- Qatar

- /

- Other Utilities

- /

- DSM:QEWS

What Qatar Electricity & Water Company Q.P.S.C.'s (DSM:QEWS) P/E Is Not Telling You

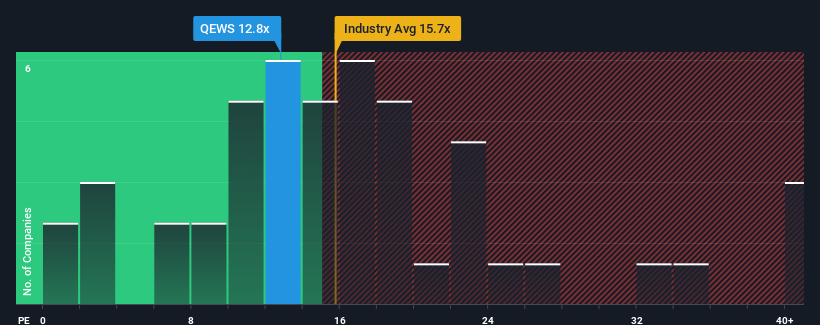

There wouldn't be many who think Qatar Electricity & Water Company Q.P.S.C.'s (DSM:QEWS) price-to-earnings (or "P/E") ratio of 12.8x is worth a mention when the median P/E in Qatar is similar at about 14x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's inferior to most other companies of late, Qatar Electricity & Water Company Q.P.S.C has been relatively sluggish. One possibility is that the P/E is moderate because investors think this lacklustre earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Qatar Electricity & Water Company Q.P.S.C

Is There Some Growth For Qatar Electricity & Water Company Q.P.S.C?

The only time you'd be comfortable seeing a P/E like Qatar Electricity & Water Company Q.P.S.C's is when the company's growth is tracking the market closely.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Likewise, not much has changed from three years ago as earnings have been stuck during that whole time. So it seems apparent to us that the company has struggled to grow earnings meaningfully over that time.

Looking ahead now, EPS is anticipated to climb by 1.2% per annum during the coming three years according to the four analysts following the company. With the market predicted to deliver 11% growth per annum, the company is positioned for a weaker earnings result.

With this information, we find it interesting that Qatar Electricity & Water Company Q.P.S.C is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Qatar Electricity & Water Company Q.P.S.C currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about this 1 warning sign we've spotted with Qatar Electricity & Water Company Q.P.S.C.

If these risks are making you reconsider your opinion on Qatar Electricity & Water Company Q.P.S.C, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Qatar Electricity & Water Company Q.P.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:QEWS

Qatar Electricity & Water Company Q.P.S.C

Invests in, develops, owns, and operates plants to produce electricity and desalinated water in Qatar and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026