- United Arab Emirates

- /

- Healthcare Services

- /

- ADX:BURJEEL

Undiscovered Gems in the Middle East to Explore This November 2025

Reviewed by Simply Wall St

As Gulf markets grapple with weak oil prices and uncertainties surrounding U.S. Federal Reserve rate decisions, the regional indices have shown mixed performances, reflecting broader global economic sentiments. In this environment, identifying promising stocks requires a keen eye for companies that demonstrate resilience and potential growth despite prevailing market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 19.37% | 17.10% | 23.35% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Burjeel Holdings (ADX:BURJEEL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Burjeel Holdings PLC, along with its subsidiaries, manages multi-specialty hospitals and medical centers across the United Arab Emirates, the Sultanate of Oman, and the Kingdom of Saudi Arabia, with a market capitalization of AED7.13 billion.

Operations: Burjeel Holdings generates revenue primarily through its network of multi-specialty hospitals and medical centers across the UAE, Oman, and Saudi Arabia. The company's market capitalization stands at AED7.13 billion.

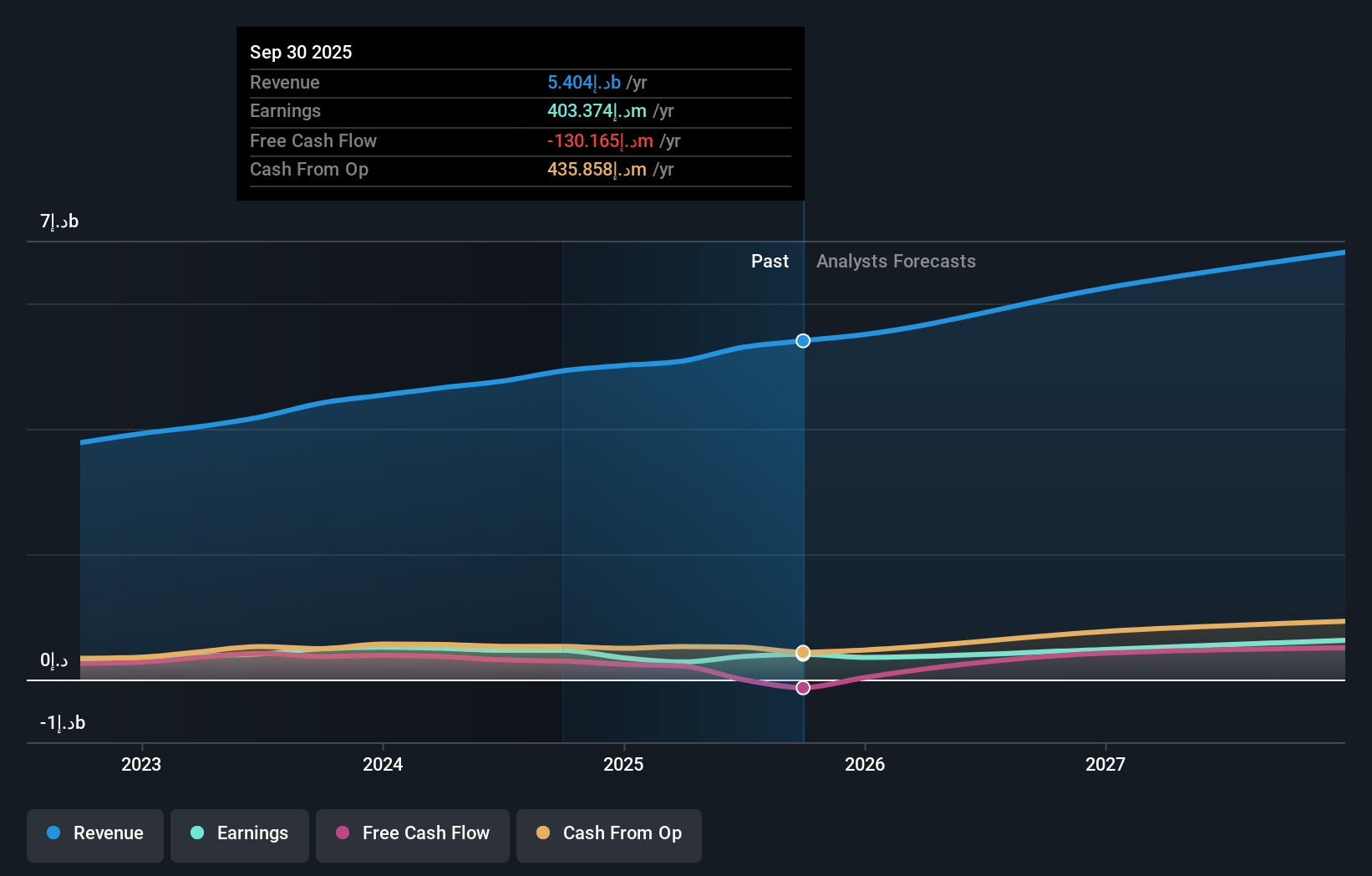

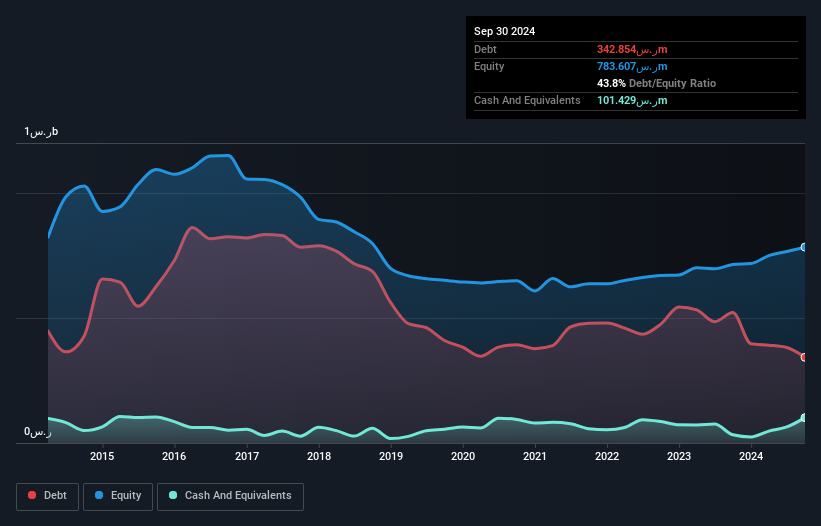

Burjeel Holdings, a healthcare provider in the GCC region, is navigating its growth path with a focus on high-value medical specialties like oncology and fertility. The company's debt to equity ratio has impressively decreased from 2883.7% to 87.7% over five years, signaling improved financial health despite its high net debt to equity ratio of 80.3%. Recent earnings show promising growth with third-quarter sales at AED 1.42 billion compared to AED 1.32 billion last year, and net income rising from AED 130.53 million to AED 165.54 million year-on-year, reflecting robust operational performance amidst competitive pressures and market expansion challenges.

Gulf Medical Projects Company (PJSC) (ADX:GMPC)

Simply Wall St Value Rating: ★★★★★★

Overview: Gulf Medical Projects Company (PJSC) operates hospitals in the United Arab Emirates with a market capitalization of AED1.45 billion.

