Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Prefab S.A. (BVB:PREH) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Prefab

What Is Prefab's Net Debt?

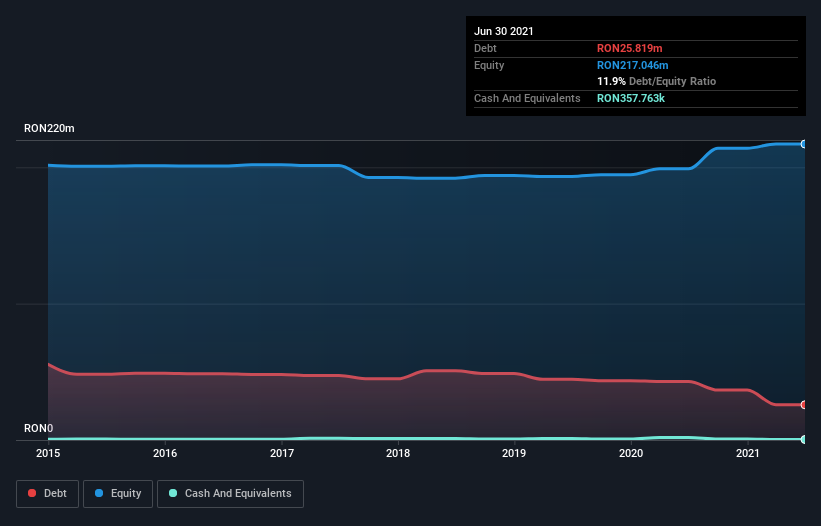

The image below, which you can click on for greater detail, shows that Prefab had debt of RON25.8m at the end of June 2021, a reduction from RON42.9m over a year. Net debt is about the same, since the it doesn't have much cash.

How Healthy Is Prefab's Balance Sheet?

The latest balance sheet data shows that Prefab had liabilities of RON39.8m due within a year, and liabilities of RON11.6m falling due after that. Offsetting this, it had RON357.8k in cash and RON38.4m in receivables that were due within 12 months. So its liabilities total RON12.7m more than the combination of its cash and short-term receivables.

Of course, Prefab has a market capitalization of RON111.6m, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Prefab's net debt is only 0.78 times its EBITDA. And its EBIT covers its interest expense a whopping 20.1 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Better yet, Prefab grew its EBIT by 153% last year, which is an impressive improvement. That boost will make it even easier to pay down debt going forward. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Prefab will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the most recent three years, Prefab recorded free cash flow worth 69% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Happily, Prefab's impressive interest cover implies it has the upper hand on its debt. And the good news does not stop there, as its EBIT growth rate also supports that impression! Considering this range of factors, it seems to us that Prefab is quite prudent with its debt, and the risks seem well managed. So we're not worried about the use of a little leverage on the balance sheet. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 4 warning signs for Prefab that you should be aware of before investing here.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BVB:PREH

Prefab

Manufactures and sells concrete products for the construction sector in Muntenia, Moldova, Bulgaria, Transylvania, and the Republic of Moldova.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Dentsply Sirona Stock: Dental Technology Built for Cycles, Not Headlines

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion