DataWalk (WSE:DAT) Shareholders Have Enjoyed A Whopping 534% Share Price Gain

We think that it's fair to say that the possibility of finding fantastic multi-year winners is what motivates many investors. Not every pick can be a winner, but when you pick the right stock, you can win big. Take, for example, the DataWalk S.A. (WSE:DAT) share price, which skyrocketed 534% over three years. In the last week shares have slid back 2.3%.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for DataWalk

Because DataWalk made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 3 years DataWalk saw its revenue grow at 64% per year. That's much better than most loss-making companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 85% per year, over the same period. It's always tempting to take profits after a share price gain like that, but high-growth companies like DataWalk can sometimes sustain strong growth for many years. So we'd recommend you take a closer look at this one, or even put it on your watchlist.

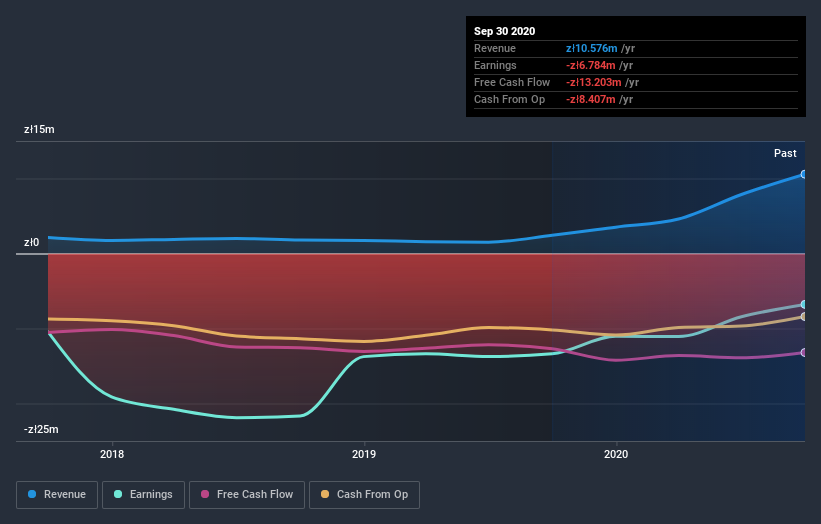

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on DataWalk's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that DataWalk has rewarded shareholders with a total shareholder return of 246% in the last twelve months. That's better than the annualised return of 44% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for DataWalk you should be aware of, and 1 of them shouldn't be ignored.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

When trading DataWalk or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:DAT

DataWalk

Provides an enterprise IT class software platform in Poland, North and South America, and internationally.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success