Stock Analysis

- Saudi Arabia

- /

- Hospitality

- /

- SASE:1810

Seera Holding Group (TADAWUL:1810) pulls back 4.1% this week, but still delivers shareholders notable 12% CAGR over 5 years

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And in our experience, buying the right stocks can give your wealth a significant boost. For example, long term Seera Holding Group (TADAWUL:1810) shareholders have enjoyed a 77% share price rise over the last half decade, well in excess of the market return of around 30% (not including dividends).

In light of the stock dropping 4.1% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

See our latest analysis for Seera Holding Group

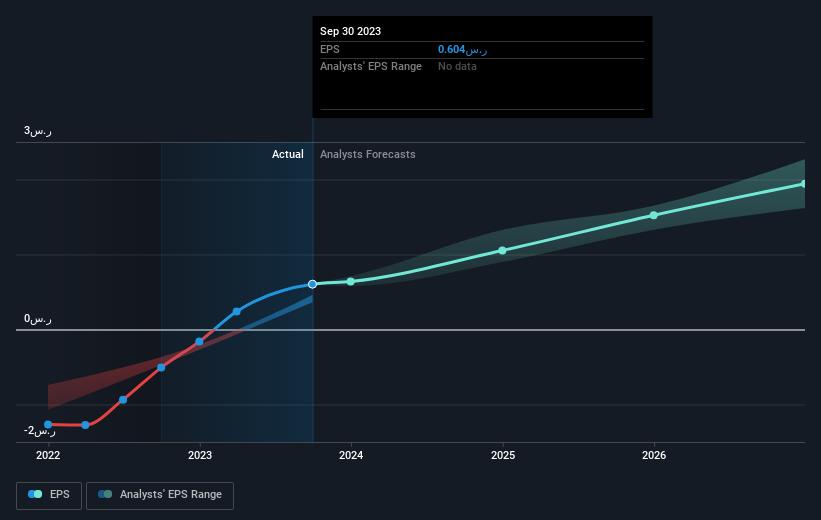

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, Seera Holding Group became profitable. That would generally be considered a positive, so we'd expect the share price to be up.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Seera Holding Group has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Seera Holding Group will grow revenue in the future.

A Different Perspective

It's nice to see that Seera Holding Group shareholders have received a total shareholder return of 63% over the last year. That gain is better than the annual TSR over five years, which is 12%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Seera Holding Group better, we need to consider many other factors. For example, we've discovered 2 warning signs for Seera Holding Group that you should be aware of before investing here.

We will like Seera Holding Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Seera Holding Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1810

Seera Holding Group

Seera Holding Group, together with its subsidiaries, provides travel and tourism services in the Kingdom of Saudi Arabia, the United Kingdom, Egypt, the United Arab Emirates, Spain, and Kuwait.

Reasonable growth potential and slightly overvalued.