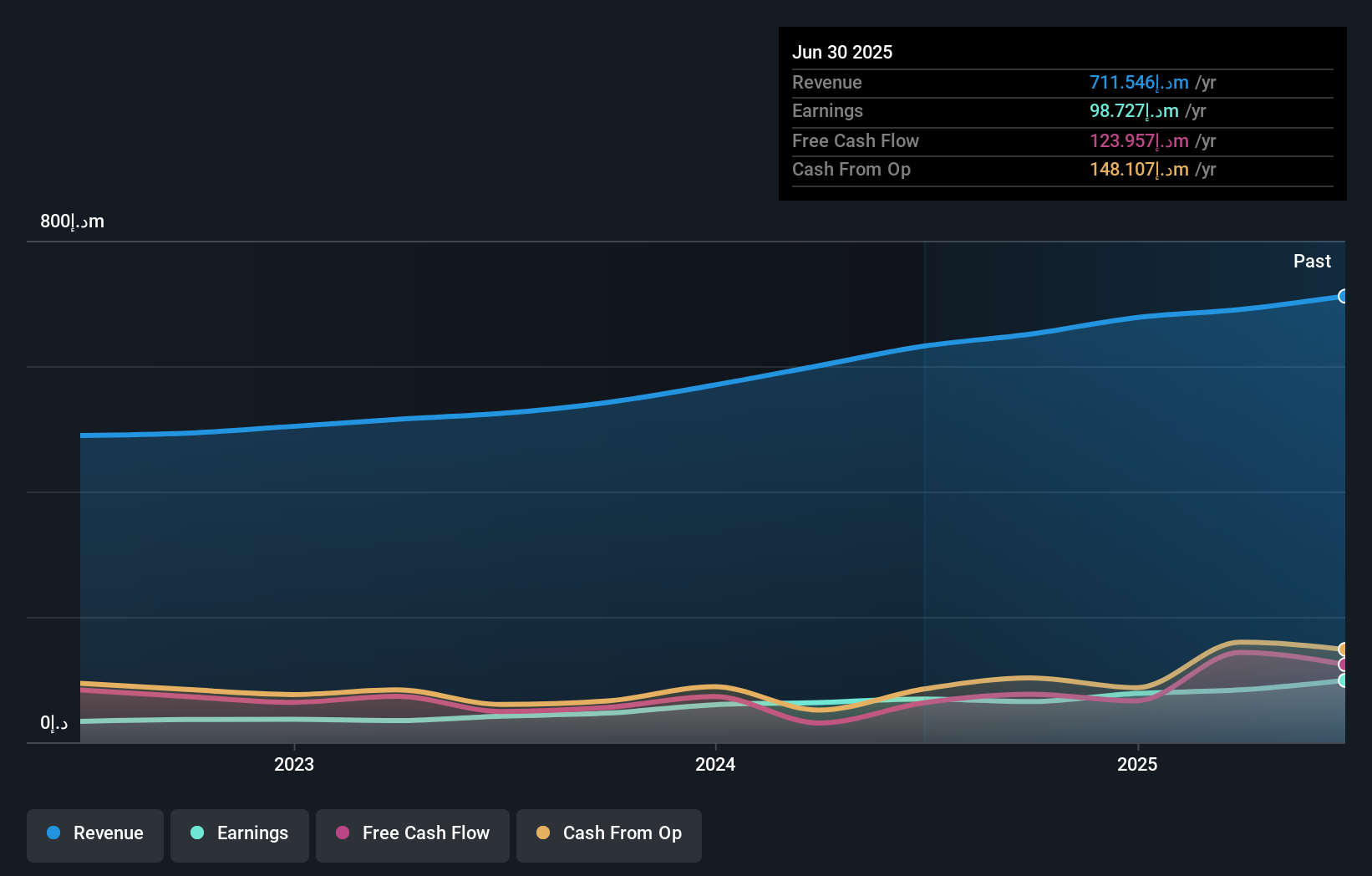

Operations: GMPC generates revenue primarily from health services, amounting to AED711.55 million, with investments contributing AED50.66 million.

Gulf Medical Projects Company, a small player in the healthcare sector, is showing strong potential with its impressive earnings growth of 43.1% over the past year, outpacing the industry average of 6.1%. The company reported sales of AED 185.37 million for Q2 2025, up from AED 164.16 million last year, while net income surged to AED 34.98 million from AED 19.79 million. Its debt-free status and high-quality earnings contribute to its robust financial health, and it trades at a significant discount to estimated fair value by about 79%. Despite these strengths, share price volatility remains a concern for investors seeking stability in their portfolios.

Al Hassan Ghazi Ibrahim Shaker (SASE:1214)

Simply Wall St Value Rating: ★★★★★★

Overview: Al Hassan Ghazi Ibrahim Shaker Company, along with its subsidiaries, operates in the trading, wholesale, and maintenance of spare parts, electronic equipment, household appliances, and air-conditioners across Saudi Arabia and Jordan with a market capitalization of SAR1.45 billion.

Operations: Shaker generates revenue primarily from its Home Appliances segment, contributing SAR353.79 million, and its Heating, Ventilation, and Air-Conditioning Solutions (HVAC) segment, which brings in SAR1.07 billion.

Shaker Co. shows a promising profile with its earnings growing by 15% over the past year, outpacing the Trade Distributors industry average of 6%. The company's net debt to equity ratio stands at a satisfactory 31%, having improved from 59% over five years, indicating prudent financial management. Its recent earnings report highlights sales growth to SAR 368 million in Q2 from SAR 345 million last year, and net income rose to SAR 19.9 million from SAR 16.45 million. With interest payments well covered by EBIT (5.4x), Shaker Co.'s financial health appears robust as it expands its board for future growth strategies.

Seize The Opportunity

- Discover the full array of 211 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Burjeel Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:BURJEEL

Burjeel Holdings

Owns and operates multi-specialty hospitals and medical centers in the United Arab Emirates, the Sultanate of Oman, and the Kingdom of Saudi Arabia.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives