- Qatar

- /

- Real Estate

- /

- DSM:BRES

Do These 3 Checks Before Buying Barwa Real Estate Company Q.P.S.C. (DSM:BRES) For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Barwa Real Estate Company Q.P.S.C. (DSM:BRES) is about to trade ex-dividend in the next 3 days. Ex-dividend means that investors that purchase the stock on or after the 9th of March will not receive this dividend, which will be paid on the 1st of January.

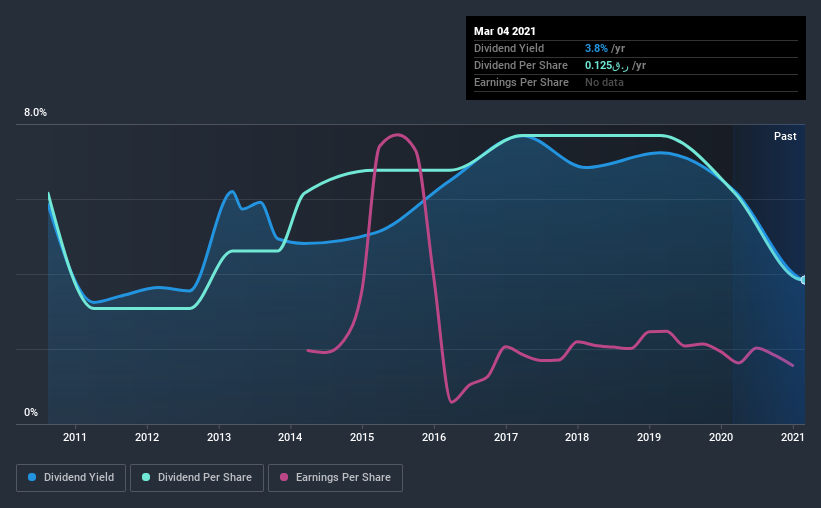

Barwa Real Estate Company Q.P.S.C's upcoming dividend is ر.ق0.13 a share, following on from the last 12 months, when the company distributed a total of ر.ق0.13 per share to shareholders. Last year's total dividend payments show that Barwa Real Estate Company Q.P.S.C has a trailing yield of 3.8% on the current share price of QAR3.26. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for Barwa Real Estate Company Q.P.S.C

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Barwa Real Estate Company Q.P.S.C paid out a comfortable 40% of its profit last year. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Over the past year it paid out 124% of its free cash flow as dividends, which is uncomfortably high. It's hard to consistently pay out more cash than you generate without either borrowing or using company cash, so we'd wonder how the company justifies this payout level.

While Barwa Real Estate Company Q.P.S.C's dividends were covered by the company's reported profits, cash is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Cash is king, as they say, and were Barwa Real Estate Company Q.P.S.C to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings fall far enough, the company could be forced to cut its dividend. Barwa Real Estate Company Q.P.S.C's earnings per share have fallen at approximately 17% a year over the previous five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Barwa Real Estate Company Q.P.S.C's dividend payments per share have declined at 4.6% per year on average over the past 10 years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

Final Takeaway

From a dividend perspective, should investors buy or avoid Barwa Real Estate Company Q.P.S.C? Barwa Real Estate Company Q.P.S.C's earnings per share have fallen noticeably and, although it paid out less than half its profit as dividends last year, it paid out a disconcertingly high percentage of its cashflow, which is not a great combination. It's not an attractive combination from a dividend perspective, and we're inclined to pass on this one for the time being.

With that being said, if you're still considering Barwa Real Estate Company Q.P.S.C as an investment, you'll find it beneficial to know what risks this stock is facing. To help with this, we've discovered 3 warning signs for Barwa Real Estate Company Q.P.S.C (1 makes us a bit uncomfortable!) that you ought to be aware of before buying the shares.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Barwa Real Estate Company Q.P.S.C, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Barwa Real Estate Company Q.P.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DSM:BRES

Barwa Real Estate Company Q.P.S.C

Barwa Real Estate Company is a real estate investment firm specializing in real estate projects which include residential facilities, a motor city, warehouses, and complementary commercial and retail spaces.

Average dividend payer with low risk.

Market Insights

Community Narratives