- Saudi Arabia

- /

- Luxury

- /

- SASE:4012

3 Middle Eastern Dividend Stocks Yielding Up To 5.6%

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently experienced a downturn, with most Gulf bourses tracking global shares lower due to concerns over high valuations. Despite this challenging environment, dividend stocks can offer stability and income potential for investors seeking resilience during market fluctuations.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.25% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.41% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.33% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.72% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.60% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.30% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 7.60% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.37% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.53% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.47% | ★★★★★☆ |

Click here to see the full list of 66 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Commercial Bank of Dubai PSC (DFM:CBD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Commercial Bank of Dubai PSC offers commercial and retail banking services in the United Arab Emirates, with a market capitalization of AED28.21 billion.

Operations: Commercial Bank of Dubai PSC's revenue segments consist of Personal Banking at AED2.13 billion, Corporate Banking at AED1.33 billion, and Institutional Banking at AED1.48 billion.

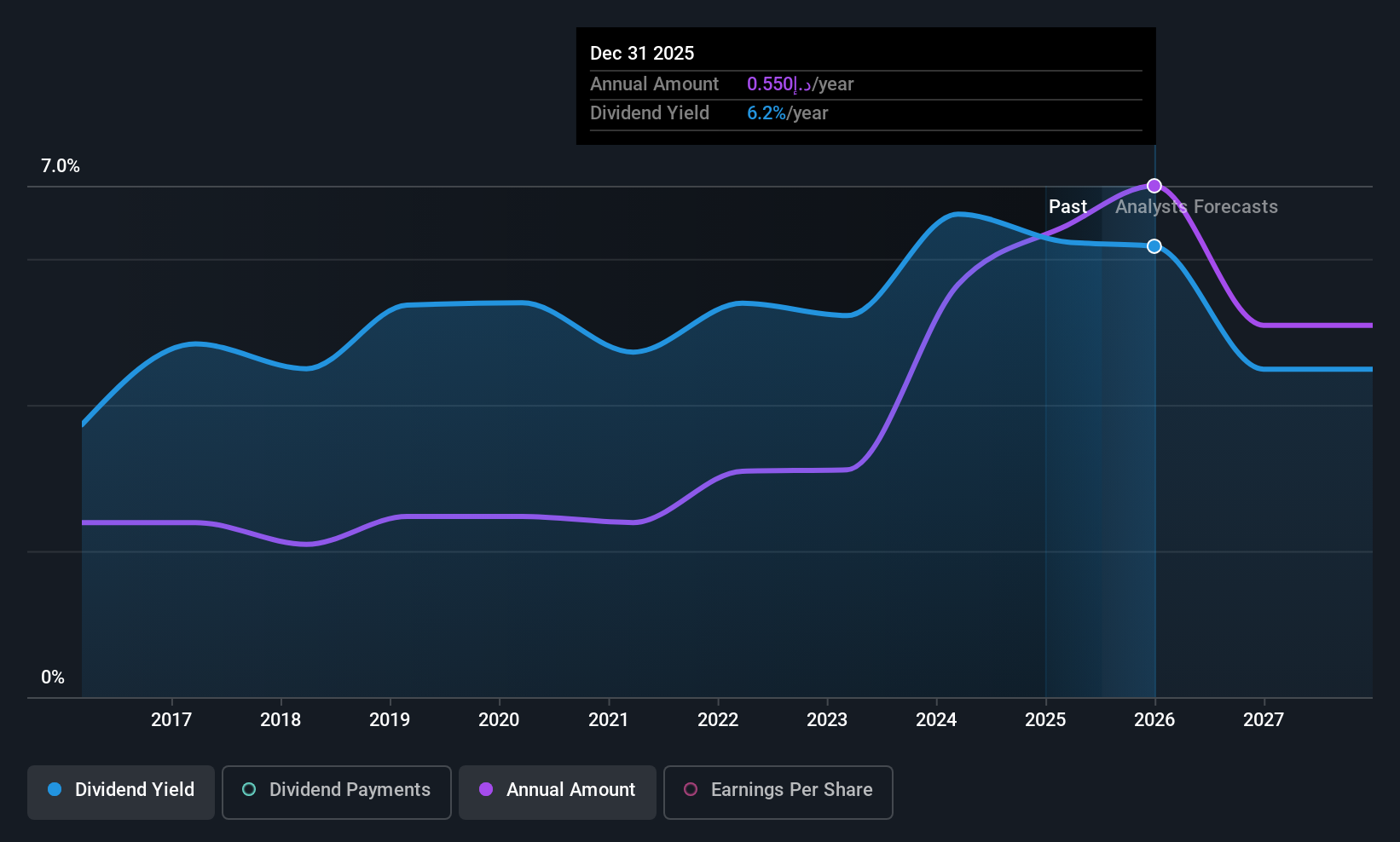

Dividend Yield: 5.4%

Commercial Bank of Dubai PSC offers a stable dividend yield of 5.37%, though it lags behind the top quartile in the AE market. The bank's dividends have shown consistent growth over the past decade, supported by a low payout ratio of 46.7%. Despite high bad loans at 4%, recent earnings reports reveal strong financial performance, with net income and earnings per share both increasing year-over-year, indicating robust coverage for future dividends.

- Take a closer look at Commercial Bank of Dubai PSC's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Commercial Bank of Dubai PSC is trading beyond its estimated value.

Thob Al Aseel (SASE:4012)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Thob Al Aseel Company engages in the development, import, export, wholesale, and retail of fabrics and readymade clothes with a market cap of SAR1.41 billion.

Operations: Thob Al Aseel's revenue primarily stems from its operations in developing, importing, exporting, wholesaling, and retailing fabrics and readymade clothes.

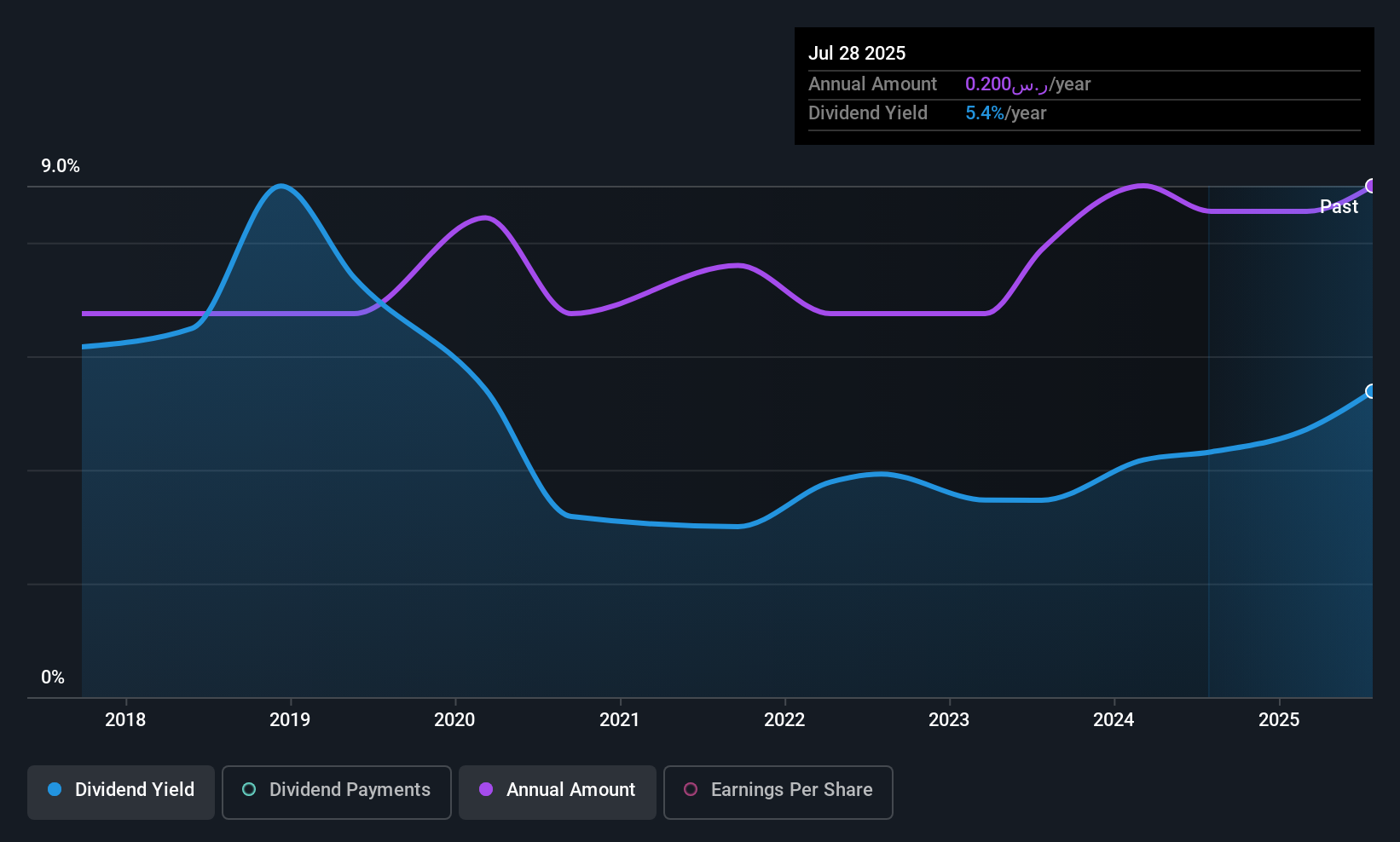

Dividend Yield: 5.7%

Thob Al Aseel's dividend yield of 5.68% places it in the top quartile of Saudi Arabian payers, but its dividends have been volatile over the past eight years. Despite a high payout ratio of 89.1%, dividends are well covered by cash flows at 33.6%. Recent earnings showed modest growth, with net income rising to SAR 78.24 million for the first nine months of 2025, although sales slightly declined compared to last year.

- Delve into the full analysis dividend report here for a deeper understanding of Thob Al Aseel.

- Our comprehensive valuation report raises the possibility that Thob Al Aseel is priced lower than what may be justified by its financials.

NewMed Energy - Limited Partnership (TASE:NWMD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NewMed Energy - Limited Partnership operates in the exploration, development, production, and sale of petroleum, natural gas, and condensate across Israel, Jordan, and Egypt with a market cap of ₪20.39 billion.

Operations: NewMed Energy - Limited Partnership generates revenue primarily from its oil and gas exploration and production segment, amounting to $903.90 million.

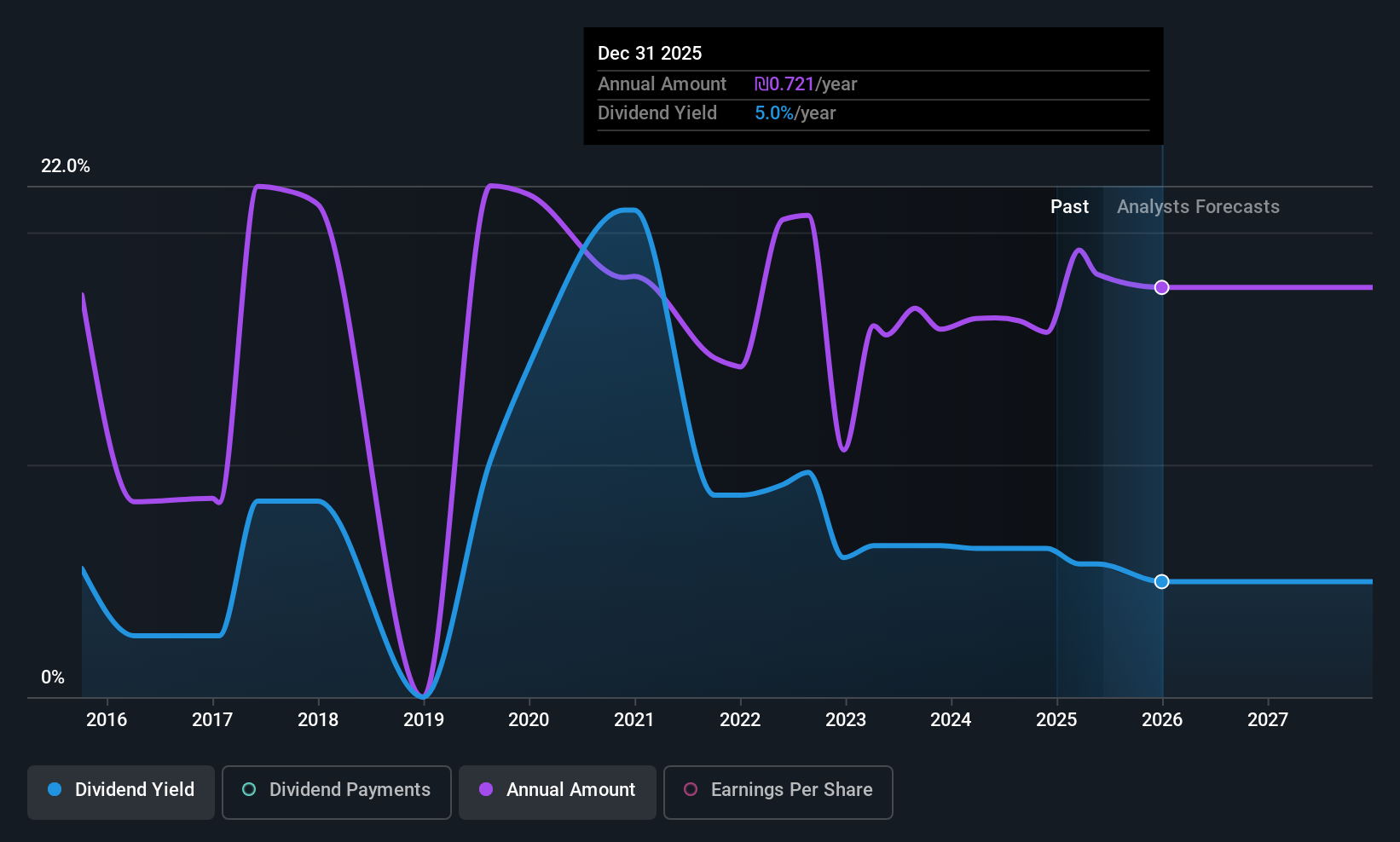

Dividend Yield: 4%

NewMed Energy's dividend yield of 3.99% is below the top tier in Israel, and its dividend history has been volatile over the past decade. However, dividends are well covered by earnings with a payout ratio of 79.6% and cash flows at 46.7%. Despite high debt levels, the company remains financially stable with a price-to-earnings ratio of 13.5x, below the market average, supported by significant revenue prospects from its $35 billion natural gas deal with Egypt.

- Navigate through the intricacies of NewMed Energy - Limited Partnership with our comprehensive dividend report here.

- According our valuation report, there's an indication that NewMed Energy - Limited Partnership's share price might be on the expensive side.

Where To Now?

- Click this link to deep-dive into the 66 companies within our Top Middle Eastern Dividend Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thob Al Aseel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4012

Thob Al Aseel

Develops, imports, exports, wholesales, and retails fabrics and readymade clothes.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives