- Saudi Arabia

- /

- Insurance

- /

- SASE:8150

Allied Cooperative Insurance Group (TADAWUL:8150 investor five-year losses grow to 69% as the stock sheds ر.س74m this past week

Generally speaking long term investing is the way to go. But unfortunately, some companies simply don't succeed. To wit, the Allied Cooperative Insurance Group (TADAWUL:8150) share price managed to fall 80% over five long years. That's not a lot of fun for true believers. And we doubt long term believers are the only worried holders, since the stock price has declined 31% over the last twelve months. And the share price decline continued over the last week, dropping some 21%. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

If the past week is anything to go by, investor sentiment for Allied Cooperative Insurance Group isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Because Allied Cooperative Insurance Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, Allied Cooperative Insurance Group grew its revenue at 15% per year. That's a pretty good rate for a long time period. So the stock price fall of 13% per year seems pretty steep. The market can be a harsh master when your company is losing money and revenue growth disappoints.

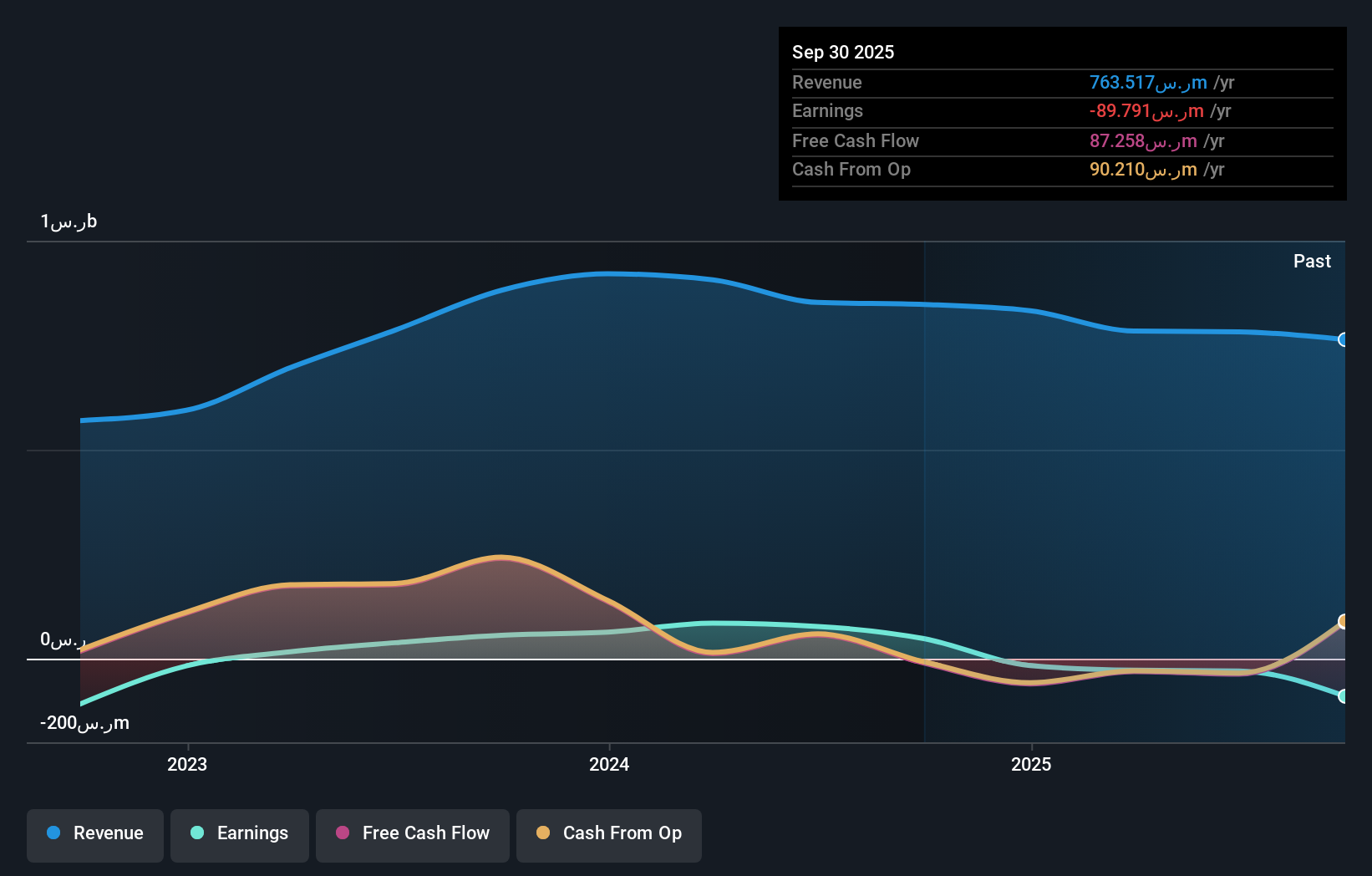

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Allied Cooperative Insurance Group's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Allied Cooperative Insurance Group's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Allied Cooperative Insurance Group's TSR, at -69% is higher than its share price return of -80%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

We regret to report that Allied Cooperative Insurance Group shareholders are down 31% for the year. Unfortunately, that's worse than the broader market decline of 3.8%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Allied Cooperative Insurance Group has 1 warning sign we think you should be aware of.

We will like Allied Cooperative Insurance Group better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:8150

Allied Cooperative Insurance Group

Engages in the cooperative insurance operations and related activities in the Kingdom of Saudi Arabia.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives