- Saudi Arabia

- /

- Electrical

- /

- SASE:1303

Should You Be Adding Electrical Industries (TADAWUL:1303) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Electrical Industries (TADAWUL:1303), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Electrical Industries with the means to add long-term value to shareholders.

View our latest analysis for Electrical Industries

Electrical Industries' Improving Profits

Electrical Industries has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Outstandingly, Electrical Industries' EPS shot from ر.س0.16 to ر.س0.32, over the last year. Year on year growth of 97% is certainly a sight to behold. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Electrical Industries shareholders is that EBIT margins have grown from 16% to 22% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

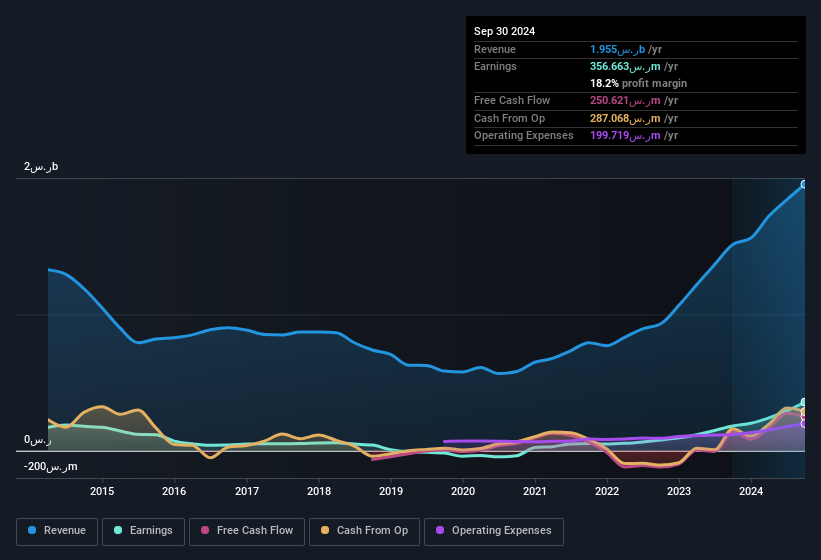

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Electrical Industries' balance sheet strength, before getting too excited.

Are Electrical Industries Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Shareholders will be pleased by the fact that insiders own Electrical Industries shares worth a considerable sum. Indeed, they hold ر.س172m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 2.2% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Our quick analysis into CEO remuneration would seem to indicate they are. For companies with market capitalisations between ر.س3.8b and ر.س12b, like Electrical Industries, the median CEO pay is around ر.س337k.

Electrical Industries' CEO only received compensation totalling ر.س215k in the year to December 2023. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Electrical Industries Deserve A Spot On Your Watchlist?

Electrical Industries' earnings per share have been soaring, with growth rates sky high. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The sharp increase in earnings could signal good business momentum. Big growth can make big winners, so the writing on the wall tells us that Electrical Industries is worth considering carefully. Even so, be aware that Electrical Industries is showing 1 warning sign in our investment analysis , you should know about...

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in SA with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Electrical Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1303

Electrical Industries

Through its subsidiaries, engages in the manufacture, assembly, supply, repair, and maintenance of transformers, compact substations and low voltage distribution panels, electrical distribution boards, cable trays, switch gears, and other electrical equipment in the Kingdom of Saudi Arabia, other Gulf countries, Europe, and Asia.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives