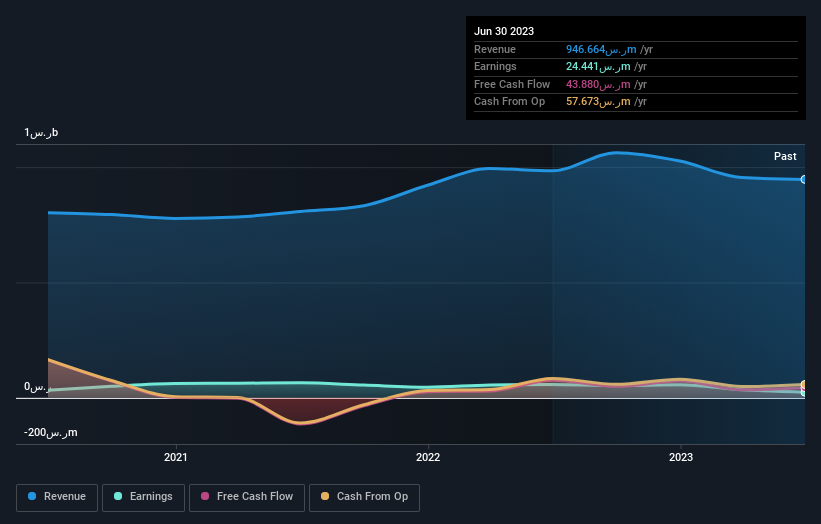

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling United Wire Factories stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between United Wire Factories' total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for United Wire Factories shareholders, and that cash payout contributed to why its TSR of 69%, over the last 5 years, is better than the share price return.

A Different Perspective

While the broader market gained around 6.6% in the last year, United Wire Factories shareholders lost 7.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 11% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with United Wire Factories .

We will like United Wire Factories better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1301

United Wire Factories

Engages in the production and marketing of steel wire products for the industrial, construction, and civil sectors in the Kingdom of Saudi Arabia.

Flawless balance sheet and fair value.