- Portugal

- /

- Paper and Forestry Products

- /

- ENXTLS:SEM

Semapa - Sociedade de Investimento e Gestão SGPS' (ELI:SEM) five-year earnings growth trails the 22% YoY shareholder returns

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But when you pick a company that is really flourishing, you can make more than 100%. One great example is Semapa - Sociedade de Investimento e Gestão, SGPS, S.A. (ELI:SEM) which saw its share price drive 104% higher over five years. It's also good to see the share price up 15% over the last quarter.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

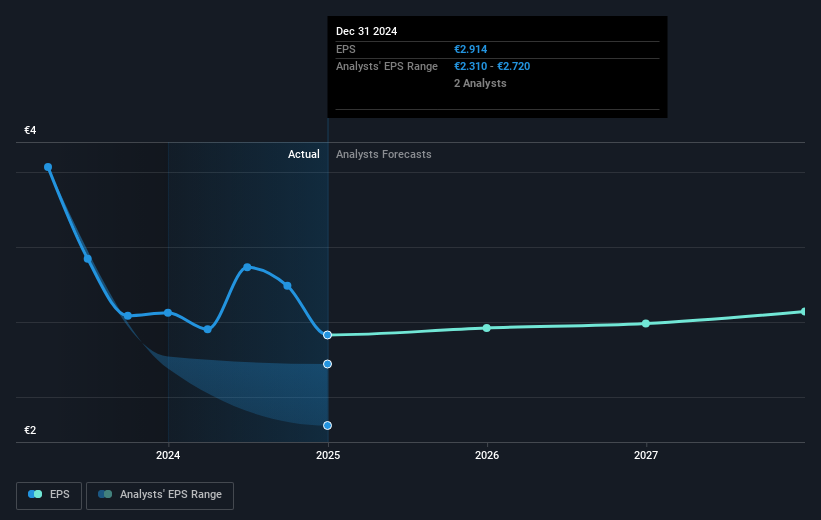

During five years of share price growth, Semapa - Sociedade de Investimento e Gestão SGPS achieved compound earnings per share (EPS) growth of 14% per year. This EPS growth is reasonably close to the 15% average annual increase in the share price. Therefore one could conclude that sentiment towards the shares hasn't morphed very much. Indeed, it would appear the share price is reacting to the EPS.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Semapa - Sociedade de Investimento e Gestão SGPS' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Semapa - Sociedade de Investimento e Gestão SGPS, it has a TSR of 175% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Semapa - Sociedade de Investimento e Gestão SGPS shareholders have received a total shareholder return of 13% over the last year. Of course, that includes the dividend. However, that falls short of the 22% TSR per annum it has made for shareholders, each year, over five years. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Semapa - Sociedade de Investimento e Gestão SGPS , and understanding them should be part of your investment process.

But note: Semapa - Sociedade de Investimento e Gestão SGPS may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Portuguese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:SEM

Semapa - Sociedade de Investimento e Gestão SGPS

Through its subsidiaries, produces and sells pulp, printing and writing papers, and tissues in Portugal, the rest of Europe, the United States, Africa, Asia, and Oceania.

Very undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives