Sescom S.A.'s (WSE:SES) Shares Leap 25% Yet They're Still Not Telling The Full Story

Sescom S.A. (WSE:SES) shares have had a really impressive month, gaining 25% after a shaky period beforehand. The last month tops off a massive increase of 163% in the last year.

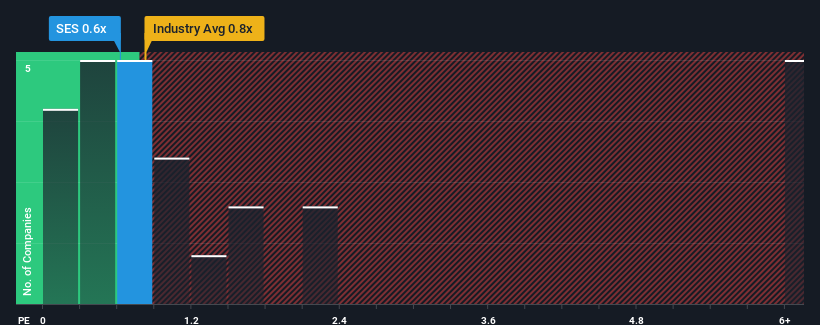

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Sescom's P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the IT industry in Poland is also close to 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Sescom

What Does Sescom's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Sescom has been doing very well. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sescom's earnings, revenue and cash flow.How Is Sescom's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Sescom's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 53%. Pleasingly, revenue has also lifted 96% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 6.1% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's curious that Sescom's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Sescom's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Sescom currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Sescom (2 can't be ignored) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:SES

Sescom

Provides facility management services for retail chains in Poland and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives