- Portugal

- /

- Other Utilities

- /

- ENXTLS:RENE

Is REN a Standout After 29.7% Jump and EU Grid Investment Momentum in 2025?

Reviewed by Simply Wall St

If you're looking at REN - Redes Energéticas Nacionais SGPS and wondering whether it's finally time to make a move, you're not alone. With so many investors eyeing utility stocks for their defensive qualities and steady returns, REN's journey has caught some attention. Just take a look at the numbers: up an impressive 29.7% year-to-date and boasting a five-year climb of 69.2%. Even when the broader energy infrastructure market saw turbulence, REN was a relative standout, signaling that something more than short-term trading is at work here.

These moves haven't gone unnoticed, especially as energy demand pivots with the EU's green transition and evolving grid needs. Signals from recent market developments suggest investors are starting to price in greater long-term stability and potential growth for companies handling the backbone of power transmission, like REN. Of course, every stock tells a story, and REN’s tale right now is one of solid returns built on cautious optimism, not hype.

Want a quick scorecard? Out of six key valuation checks, REN is currently undervalued in five, landing it a robust value score of 5. That’s a strong indicator for anyone weighing both risk and reward. But valuations are more than numbers on a spreadsheet; they are shaped by how, and which, methods you use. In the sections to come, we'll dig into those different valuation approaches to shine a brighter light on REN's prospects, and for those who stick around, reveal a perspective on valuation that just might change how you invest.

REN - Redes Energéticas Nacionais SGPS delivered 29.1% returns over the last year. See how this stacks up to the rest of the Integrated Utilities industry.Approach 1: REN - Redes Energéticas Nacionais SGPS Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a tried-and-true method that estimates a company’s value by projecting future free cash flows and discounting them back to today’s terms. This technique helps investors understand what REN is truly worth if it continues to earn and grow as expected.

REN's latest reported Free Cash Flow sits at €382.3 Million. Looking ahead, analysts project the company’s Free Cash Flow will grow over the next several years, with an estimate of €124 Million in 2029. Beyond these analyst estimates, further projections rely on calculated trends. Over a ten-year span, available projections show Free Cash Flow steadily rising, with consensus and extrapolated numbers each year.

