- Saudi Arabia

- /

- Food and Staples Retail

- /

- SASE:4162

Almunajem Foods (TADAWUL:4162) Will Pay A Dividend Of SAR1.00

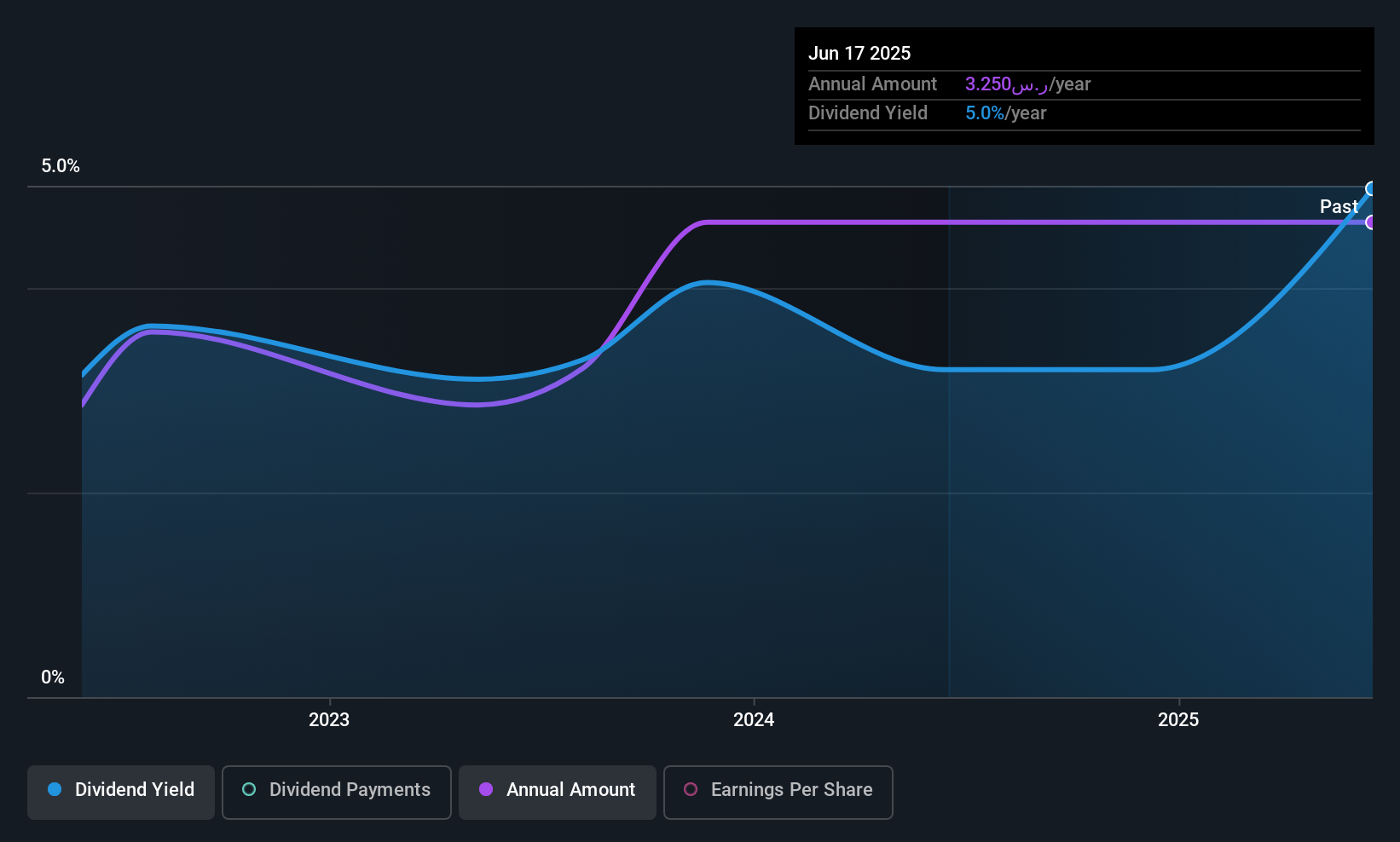

Almunajem Foods Company (TADAWUL:4162) will pay a dividend of SAR1.00 on the 16th of December. The dividend yield of 5.9% is still a nice boost to shareholder returns, despite the cut.

Almunajem Foods' Projected Earnings Seem Likely To Cover Future Distributions

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Based on the last payment, the company wasn't making enough to cover what it was paying to shareholders. This situation certainly isn't ideal, and could place significant strain on the balance sheet if it continues.

Looking forward, EPS could fall by 8.7% if the company can't turn things around from the last few years. If the dividend continues along recent trends, we estimate the payout ratio could be 4.6%, which we consider to be quite comfortable, even though the current levels are slightly more elevated.

View our latest analysis for Almunajem Foods

Almunajem Foods' Dividend Has Lacked Consistency

The track record isn't the longest, but we are already seeing a bit of instability in the payments. Since 2021, the dividend has gone from SAR2.00 total annually to SAR3.25. This works out to be a compound annual growth rate (CAGR) of approximately 13% a year over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

Dividend Growth May Be Hard To Come By

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Almunajem Foods has seen earnings per share falling at 8.7% per year over the last five years. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends.

Almunajem Foods' Dividend Doesn't Look Great

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. Considering all of these factors, we wouldn't rely on this dividend if we wanted to live on the income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 2 warning signs for Almunajem Foods you should be aware of, and 1 of them shouldn't be ignored. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4162

Almunajem Foods

Together with its subsidiary, engages in the wholesale and retail trade of fruits, vegetables, cold and frozen poultry and meat, bottled, and food stuff in Saudi Arabia.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives