Stock Analysis

- Poland

- /

- Electric Utilities

- /

- WSE:TPE

Investors one-year returns in TAURON Polska Energia (WSE:TPE) have not grown faster than the company's underlying earnings growth

While TAURON Polska Energia S.A. (WSE:TPE) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 16% in the last quarter. But looking back over the last year, the returns have actually been rather pleasing! To wit, it had solidly beat the market, up 65%.

While this past week has detracted from the company's one-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

View our latest analysis for TAURON Polska Energia

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year TAURON Polska Energia grew its earnings per share, moving from a loss to a profit.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

However the year on year revenue growth of 46% would help. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

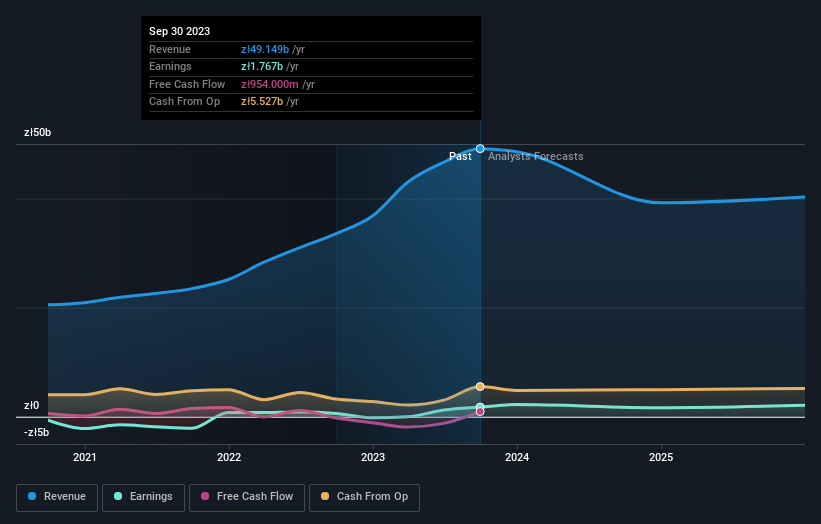

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It is of course excellent to see how TAURON Polska Energia has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that TAURON Polska Energia shareholders have received a total shareholder return of 65% over the last year. That gain is better than the annual TSR over five years, which is 9%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for TAURON Polska Energia that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Polish exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether TAURON Polska Energia is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:TPE

TAURON Polska Energia

Through its subsidiaries, generates, distributes, and supplies electricity and heat in Poland.

Fair value with acceptable track record.