There's no doubt that money can be made by owning shares of unprofitable businesses. Indeed, Acrebit (WSE:ACR) stock is up 435% in the last year, providing strong gains for shareholders. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

In light of its strong share price run, we think now is a good time to investigate how risky Acrebit's cash burn is. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

See our latest analysis for Acrebit

How Long Is Acrebit's Cash Runway?

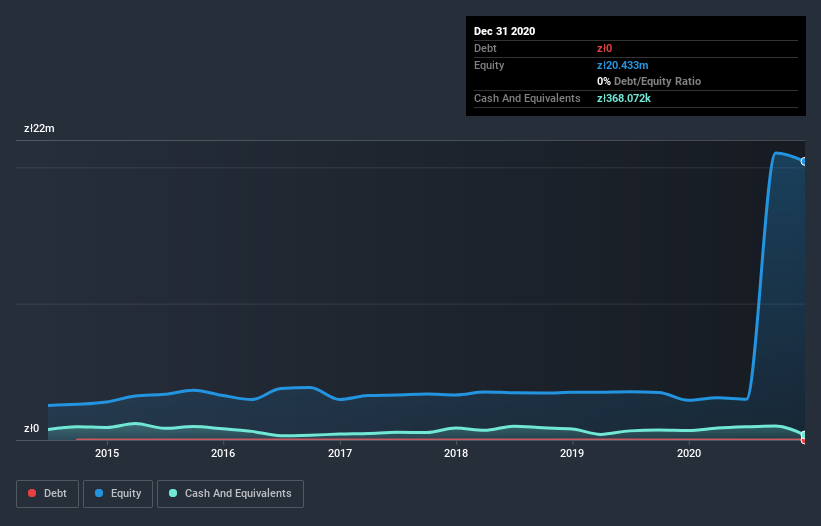

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at December 2020, Acrebit had cash of zł368k and such minimal debt that we can ignore it for the purposes of this analysis. Looking at the last year, the company burnt through zł520k. Therefore, from December 2020 it had roughly 8 months of cash runway. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. You can see how its cash balance has changed over time in the image below.

How Hard Would It Be For Acrebit To Raise More Cash For Growth?

Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of zł95m, Acrebit's zł520k in cash burn equates to about 0.5% of its market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

So, Should We Worry About Acrebit's Cash Burn?

Given it's an early stage company, we don't have a lot of data with which to judge Acrebit's cash burn. However, it is fair to say that its cash burn relative to its market cap gave us comfort. Even though we don't think shareholders should be alarmed by its cash burn, we do think they should be keeping a close eye on it. Taking a deeper dive, we've spotted 5 warning signs for Acrebit you should be aware of, and 3 of them don't sit too well with us.

Of course Acrebit may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Acrebit, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:YOS

Yoshi Innovation

Engages in the medical technology brokerage business in Poland.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives