- Romania

- /

- Healthcare Services

- /

- BVB:M

3 European Growth Companies With Insider Ownership Up To 39%

Reviewed by Simply Wall St

As European markets remain mixed, with the pan-European STOXX Europe 600 Index ending roughly flat amid cautious investor sentiment over U.S. and European trade talks, investors are increasingly looking for opportunities in growth companies with strong insider ownership. In this environment, companies where insiders have significant stakes can signal confidence in future prospects and align management's interests with those of shareholders, making them attractive considerations for those seeking growth potential.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 21.8% | 56.8% |

| Pharma Mar (BME:PHM) | 11.8% | 43.3% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 130.8% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| KebNi (OM:KEBNI B) | 38.3% | 94.5% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.7% | 94.8% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 62.3% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

Here's a peek at a few of the choices from the screener.

Med Life (BVB:M)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Med Life S.A. is a private healthcare provider operating clinics and hospitals across several cities in Romania, with a market cap of RON3.84 billion.

Operations: The company's revenue is primarily derived from its clinics (RON1.07 billion), hospitals (RON719.63 million), corporate services (RON297.95 million), laboratories (RON313.75 million), pharmacies (RON70.84 million), and stomatology services (RON123.31 million).

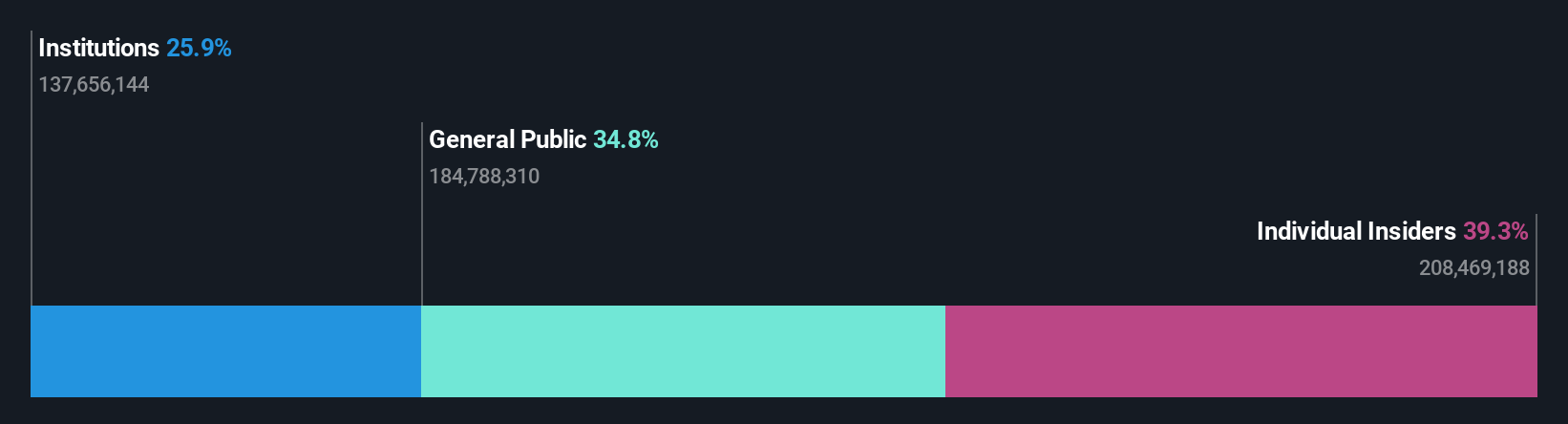

Insider Ownership: 39.3%

Med Life's recent earnings report shows a healthy increase in revenue to RON 779.21 million, up from RON 648.41 million the previous year, though net income slightly decreased to RON 13.38 million. Trading significantly below estimated fair value, Med Life is positioned for substantial profit growth with earnings forecasted to rise by 59.6% annually, outpacing market averages despite slower revenue growth projections of 11% per year compared to the broader market's expectations.

- Get an in-depth perspective on Med Life's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Med Life's shares may be trading at a premium.

Bittium Oyj (HLSE:BITTI)

Simply Wall St Growth Rating: ★★★★☆☆

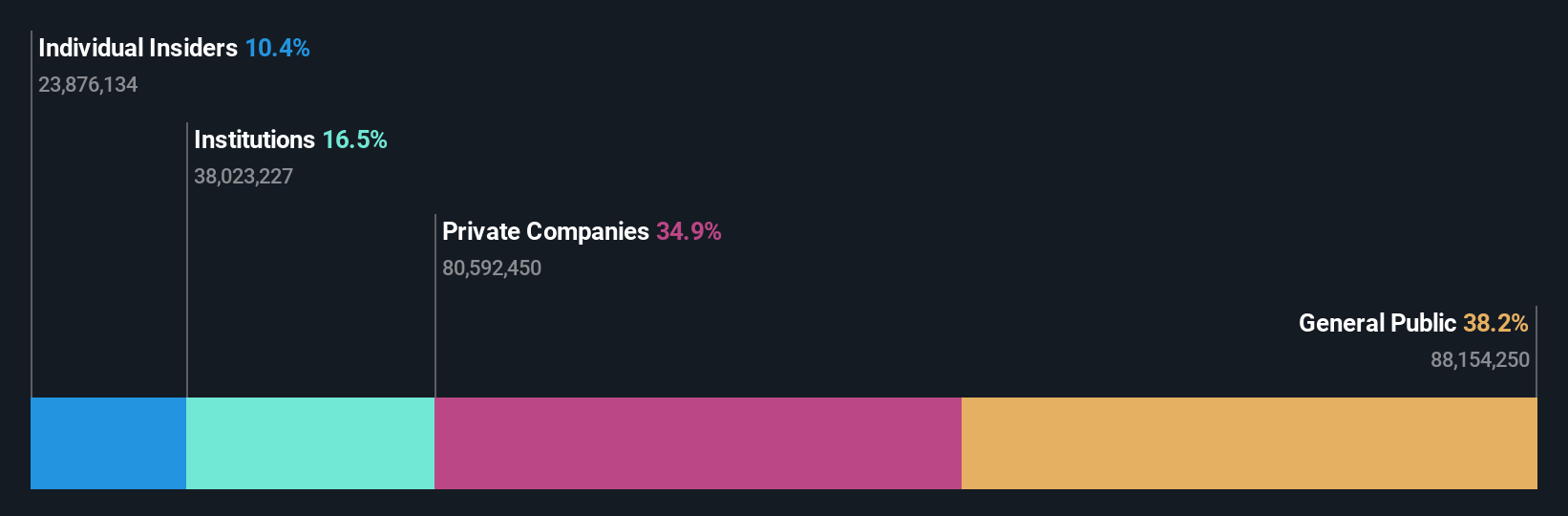

Overview: Bittium Oyj is a company that offers communications and connectivity solutions, healthcare technology products and services, and biosignal measuring and monitoring across Finland, Germany, and the United States with a market cap of €372.60 million.

Operations: Bittium Oyj's revenue is primarily derived from its Defense & Security segment (€51.60 million), Medical solutions (€29.80 million), and Engineering Services (€14.32 million).

Insider Ownership: 12.4%

Bittium Oyj, a Finnish tech firm, is advancing its growth trajectory through strategic collaborations and innovative solutions. Recent partnerships include a EUR 2 million project with Terrestar Solutions to develop a 5G Non-Terrestrial Network solution, enhancing satellite connectivity for mobile devices. Despite volatile share prices, Bittium's earnings are projected to grow significantly at 24.19% annually, surpassing the Finnish market average. However, revenue growth is moderate at 10.2%, and insider trading activity remains stable.

- Click to explore a detailed breakdown of our findings in Bittium Oyj's earnings growth report.

- According our valuation report, there's an indication that Bittium Oyj's share price might be on the expensive side.

YIT Oyj (HLSE:YIT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: YIT Oyj is a construction services company operating in Finland, the Czech Republic, Slovakia, Poland, and internationally with a market cap of €654.83 million.

Operations: The company's revenue is derived from three main segments: Housing (€719 million), Infrastructure (€418 million), and Business Premises (€690 million).

Insider Ownership: 12.7%

YIT Oyj, a Finnish construction company, is leveraging its high insider ownership to drive growth through strategic projects and sustainable practices. Recent initiatives include the EUR 21 million Asunto Oy Helsingin Taikalyhty residential project and a EUR 27.6 million port extension in Helsinki. Despite current financial challenges, YIT's revenue is forecast to grow at 7.7% annually, outpacing the Finnish market's average growth rate of 3.8%. However, debt coverage by operating cash flow remains a concern.

- Delve into the full analysis future growth report here for a deeper understanding of YIT Oyj.

- In light of our recent valuation report, it seems possible that YIT Oyj is trading behind its estimated value.

Summing It All Up

- Access the full spectrum of 214 Fast Growing European Companies With High Insider Ownership by clicking on this link.

- Curious About Other Options? The end of cancer? These 25 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:M

Med Life

A private healthcare provider, provides healthcare services through its clinics and hospitals in Bucharest, Cluj, Braila, Timisoara, Iasi, Galati, Ploiesti, Constanta, and Targu Mures, Romania.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives