Stock Analysis

- Saudi Arabia

- /

- Food

- /

- SASE:2280

Almarai Company's (TADAWUL:2280) Financial Prospects Don't Look Very Positive: Could It Mean A Stock Price Drop In The Future?

Almarai's (TADAWUL:2280) stock up by 2.7% over the past three months. However, its weak financial performance indicators makes us a bit doubtful if that trend could continue. Particularly, we will be paying attention to Almarai's ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

Check out our latest analysis for Almarai

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Almarai is:

12% = ر.س2.1b ÷ ر.س18b (Based on the trailing twelve months to December 2023).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every SAR1 worth of equity, the company was able to earn SAR0.12 in profit.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Almarai's Earnings Growth And 12% ROE

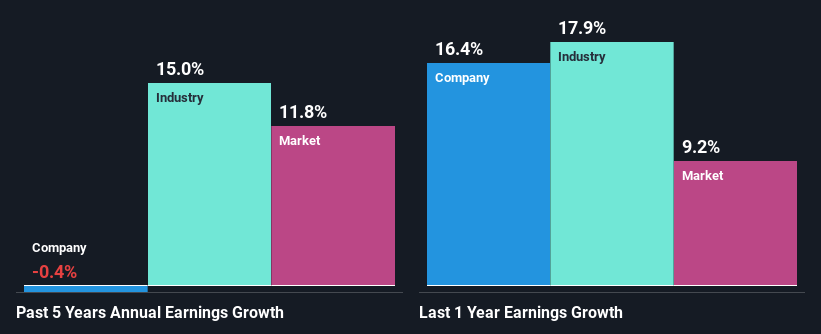

It is hard to argue that Almarai's ROE is much good in and of itself. An industry comparison shows that the company's ROE is not much different from the industry average of 12% either. Thus, the low ROE provides some context to Almarai's flat net income growth over the past five years.

As a next step, we compared Almarai's net income growth with the industry and discovered that the industry saw an average growth of 15% in the same period.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Has the market priced in the future outlook for 2280? You can find out in our latest intrinsic value infographic research report.

Is Almarai Using Its Retained Earnings Effectively?

Almarai has a high three-year median payout ratio of 54% (or a retention ratio of 46%), meaning that the company is paying most of its profits as dividends to its shareholders. This does go some way in explaining why there's been no growth in its earnings.

Additionally, Almarai has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to drop to 43% over the next three years. Accordingly, the expected drop in the payout ratio explains the expected increase in the company's ROE to 14%, over the same period.

Summary

Overall, we would be extremely cautious before making any decision on Almarai. As a result of its low ROE and lack of much reinvestment into the business, the company has seen a disappointing earnings growth rate. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Valuation is complex, but we're helping make it simple.

Find out whether Almarai is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2280

Almarai

Almarai Company operates as an integrated consumer food and beverage company in Saudi Arabia, Egypt, Jordan, and other Gulf Cooperation Council countries.

Established dividend payer with proven track record.