- Saudi Arabia

- /

- Diversified Financial

- /

- SASE:2120

Three Things You Should Check Before Buying Saudi Advanced Industries Company (TADAWUL:2120) For Its Dividend

Dividend paying stocks like Saudi Advanced Industries Company (TADAWUL:2120) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

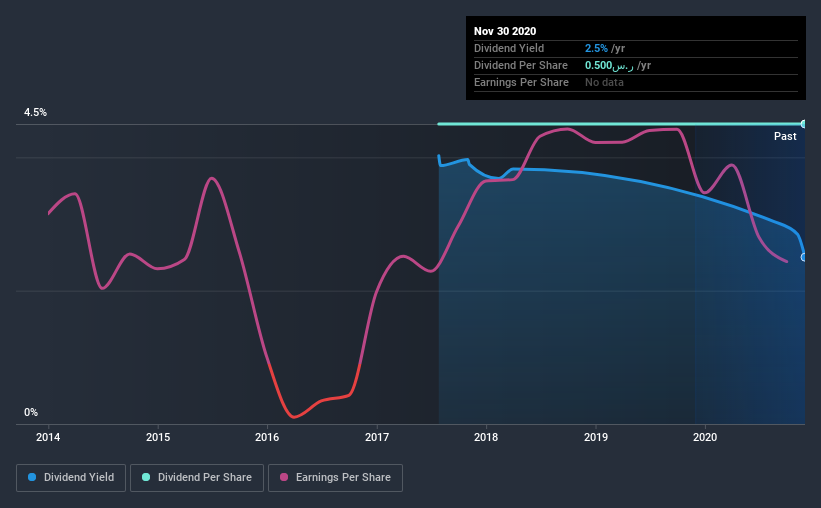

Some readers mightn't know much about Saudi Advanced Industries's 2.5% dividend, as it has only been paying distributions for the last three years. A low dividend might not be a bad thing, if the company is reinvesting heavily and growing its sales and profits. Some simple analysis can reduce the risk of holding Saudi Advanced Industries for its dividend, and we'll focus on the most important aspects below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Saudi Advanced Industries paid out 73% of its profit as dividends, over the trailing twelve month period. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

Remember, you can always get a snapshot of Saudi Advanced Industries' latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. The dividend has not fluctuated much, but with a relatively short payment history, we can't be sure this is sustainable across a full market cycle. Its most recent annual dividend was ر.س0.5 per share, effectively flat on its first payment three years ago.

Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. While there may be fluctuations in the past , Saudi Advanced Industries' earnings per share have basically not grown from where they were five years ago. Flat earnings per share are acceptable for a time, but over the long term, the purchasing power of the company's dividends could be eroded by inflation. 1.5% per annum is not a particularly high rate of growth, which we find curious. If the company is struggling to grow, perhaps that's why it elects to pay out more than half of its earnings to shareholders.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Saudi Advanced Industries' payout ratio is within an average range for most market participants. Second, the company has not been able to generate earnings growth, and its history of dividend payments is shorter than we consider ideal (from a reliability perspective). While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than Saudi Advanced Industries out there.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 3 warning signs for Saudi Advanced Industries that investors should take into consideration.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you’re looking to trade Saudi Advanced Industries, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SASE:2120

Saudi Advanced Industries

Through its subsidiary, operates in investment and financing sector in the Kingdom of Saudi Arabia.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives