- Russia

- /

- Electric Utilities

- /

- MISX:HYDR

Does Federal Hydro-Generating Company - RusHydro (MCX:HYDR) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Public Joint-Stock Company Federal Hydro-Generating Company - RusHydro (MCX:HYDR) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Federal Hydro-Generating Company - RusHydro

What Is Federal Hydro-Generating Company - RusHydro's Debt?

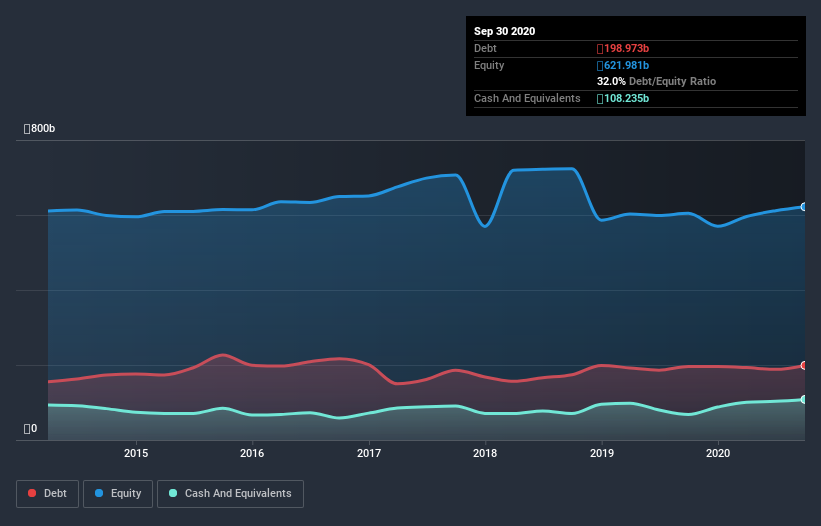

As you can see below, Federal Hydro-Generating Company - RusHydro had ₽199.0b of debt, at September 2020, which is about the same as the year before. You can click the chart for greater detail. However, it does have ₽108.2b in cash offsetting this, leading to net debt of about ₽90.7b.

How Healthy Is Federal Hydro-Generating Company - RusHydro's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Federal Hydro-Generating Company - RusHydro had liabilities of ₽146.2b due within 12 months and liabilities of ₽207.2b due beyond that. Offsetting these obligations, it had cash of ₽108.2b as well as receivables valued at ₽56.5b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₽188.7b.

This deficit isn't so bad because Federal Hydro-Generating Company - RusHydro is worth ₽350.4b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Federal Hydro-Generating Company - RusHydro's net debt is only 0.77 times its EBITDA. And its EBIT easily covers its interest expense, being 22.6 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Also positive, Federal Hydro-Generating Company - RusHydro grew its EBIT by 21% in the last year, and that should make it easier to pay down debt, going forward. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Federal Hydro-Generating Company - RusHydro's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Federal Hydro-Generating Company - RusHydro created free cash flow amounting to 19% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

Happily, Federal Hydro-Generating Company - RusHydro's impressive interest cover implies it has the upper hand on its debt. But truth be told we feel its conversion of EBIT to free cash flow does undermine this impression a bit. We would also note that Electric Utilities industry companies like Federal Hydro-Generating Company - RusHydro commonly do use debt without problems. All these things considered, it appears that Federal Hydro-Generating Company - RusHydro can comfortably handle its current debt levels. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Federal Hydro-Generating Company - RusHydro you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Federal Hydro-Generating Company - RusHydro, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:HYDR

Federal Hydro-Generating Company - RusHydro

Public Joint-Stock Company Federal Hydro-Generating Company - RusHydro, together with its subsidiaries, generates, transmits, distributes, and sells electricity and heat in Russia.

Adequate balance sheet second-rate dividend payer.