- Poland

- /

- Entertainment

- /

- WSE:CDR

Exploring 3 High Growth Tech Stocks For A Dynamic Portfolio

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and steady inflation rates, major U.S. stock indexes have experienced declines, with the Nasdaq Composite and Russell 2000 Index seeing notable losses. In this environment of tempered optimism and shifting economic indicators, high growth tech stocks can offer dynamic opportunities for investors seeking to enhance their portfolios through innovation-driven potential amidst broader market challenges.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 31.53% | 46.86% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.55% | 44.13% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| KebNi | 21.99% | 63.71% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CD Projekt | 35.15% | 43.54% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Qt Group Oyj (HLSE:QTCOM)

Simply Wall St Growth Rating: ★★★★☆☆

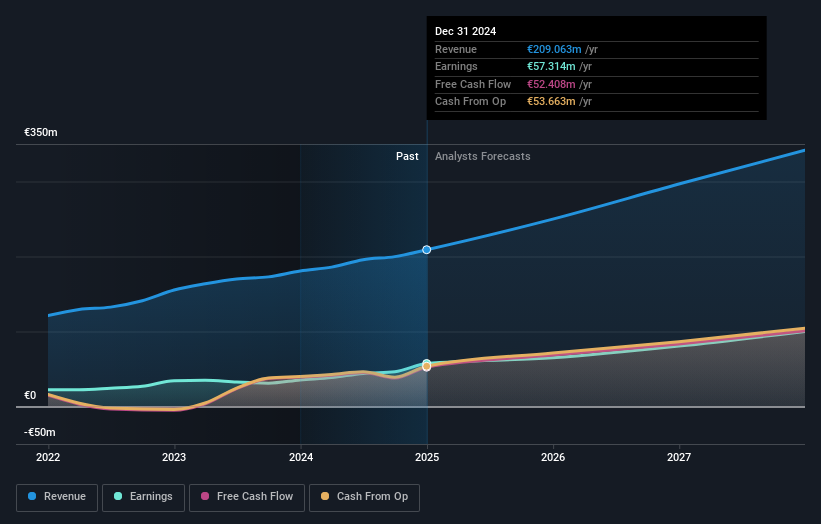

Overview: Qt Group Oyj provides cross-platform solutions for the software development lifecycle across various regions, including Finland, Europe, Asia Pacific, and North America, with a market capitalization of €1.12 billion.

Operations: The company generates revenue primarily from Software Development Tools, amounting to €209.12 million.

Qt Group Oyj, a leader in cross-platform software development, is capitalizing on the growing demand for advanced user interfaces across industries. Recently, Suzuki selected Qt's framework for its new electric vehicle's digital cockpit, highlighting the framework's ability to deliver sophisticated and customizable UIs efficiently. This partnership could significantly enhance Qt's visibility and adoption in the automotive sector, a key growth area for software technologies. Additionally, Qt has extended its influence into defense applications by achieving FACE Conformance for its MOSA framework version, ensuring that its solutions meet stringent interoperability standards required in defense systems. Despite a recent dip in earnings with net income falling to €6.74 million from €13.38 million year-over-year as of Q2 2025, the company maintains an optimistic outlook with expected sales growth between 10% to 20%. These strategic moves coupled with sustained R&D investment underscore Qt’s commitment to maintaining technological leadership and expanding market reach.

NextVision Stabilized Systems (TASE:NXSN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NextVision Stabilized Systems, Ltd. specializes in the development, manufacturing, and marketing of stabilized day and night cameras for ground and aerial vehicles with a market cap of ₪13.69 billion.

Operations: NextVision generates revenue primarily from its electronic security devices segment, amounting to $132.90 million. The company focuses on providing advanced camera solutions for both ground and aerial applications.

NextVision Stabilized Systems has demonstrated robust growth, with a notable 66.9% increase in earnings over the past year, outpacing the electronic industry's average of 3.6%. This surge is underpinned by significant sales growth from $28.06 million to $37.08 million in Q2 2025 alone, reflecting a strategic expansion in its product offerings and market reach. The company's commitment to innovation is evident from its recent inclusion in the FTSE All-World Index and substantial follow-on equity offering aimed at fueling further growth. With a forecasted annual revenue growth rate of 21.4% and earnings expected to grow by 19.5% per year, NextVision is strategically positioned to capitalize on emerging tech trends while enhancing shareholder value through careful financial strategies and expanding client engagements.

CD Projekt (WSE:CDR)

Simply Wall St Growth Rating: ★★★★★★

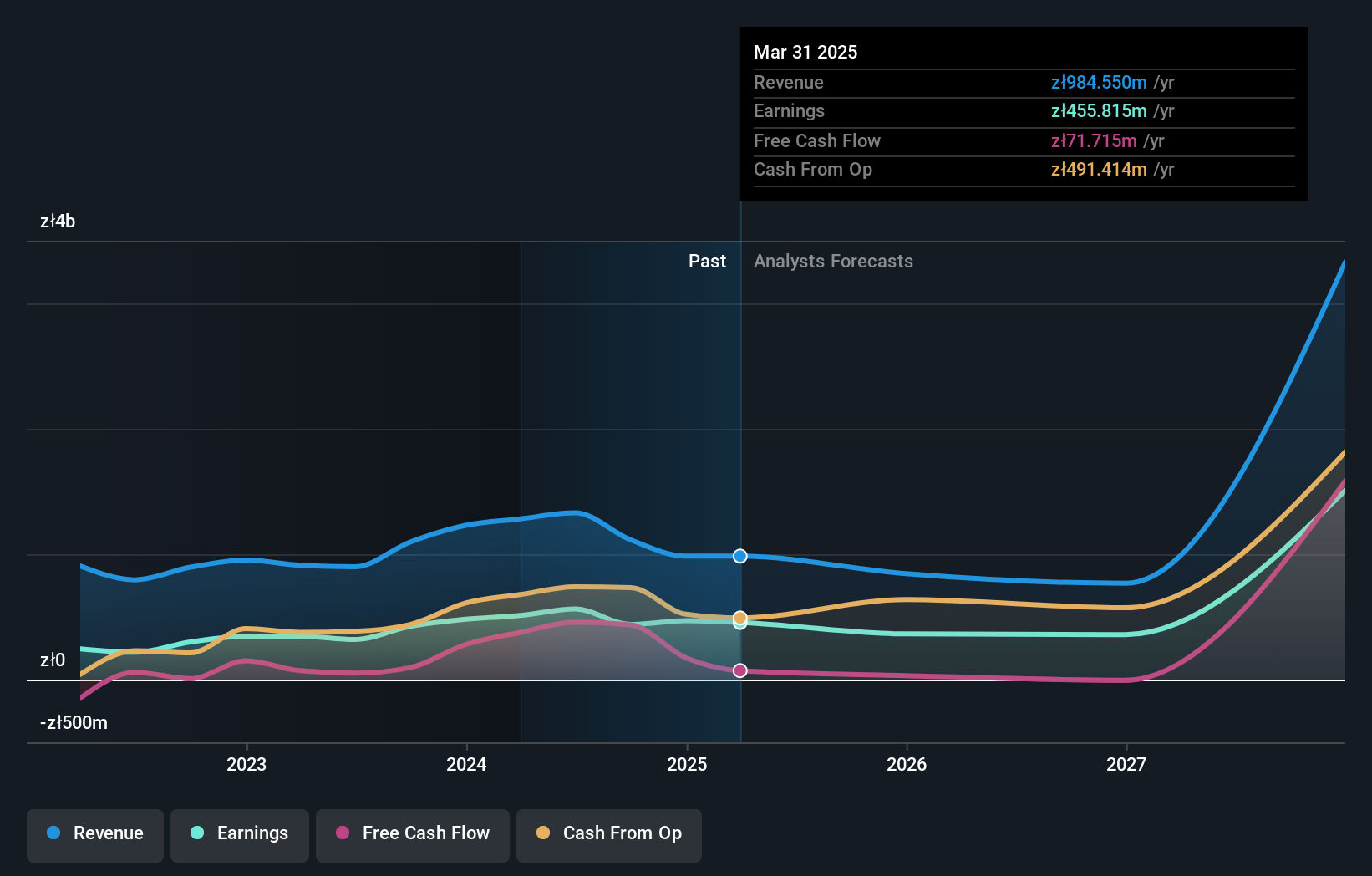

Overview: CD Projekt S.A., along with its subsidiaries, is involved in the development, publishing, and digital distribution of video games for PCs and consoles in Poland, with a market capitalization of PLN25.61 billion.

Operations: The company generates revenue primarily through its CD PROJEKT RED segment, which accounts for PLN812.26 million, and GOG.Com, contributing PLN205.97 million. The net profit margin presents an intriguing aspect of the financials worth analyzing further in context with industry standards or historical performance if available.

CD Projekt, navigating through a challenging market, has shown resilience with its earnings projected to surge by 43.5% annually, outstripping the Polish market's average of 14.7%. This growth is supported by a robust revenue increase forecast at 35.1% per year, significantly ahead of the local market projection of 4.3%. Despite a recent dip in net income from PLN 170.01 million to PLN 154.96 million in the first half of 2025, the firm remains committed to innovation and expansion as evidenced by its active participation in key industry conferences like the Goldman Sachs Communacopia + Technology Conference. With R&D expenditures tailored to bolster future offerings and maintain competitive edge, CD Projekt is strategically poised for sustained growth in the evolving entertainment sector.

- Unlock comprehensive insights into our analysis of CD Projekt stock in this health report.

Evaluate CD Projekt's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 250 companies within our Global High Growth Tech and AI Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:CDR

CD Projekt

Together its subsidiaries, engages in the development, publishing, and digital distribution of video games for personal computers and video game consoles in Poland.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives