- Poland

- /

- Entertainment

- /

- WSE:CRJ

Here's Why We Think Creepy Jar's (WSE:CRJ) Statutory Earnings Might Be Conservative

Broadly speaking, profitable businesses are less risky than unprofitable ones. That said, the current statutory profit is not always a good guide to a company's underlying profitability. In this article, we'll look at how useful this year's statutory profit is, when analysing Creepy Jar (WSE:CRJ).

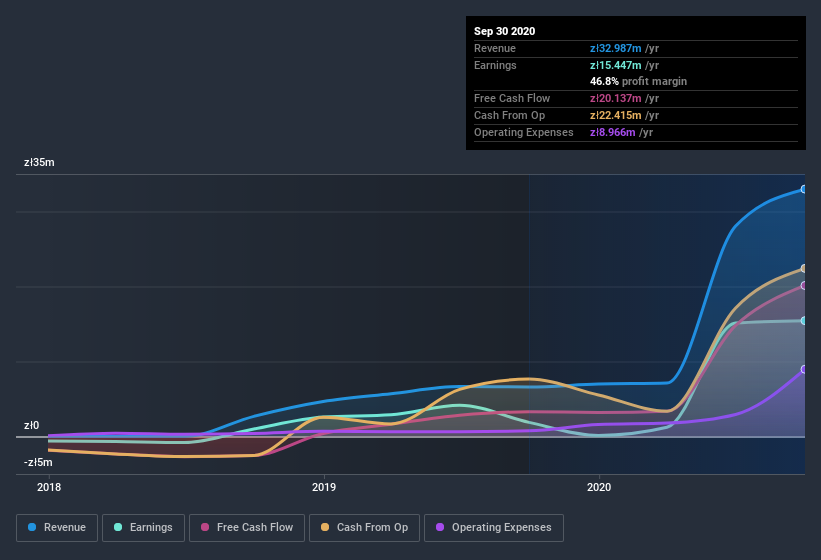

While Creepy Jar was able to generate revenue of zł33.0m in the last twelve months, we think its profit result of zł15.4m was more important. At the risk of seeming quaint, we do like to at least examine profit, even when a stock is improving revenue and considered a 'growth stock'.

View our latest analysis for Creepy Jar

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. As a result, we think it's well worth considering what Creepy Jar's cashflow (when compared to its earnings) can tell us about the nature of its statutory profit. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Creepy Jar.

A Closer Look At Creepy Jar's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

For the year to September 2020, Creepy Jar had an accrual ratio of -1.45. That indicates that its free cash flow quite significantly exceeded its statutory profit. Indeed, in the last twelve months it reported free cash flow of zł20m, well over the zł15.4m it reported in profit. Creepy Jar's free cash flow improved over the last year, which is generally good to see.

Our Take On Creepy Jar's Profit Performance

As we discussed above, Creepy Jar's accrual ratio indicates strong conversion of profit to free cash flow, which is a positive for the company. Based on this observation, we consider it possible that Creepy Jar's statutory profit actually understates its earnings potential! Furthermore, it has done a great job growing EPS over the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. While earnings are important, another area to consider is the balance sheet. If you're interested we have a graphic representation of Creepy Jar's balance sheet.

Today we've zoomed in on a single data point to better understand the nature of Creepy Jar's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Creepy Jar, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:CRJ

Creepy Jar

Develops and publishes computer games in Poland and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives