In the wake of a significant rally in U.S. stocks, driven by hopes for economic growth and tax reforms following a "red sweep" election outcome, small-cap stocks have shown notable gains with the Russell 2000 Index leading the charge. Amidst these market dynamics, investors are increasingly turning their attention to small-cap companies that offer unique value propositions and potential for growth beyond what is currently reflected in broader indices. Identifying such opportunities often involves looking at companies with strong fundamentals, innovative business models, or niche market positions that can thrive even amidst shifting economic policies and global uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Interactive Digital Technologies | 9.01% | 4.39% | 3.03% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| S J Logistics (India) | 34.96% | 59.89% | 51.25% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Link and Motivation (TSE:2170)

Simply Wall St Value Rating: ★★★★★★

Overview: Link and Motivation Inc. is a Japanese company offering consulting and cloud services, with a market capitalization of approximately ¥62.18 billion.

Operations: Link and Motivation generates revenue primarily from its Matching Division and Organization Development Division, with contributions of ¥15.92 billion and ¥13.49 billion, respectively. The Individual Development Division adds another ¥6.48 billion to the total revenue stream.

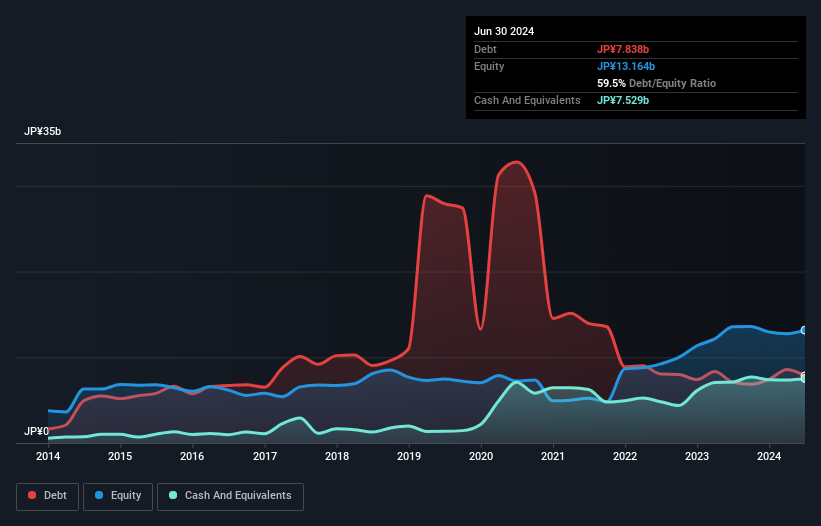

Link and Motivation, a nimble player in the market, has shown impressive financial strides. Over the past year, earnings surged by 43%, outpacing the Professional Services industry's 7% growth. The company boasts an admirable net debt to equity ratio of 2.3%, reflecting strong financial health. Interest payments are well-covered by EBIT at a robust 82x coverage, indicating solid operational performance. Recently, Link and Motivation announced plans for strategic mergers and acquisitions to boost its Consulting & Cloud business, aiming for expansion through new products and sales channels while enhancing its workforce capabilities.

- Navigate through the intricacies of Link and Motivation with our comprehensive health report here.

Explore historical data to track Link and Motivation's performance over time in our Past section.

Fukushima GalileiLtd (TSE:6420)

Simply Wall St Value Rating: ★★★★★★

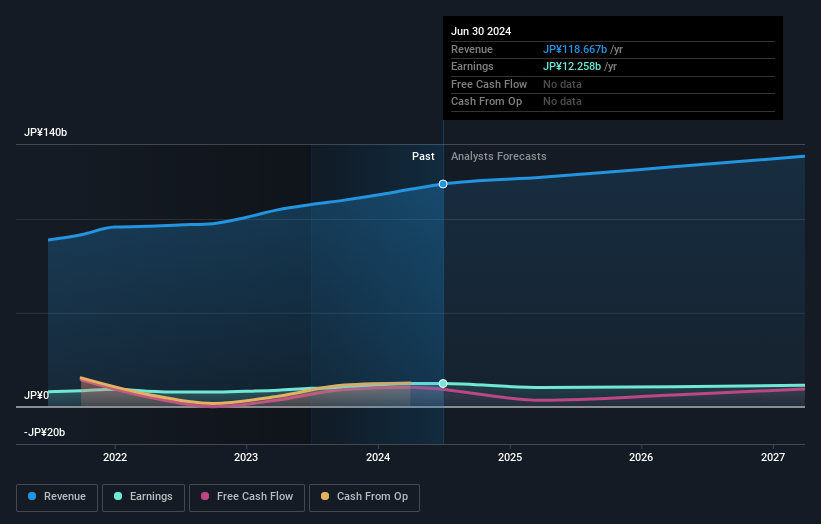

Overview: Fukushima Galilei Co. Ltd. is engaged in the manufacturing, sales, and maintenance of commercial freezer refrigerators and refrigerated showcases, serving both domestic and international markets with a market cap of ¥113.71 billion.

Operations: Fukushima Galilei generates revenue through manufacturing, sales, and maintenance of refrigeration equipment. The company has a market cap of ¥113.71 billion.

Fukushima Galilei is making waves with its impressive 26% earnings growth over the past year, outpacing the Machinery industry's modest 0.8%. This debt-free company has significantly improved its financial health from five years ago when it had a debt-to-equity ratio of 0.4%. Trading at a substantial discount of 67.2% below estimated fair value, it presents an attractive opportunity compared to peers. Despite forecasts suggesting a potential earnings dip by 2% annually over the next three years, its high-quality earnings and positive free cash flow reinforce confidence in its operational strength and profitability.

Vercom (WSE:VRC)

Simply Wall St Value Rating: ★★★★★☆

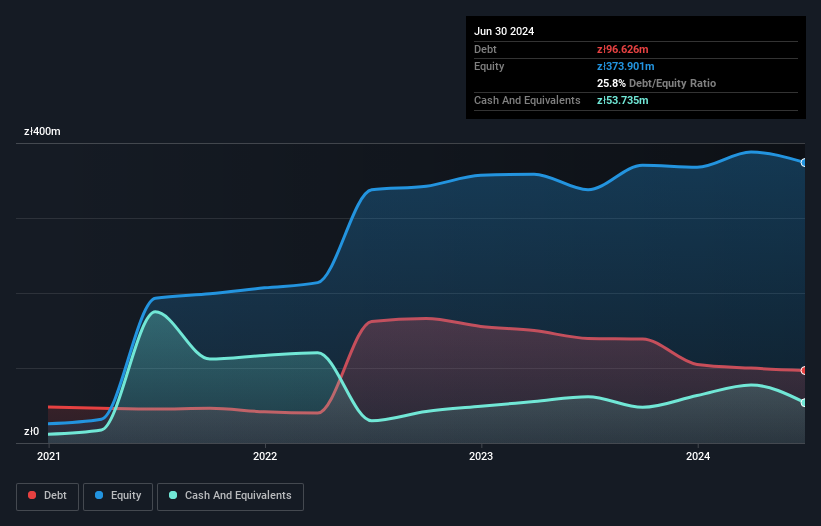

Overview: Vercom S.A. develops cloud communications platforms and has a market capitalization of PLN2.68 billion.

Operations: Vercom generates revenue primarily from its CPaaS segment, totaling PLN401.89 million.

Vercom showcases a promising profile with earnings growth of 65.6% over the past year, outpacing the Software industry average of 0.8%. The company's recent financial report highlights a sales increase to PLN 115.91 million for Q2, up from PLN 81.1 million in the previous year, while net income reached PLN 18.24 million compared to PLN 17.59 million last year. With high-quality earnings and interest payments well-covered by EBIT at a ratio of 9.6x, Vercom seems robust financially and is trading at approximately 3% below its estimated fair value, suggesting potential for future appreciation in value.

- Click to explore a detailed breakdown of our findings in Vercom's health report.

Examine Vercom's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Access the full spectrum of 4643 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6420

Fukushima GalileiLtd

Manufactures, sells, and maintains commercial freezer refrigerators, refrigerated showcases, and other refrigeration devices in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.