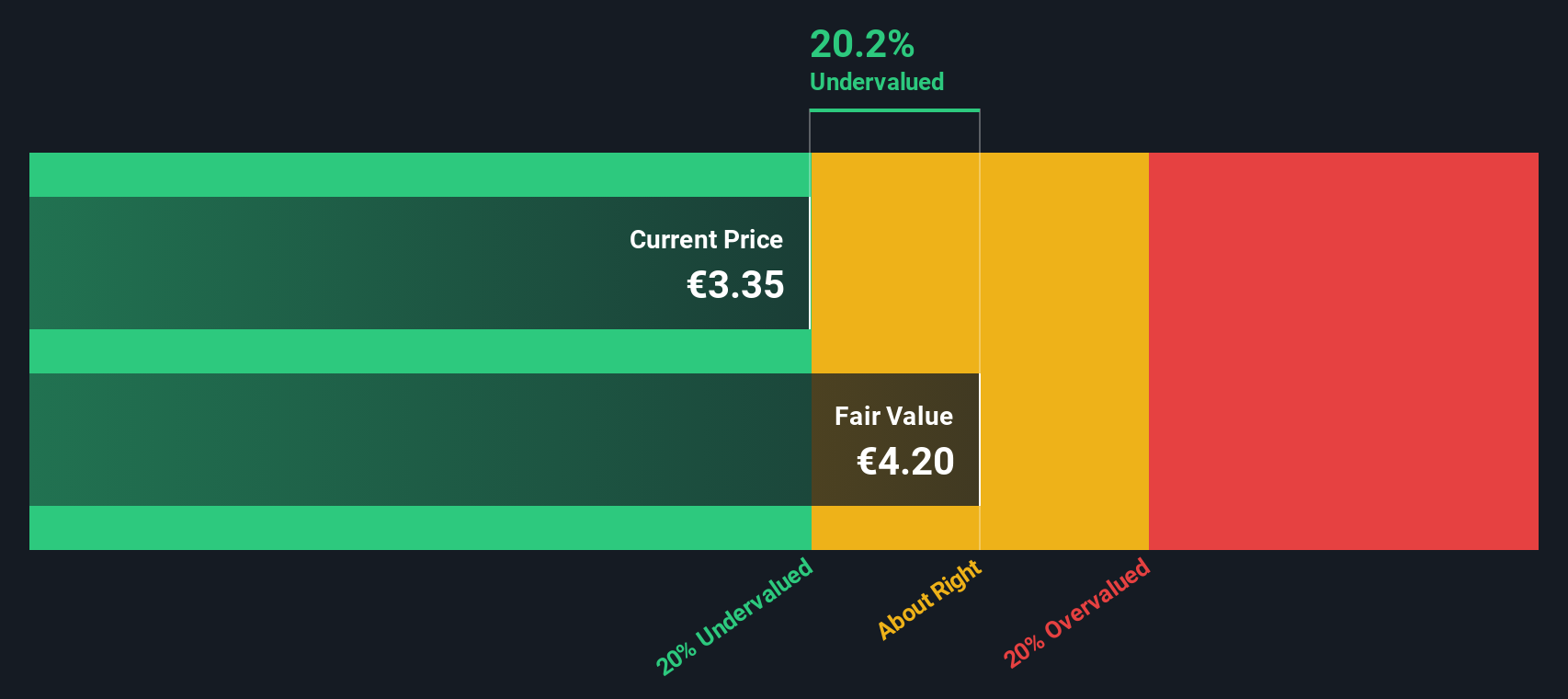

Based on the 2 Stage Free Cash Flow to Equity model, the resulting intrinsic value per share is estimated at €3.95. This value is approximately 24.8% higher than REN’s current share price, indicating meaningful upside if these forecasts pan out.

For investors, this sizable DCF-implied discount means REN is trading well below its calculated worth, offering an attractive margin of safety for value-focused portfolios.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for REN - Redes Energéticas Nacionais SGPS.

Approach 2: REN - Redes Energéticas Nacionais SGPS Price vs Earnings

The Price-to-Earnings (PE) ratio is often the preferred valuation tool for established, profitable companies like REN. This multiple reveals how much investors are paying for each euro of the company's earnings, which makes it ideal for businesses generating steady profits. The PE ratio is especially telling because it reflects market expectations for future growth as well as perceived risk in the company’s future outlook. Higher growth and lower risk often justify a higher "normal" PE ratio.

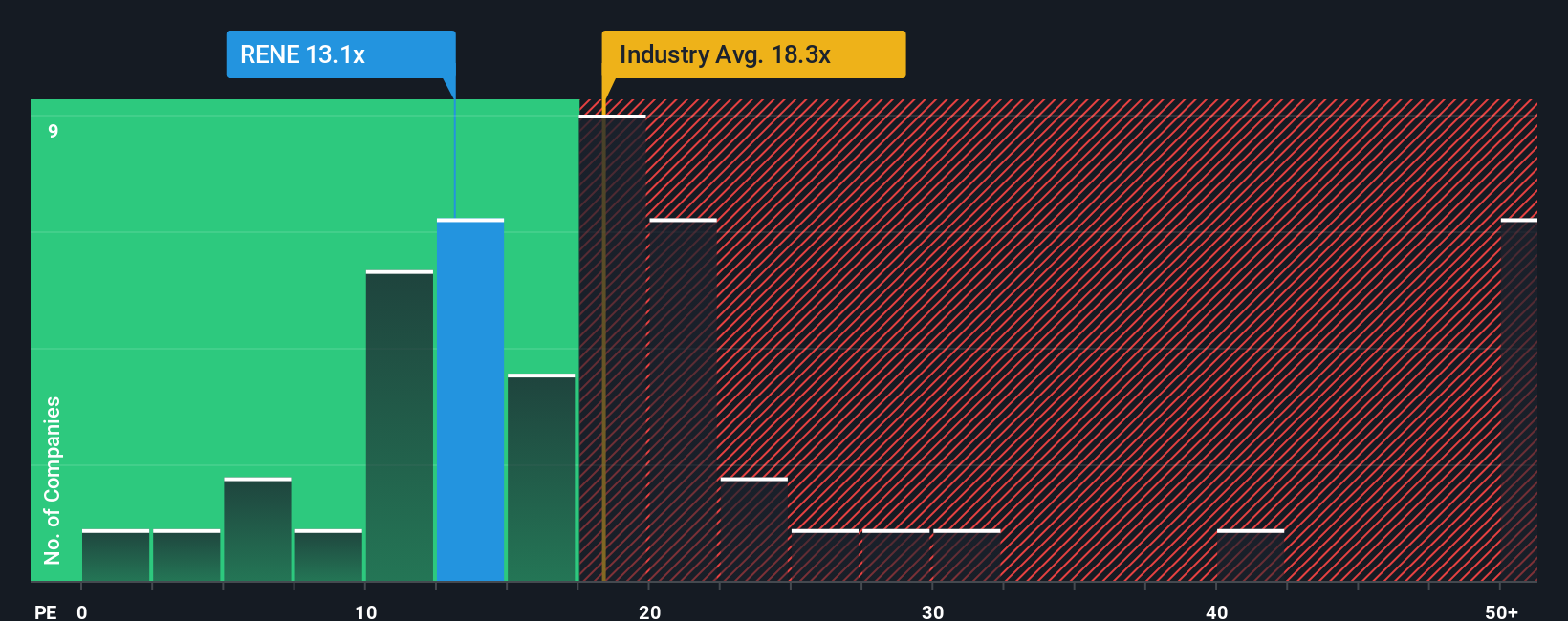

Looking at REN’s valuation, the company is trading at a PE ratio of 11.6x. For context, the average for REN's industry, Integrated Utilities, is 17.8x, and the peer average is notably higher at 40.2x. While these benchmarks suggest REN trades at a lower valuation than many of its peers, direct multiples do not always tell the whole story.

