As the European markets navigate the complexities of global economic shifts, including concerns about growth and currency fluctuations, investors are increasingly attentive to emerging opportunities. Penny stocks, though often associated with smaller or newer companies, continue to intrigue due to their potential for growth at accessible price points. When these stocks are supported by strong financials and solid fundamentals, they can offer a compelling mix of value and stability that appeals to those seeking hidden gems in the market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.246 | €1.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €241.45M | ✅ 2 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.382 | RON15.22M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €3.14 | €66.23M | ✅ 4 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.02 | €9.58M | ✅ 2 ⚠️ 5 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.34 | €383.59M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €3.58 | €70.37M | ✅ 1 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.085 | €288.19M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.932 | €31.43M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 330 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Ariston Holding (BIT:ARIS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ariston Holding N.V. operates through its subsidiaries to produce and distribute hot water and space heating solutions in the Netherlands, Germany, Italy, Switzerland, and internationally, with a market cap of €1.47 billion.

Operations: The company's revenue is primarily derived from its Thermal Comfort segment, which accounts for €2.48 billion, followed by Burners at €89.2 million and Components at €83.3 million.

Market Cap: €1.47B

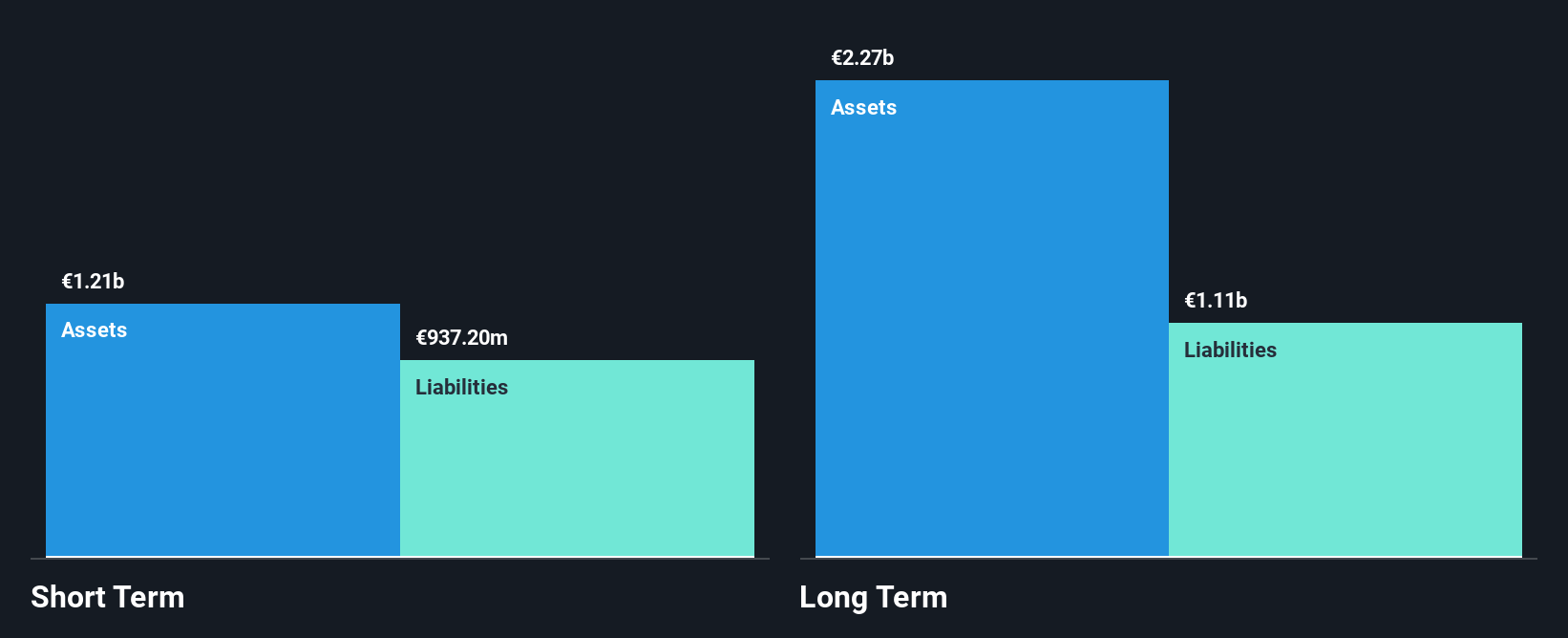

Ariston Holding has shown a significant turnaround with net income of €58.7 million for the first half of 2025, compared to a net loss in the previous year. Despite its high debt level, Ariston's short-term assets comfortably cover both short and long-term liabilities, indicating sound financial health. The company benefits from stable earnings growth and strong cash flow coverage for its debt. However, its return on equity remains low at 6.6%, and it faces challenges with an unstable dividend track record. Trading below estimated fair value suggests potential upside if operational improvements continue.

- Click to explore a detailed breakdown of our findings in Ariston Holding's financial health report.

- Gain insights into Ariston Holding's outlook and expected performance with our report on the company's earnings estimates.

AROBS Transilvania Software (BVB:AROBS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AROBS Transilvania Software S.A. offers customized software services across Romania, Europe, the United States, Asia, and the Middle East with a market cap of RON722.63 million.

Operations: The company's revenue is primarily derived from Software Services at RON302.50 million, followed by Software Products at RON88.40 million and Integrated Systems at RON32.85 million.

Market Cap: RON722.63M

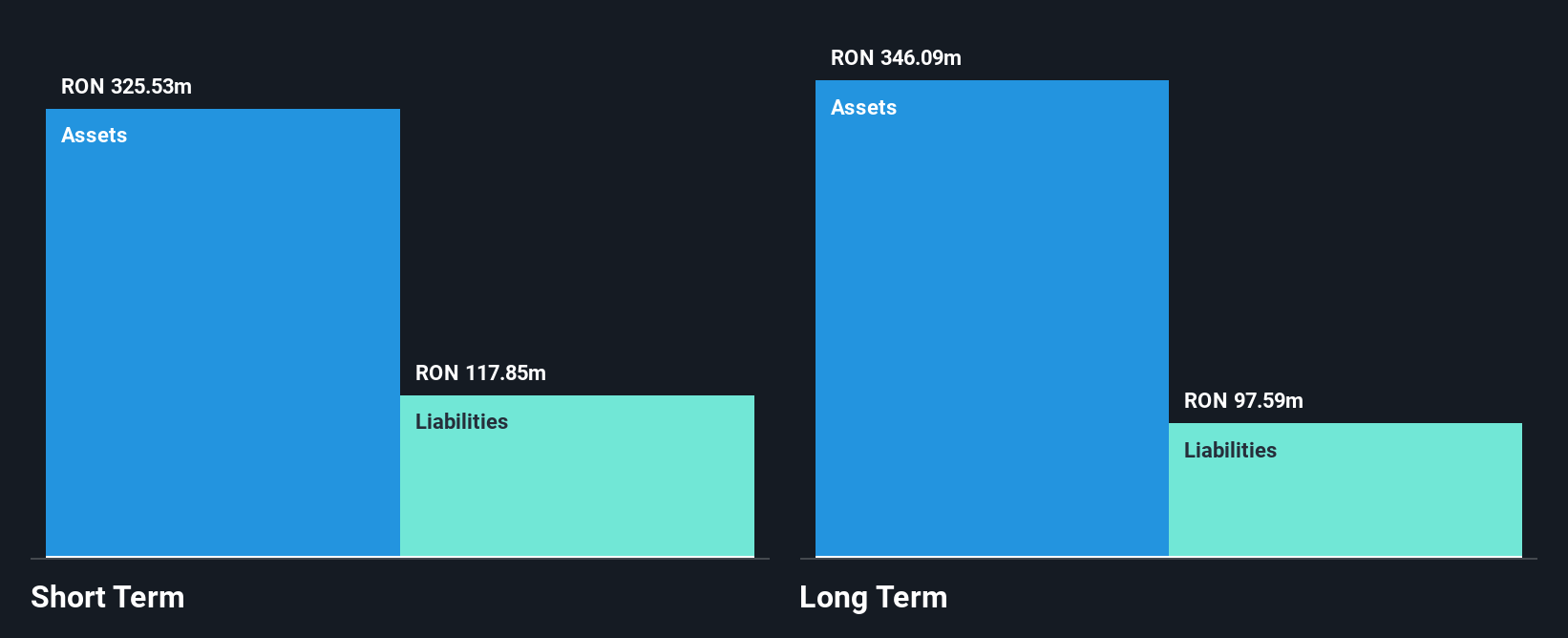

AROBS Transilvania Software has demonstrated robust financial health, with short-term assets of RON325.5 million exceeding both short and long-term liabilities. Its earnings growth of 4.1% over the past year surpasses industry averages, despite a historical decline in profits over five years. The company maintains more cash than debt, ensuring strong interest coverage and operating cash flow that comfortably covers its debt obligations at 167.8%. Trading at a discount to estimated fair value may present opportunities if forecasted earnings growth of 28.51% materializes, although its return on equity remains low at 4.5%.

- Take a closer look at AROBS Transilvania Software's potential here in our financial health report.

- Examine AROBS Transilvania Software's earnings growth report to understand how analysts expect it to perform.

Nordic Iron Ore (OM:NIO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nordic Iron Ore AB (publ) is involved in the exploration, development, and mining of iron ore deposits in Västerbergslagen, Sweden, with a market cap of SEK339.58 million.

Operations: Nordic Iron Ore AB (publ) currently does not report any specific revenue segments.

Market Cap: SEK339.58M

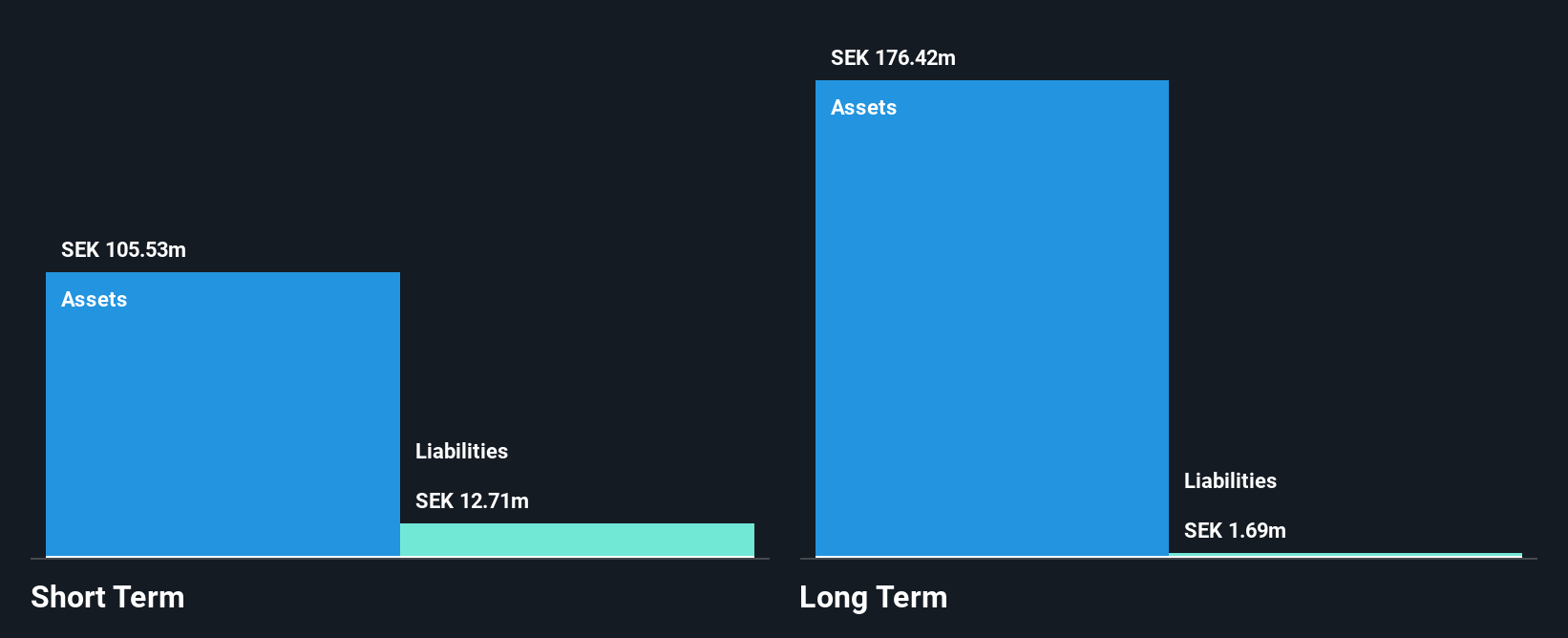

Nordic Iron Ore AB (publ) operates with a market cap of SEK339.58 million and remains pre-revenue, reflecting its developmental stage in the mining sector. Despite being unprofitable, the company maintains a strong cash position with short-term assets of SEK82.1 million exceeding both short and long-term liabilities, ensuring financial stability without debt obligations. Recent relocation to new premises in Ludvika highlights strategic growth initiatives aimed at enhancing operational capacity and workforce expansion. However, high share price volatility persists alongside management's limited experience, factors that potential investors should consider when evaluating this penny stock's risk profile.

- Unlock comprehensive insights into our analysis of Nordic Iron Ore stock in this financial health report.

- Review our historical performance report to gain insights into Nordic Iron Ore's track record.

Key Takeaways

- Investigate our full lineup of 330 European Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:AROBS

AROBS Transilvania Software

Provides customized software services in Romania, Europe, the United States, Asia, and the Middle East.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success