Does S.C. Romcarbon (BVB:ROCE) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies S.C. Romcarbon S.A. (BVB:ROCE) makes use of debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for S.C. Romcarbon

What Is S.C. Romcarbon's Debt?

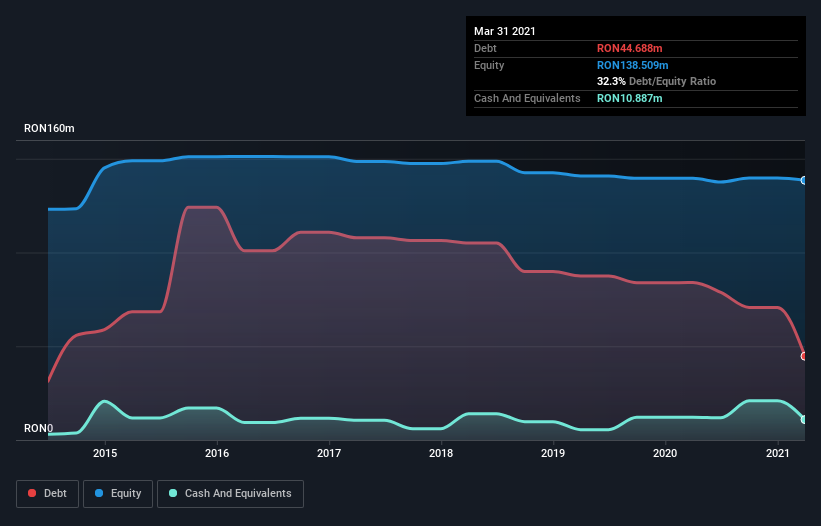

As you can see below, S.C. Romcarbon had RON44.7m of debt at March 2021, down from RON83.9m a year prior. However, it does have RON10.9m in cash offsetting this, leading to net debt of about RON33.8m.

A Look At S.C. Romcarbon's Liabilities

The latest balance sheet data shows that S.C. Romcarbon had liabilities of RON86.4m due within a year, and liabilities of RON23.7m falling due after that. Offsetting this, it had RON10.9m in cash and RON57.4m in receivables that were due within 12 months. So it has liabilities totalling RON41.9m more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of RON56.0m. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

S.C. Romcarbon has net debt worth 1.6 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 4.2 times the interest expense. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. Pleasingly, S.C. Romcarbon is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 153% gain in the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since S.C. Romcarbon will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Happily for any shareholders, S.C. Romcarbon actually produced more free cash flow than EBIT over the last two years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

The good news is that S.C. Romcarbon's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. But truth be told we feel its level of total liabilities does undermine this impression a bit. All these things considered, it appears that S.C. Romcarbon can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for S.C. Romcarbon (1 can't be ignored) you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BVB:ROCE

S.C. Romcarbon

Operates as a plastic processor and a recycler in Romania, Europe, China, Israel, Taiwan, and Panama.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives