Stock Analysis

Doha Bank Q.P.S.C (DSM:DHBK) sheds ر.ق301m, company earnings and investor returns have been trending downwards for past three years

Many investors define successful investing as beating the market average over the long term. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term Doha Bank Q.P.S.C. (DSM:DHBK) shareholders have had that experience, with the share price dropping 37% in three years, versus a market decline of about 3.5%. The more recent news is of little comfort, with the share price down 36% in a year. Even worse, it's down 9.4% in about a month, which isn't fun at all.

After losing 6.0% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Doha Bank Q.P.S.C

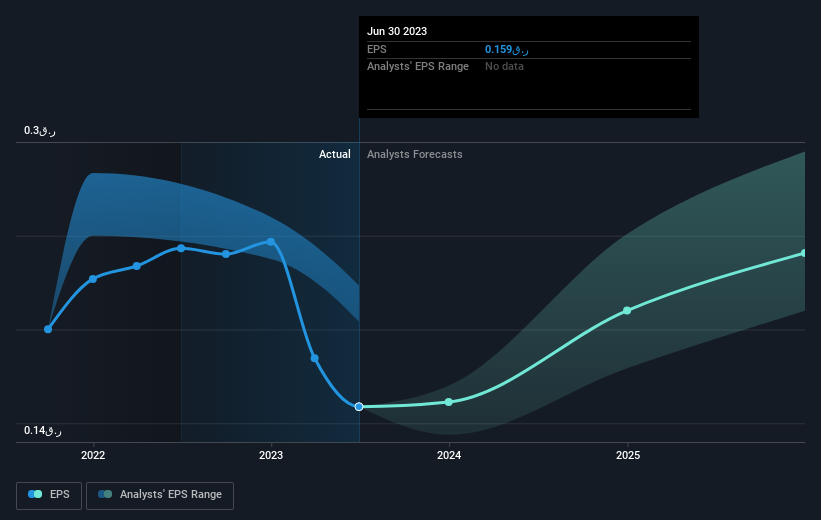

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the three years that the share price fell, Doha Bank Q.P.S.C's earnings per share (EPS) dropped by 1.5% each year. This reduction in EPS is slower than the 14% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy. This increased caution is also evident in the rather low P/E ratio, which is sitting at 9.51.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Doha Bank Q.P.S.C, it has a TSR of -30% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

We regret to report that Doha Bank Q.P.S.C shareholders are down 32% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 18%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 3% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Doha Bank Q.P.S.C is showing 1 warning sign in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Qatari exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Doha Bank Q.P.S.C is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:DHBK

Doha Bank Q.P.S.C

Doha Bank Q.P.S.C., together with its subsidiaries, provides various banking products and services to individual and corporate clients in Qatar and internationally.

Solid track record with adequate balance sheet.