- Poland

- /

- Real Estate

- /

- WSE:ECH

Share Price Aside, Echo Investment (WSE:ECH) Has Delivered Shareholders A 132% Return.

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But if you pick the right individual stocks, you could make more -- or less -- than that. While the Echo Investment S.A. (WSE:ECH) share price is down 46% over half a decade, the total return to shareholders (which includes dividends) was 132%. That's better than the market which declined 0.1% over the same time. The good news is that the stock is up 1.1% in the last week.

View our latest analysis for Echo Investment

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate half decade during which the share price slipped, Echo Investment actually saw its earnings per share (EPS) improve by 141% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS.

Due to the lack of correlation between the EPS growth and the falling share price, it's worth taking a look at other metrics to try to understand the share price movement.

We note that the dividend has fallen in the last five years, so that may have contributed to the share price decline.

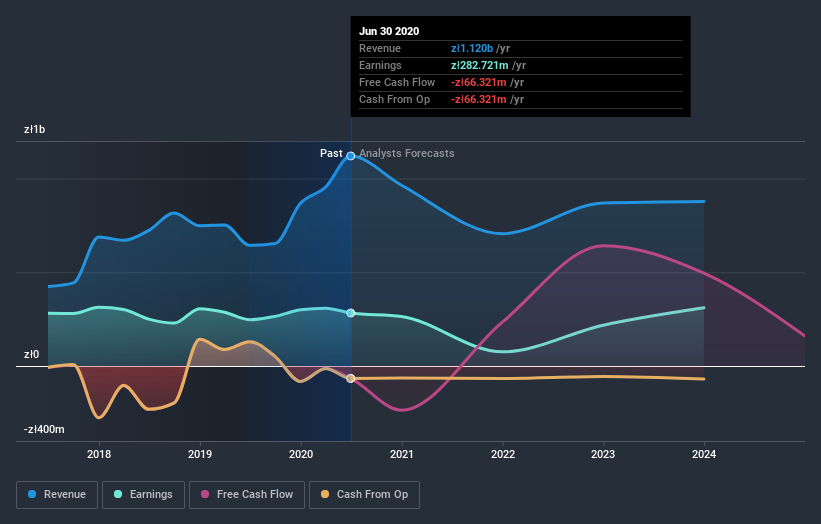

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Echo Investment has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Echo Investment stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Echo Investment, it has a TSR of 132% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market lost about 7.2% in the twelve months, Echo Investment shareholders did even worse, losing 16% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 18%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Echo Investment better, we need to consider many other factors. Even so, be aware that Echo Investment is showing 4 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

But note: Echo Investment may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

If you decide to trade Echo Investment, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Echo Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About WSE:ECH

Echo Investment

Engages in the construction, lease, and sale of office, retail, and residential buildings in Poland.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Community Narratives