- Russia

- /

- Metals and Mining

- /

- MISX:VSMO

public stock company VSMPO-AVISMA (MCX:VSMO) Has Gifted Shareholders With A Fantastic 168% Total Return On Their Investment

The main point of investing for the long term is to make money. But more than that, you probably want to see it rise more than the market average. But public stock company VSMPO-AVISMA Corporation (MCX:VSMO) has fallen short of that second goal, with a share price rise of 75% over five years, which is below the market return. But if you include dividends then the return is market-beating. Zooming in, the stock is actually down 6.3% in the last year.

View our latest analysis for public stock company VSMPO-AVISMA

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, public stock company VSMPO-AVISMA actually saw its EPS drop 9.2% per year.

Essentially, it doesn't seem likely that investors are focused on EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

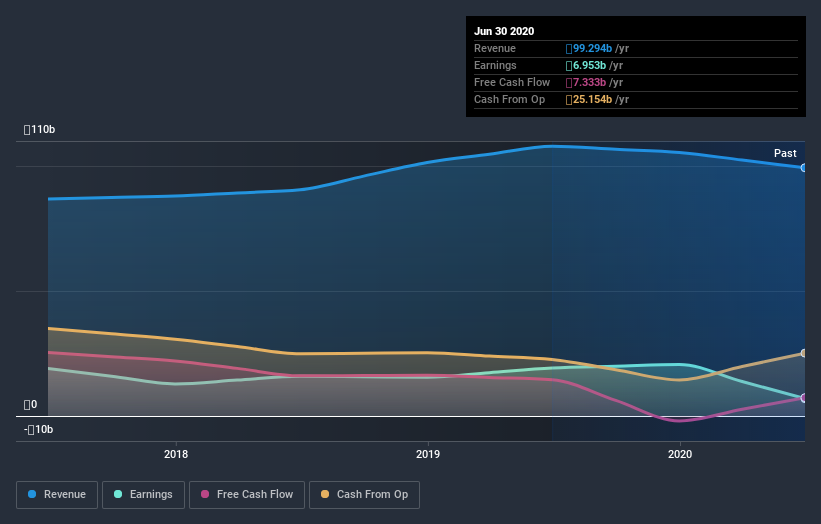

On the other hand, public stock company VSMPO-AVISMA's revenue is growing nicely, at a compound rate of 6.6% over the last five years. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at public stock company VSMPO-AVISMA's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered public stock company VSMPO-AVISMA's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. public stock company VSMPO-AVISMA's TSR of 168% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

While the broader market gained around 8.6% in the last year, public stock company VSMPO-AVISMA shareholders lost 6.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 22%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - public stock company VSMPO-AVISMA has 4 warning signs (and 1 which is concerning) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on RU exchanges.

When trading public stock company VSMPO-AVISMA or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:VSMO

public stock company VSMPO-AVISMA

public stock company VSMPO-AVISMA Corporation produces and sells titanium in Russia and internationally.

Flawless balance sheet and slightly overvalued.