ASBISc Enterprises Plc's (WSE:ASB) CEO Compensation Is Looking A Bit Stretched At The Moment

Key Insights

- ASBISc Enterprises' Annual General Meeting to take place on 8th of May

- Salary of US$213.0k is part of CEO Siarhei Kostevitch's total remuneration

- Total compensation is 67% above industry average

- ASBISc Enterprises' EPS grew by 13% over the past three years while total shareholder return over the past three years was 48%

CEO Siarhei Kostevitch has done a decent job of delivering relatively good performance at ASBISc Enterprises Plc (WSE:ASB) recently. As shareholders go into the upcoming AGM on 8th of May, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders will still be cautious of paying the CEO excessively.

See our latest analysis for ASBISc Enterprises

How Does Total Compensation For Siarhei Kostevitch Compare With Other Companies In The Industry?

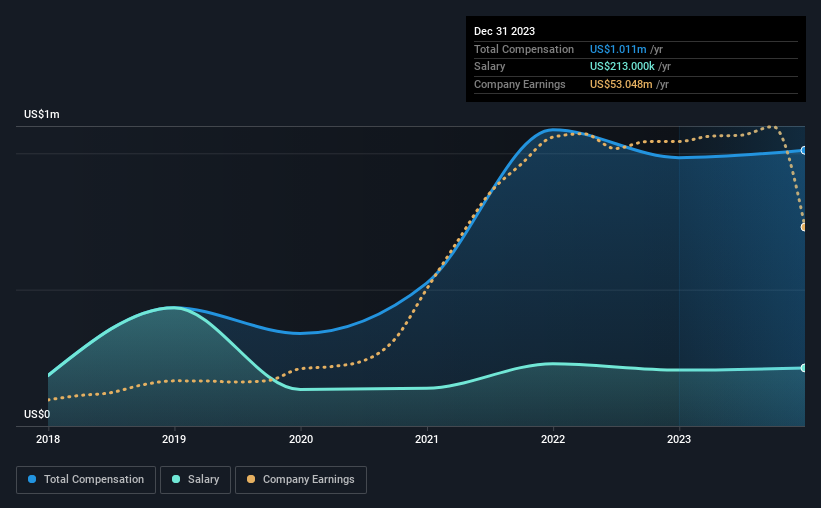

At the time of writing, our data shows that ASBISc Enterprises Plc has a market capitalization of zł1.4b, and reported total annual CEO compensation of US$1.0m for the year to December 2023. That's mostly flat as compared to the prior year's compensation. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$213k.

In comparison with other companies in the Polish Electronic industry with market capitalizations ranging from zł814m to zł3.3b, the reported median CEO total compensation was US$606k. This suggests that Siarhei Kostevitch is paid more than the median for the industry. Moreover, Siarhei Kostevitch also holds zł501m worth of ASBISc Enterprises stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$213k | US$205k | 21% |

| Other | US$798k | US$779k | 79% |

| Total Compensation | US$1.0m | US$984k | 100% |

On an industry level, roughly 62% of total compensation represents salary and 38% is other remuneration. ASBISc Enterprises sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at ASBISc Enterprises Plc's Growth Numbers

ASBISc Enterprises Plc's earnings per share (EPS) grew 13% per year over the last three years. In the last year, its revenue is up 14%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has ASBISc Enterprises Plc Been A Good Investment?

Most shareholders would probably be pleased with ASBISc Enterprises Plc for providing a total return of 48% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 2 warning signs for ASBISc Enterprises that investors should be aware of in a dynamic business environment.

Switching gears from ASBISc Enterprises, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:ASB

ASBISc Enterprises

Operates as a trader and distributor of computer hardware and software in the Former Soviet Union, Central Eastern Europe, Western Europe, the Middle east, Africa, and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success