Simply Wall St’s "Fair Ratio" provides an alternative view. Unlike straightforward comparisons, this proprietary metric adjusts for REN’s earnings growth, profit margins, market cap, and risk factors. The Fair Ratio for REN currently sits at 12.3x, highlighting that fair value should account for nuances that peer or industry averages can miss.

Since the difference between REN’s actual PE ratio (11.6x) and its Fair Ratio (12.3x) is less than 0.10, the stock appears to be valued about right based on these broader fundamentals.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your REN - Redes Energéticas Nacionais SGPS Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your unique way of connecting REN’s story, such as regulatory changes, strategies, or energy trends, to specific financial forecasts and an assumed fair value. Instead of relying only on formulas or static metrics, Narratives let you create and update your own view for REN, bringing together your expectations for future revenues, profit margins, and how the business will adapt.

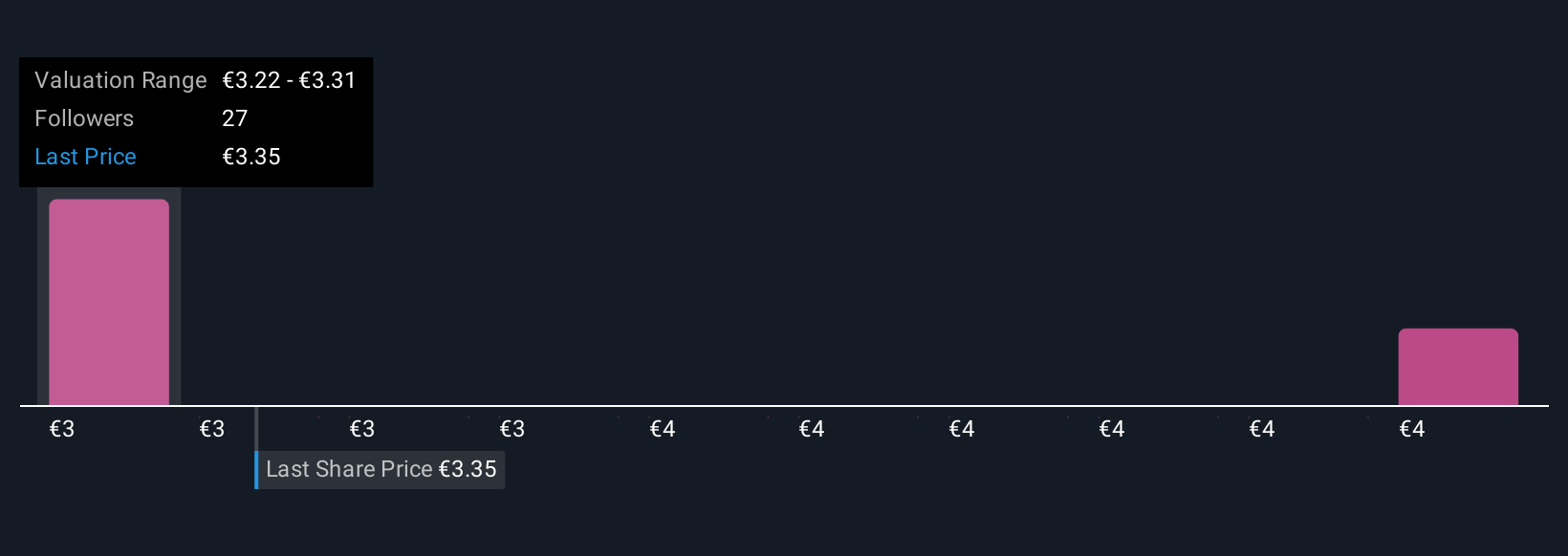

Using Narratives, available on the Simply Wall St Community page used by millions of investors, you can test out your investment thesis by linking your outlook directly to a fair value and tracking how that compares to the current share price. Narratives are dynamic and automatically reflect new news or earnings results, so your outlook evolves in real time. For instance, one REN investor might believe in steady grid modernization and see a fair value near €3.50, while another expects margin pressure from regulation and sets it closer to €2.70. Narratives help you put your analysis in context so you can decide with confidence whether REN is undervalued, fairly priced, or a hold for you right now.

Do you think there's more to the story for REN - Redes Energéticas Nacionais SGPS? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:RENE

REN - Redes Energéticas Nacionais SGPS

Engages in the transmission of electricity and natural gas in Portugal.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives