Some Shareholders Feeling Restless Over e-Kiosk S.A.'s (WSE:EKS) P/E Ratio

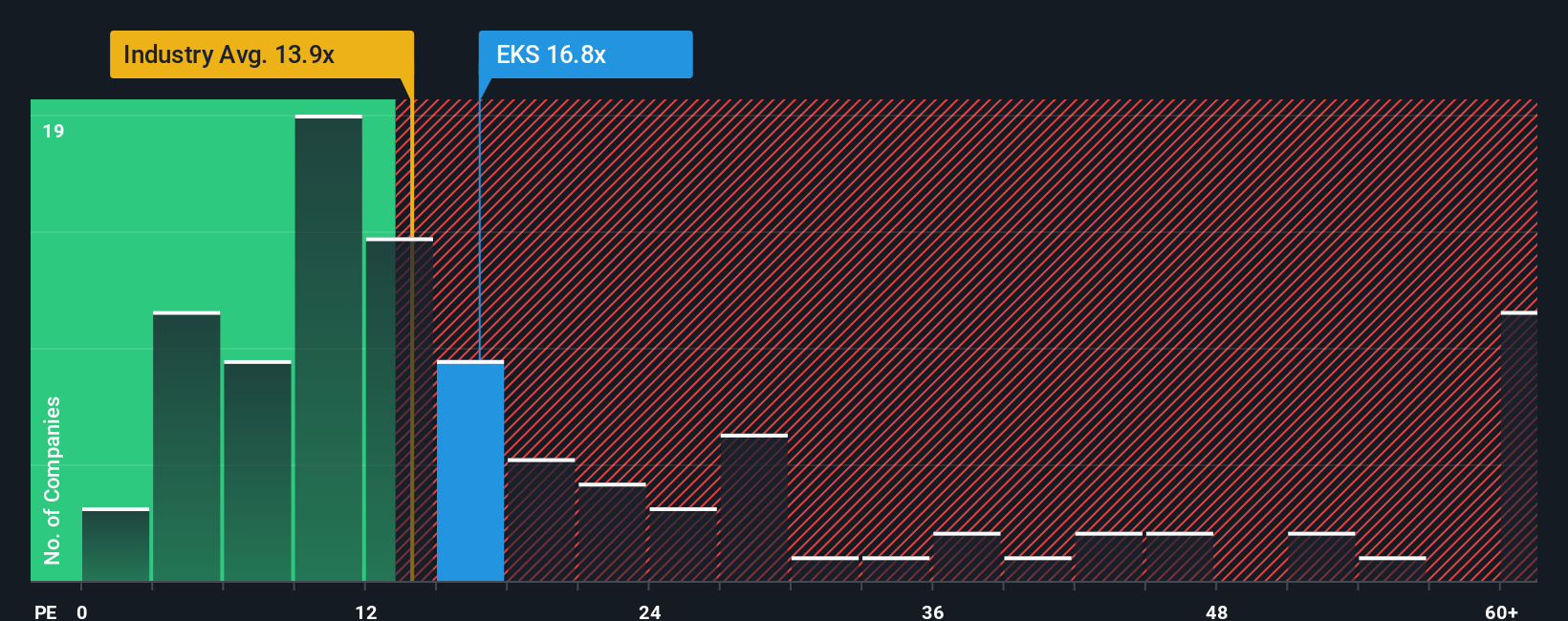

When close to half the companies in Poland have price-to-earnings ratios (or "P/E's") below 12x, you may consider e-Kiosk S.A. (WSE:EKS) as a stock to potentially avoid with its 16.8x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

For example, consider that e-Kiosk's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for e-Kiosk

How Is e-Kiosk's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like e-Kiosk's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 25%. The last three years don't look nice either as the company has shrunk EPS by 62% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 19% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that e-Kiosk is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

What We Can Learn From e-Kiosk's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that e-Kiosk currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You need to take note of risks, for example - e-Kiosk has 4 warning signs (and 2 which don't sit too well with us) we think you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:EKS

e-Kiosk

Engages in the distribution of digital publications for corporate entities and public institutions in Poland.

Moderate risk with mediocre balance sheet.

Market Insights

Community Narratives