Stock Analysis

Qatar General Insurance & Reinsurance Company Q.P.S.C (DSM:QGRI investor five-year losses grow to 77% as the stock sheds ر.ق129m this past week

Some stocks are best avoided. It hits us in the gut when we see fellow investors suffer a loss. Anyone who held Qatar General Insurance & Reinsurance Company Q.P.S.C. (DSM:QGRI) for five years would be nursing their metaphorical wounds since the share price dropped 77% in that time. And it's not just long term holders hurting, because the stock is down 42% in the last year. On top of that, the share price is down 12% in the last week.

If the past week is anything to go by, investor sentiment for Qatar General Insurance & Reinsurance Company Q.P.S.C isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Qatar General Insurance & Reinsurance Company Q.P.S.C

SWOT Analysis for Qatar General Insurance & Reinsurance Company Q.P.S.C

- Net debt to equity ratio below 40%.

- Interest payments on debt are not well covered.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Lack of analyst coverage makes it difficult to determine QGRI's earnings prospects.

- Debt is not well covered by operating cash flow.

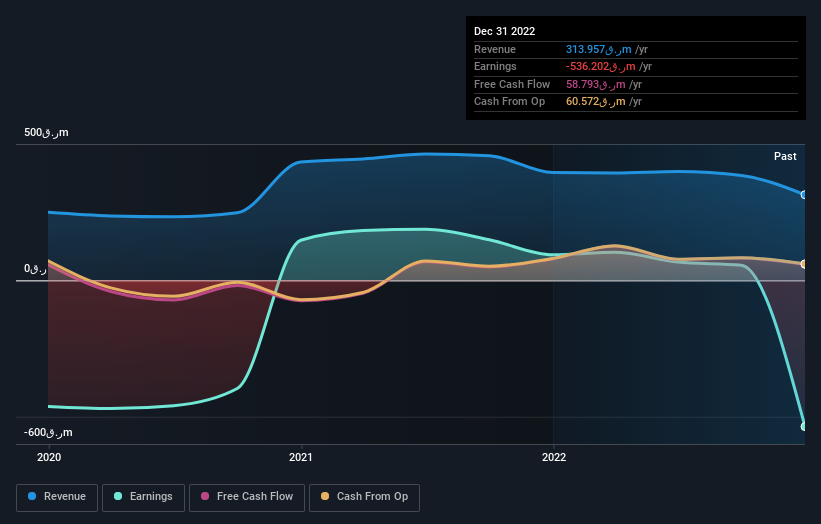

Given that Qatar General Insurance & Reinsurance Company Q.P.S.C didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last half decade, Qatar General Insurance & Reinsurance Company Q.P.S.C saw its revenue increase by 4.4% per year. That's not a very high growth rate considering it doesn't make profits. Nonetheless, it's fair to say the rapidly declining share price (down 12%, compound, over five years) suggests the market is very disappointed with this level of growth. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. We'd recommend focussing any further research on the likelihood of profitability in the foreseeable future, given the muted revenue growth.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We regret to report that Qatar General Insurance & Reinsurance Company Q.P.S.C shareholders are down 42% for the year. Unfortunately, that's worse than the broader market decline of 16%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Qatar General Insurance & Reinsurance Company Q.P.S.C has 2 warning signs we think you should be aware of.

We will like Qatar General Insurance & Reinsurance Company Q.P.S.C better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Qatari exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Qatar General Insurance & Reinsurance Company Q.P.S.C is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:QGRI

Qatar General Insurance & Reinsurance Company Q.P.S.C

Qatar General Insurance & Reinsurance Company Q.P.S.C., together with its subsidiaries, engages in the provision of general insurance and reinsurance products.

Imperfect balance sheet and overvalued.