- Qatar

- /

- Industrials

- /

- DSM:AHCS

While shareholders of Aamal Company Q.P.S.C (DSM:AHCS) are in the red over the last three years, underlying earnings have actually grown

Many investors define successful investing as beating the market average over the long term. But if you try your hand at stock picking, you risk returning less than the market. Unfortunately, that's been the case for longer term Aamal Company Q.P.S.C. (DSM:AHCS) shareholders, since the share price is down 14% in the last three years, falling well short of the market decline of around 1.8%. In contrast, the stock price has popped 8.7% in the last thirty days. However, this may be a matter of broader market optimism, since stocks are up 5.1% in the same time.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Aamal Company Q.P.S.C

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Although the share price is down over three years, Aamal Company Q.P.S.C actually managed to grow EPS by 52% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

It's strange to see such muted share price performance despite sustained growth. Perhaps a clue lies in other metrics. Therefore, we should look at some other metrics to try to understand why the market is disappointed.

We note that, in three years, revenue has actually grown at a 17% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating Aamal Company Q.P.S.C further; while we may be missing something on this analysis, there might also be an opportunity.

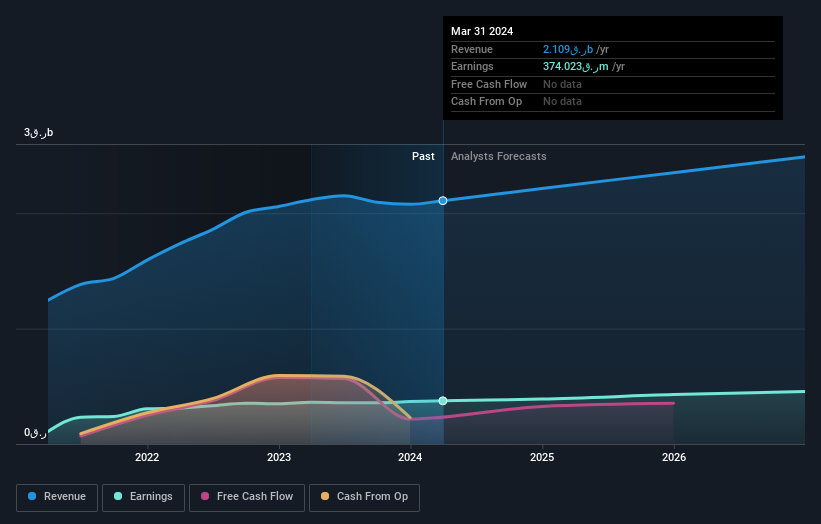

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Aamal Company Q.P.S.C has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Aamal Company Q.P.S.C's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Aamal Company Q.P.S.C's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Aamal Company Q.P.S.C's TSR, which was a 5.5% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

While the broader market gained around 1.3% in the last year, Aamal Company Q.P.S.C shareholders lost 3.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 5% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before forming an opinion on Aamal Company Q.P.S.C you might want to consider these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Qatari exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DSM:AHCS

Aamal Company Q.P.S.C

Engages in the property, trading and distribution, industrial manufacturing, and managed services businesses in Qatar and internationally.

Solid track record with excellent balance sheet.