Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Agora S.A. (WSE:AGO) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Agora

What Is Agora's Net Debt?

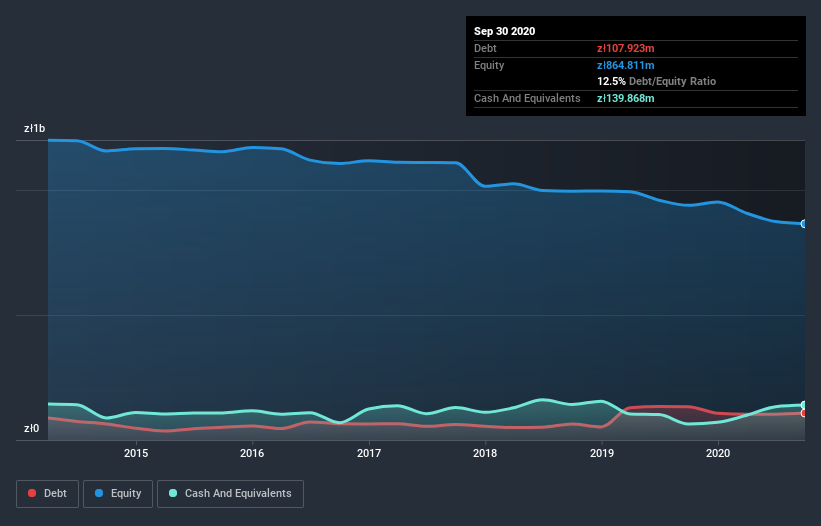

The image below, which you can click on for greater detail, shows that Agora had debt of zł107.9m at the end of September 2020, a reduction from zł133.5m over a year. However, its balance sheet shows it holds zł139.9m in cash, so it actually has zł31.9m net cash.

How Strong Is Agora's Balance Sheet?

We can see from the most recent balance sheet that Agora had liabilities of zł407.0m falling due within a year, and liabilities of zł691.3m due beyond that. Offsetting this, it had zł139.9m in cash and zł163.2m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by zł795.2m.

This deficit casts a shadow over the zł303.7m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Agora would likely require a major re-capitalisation if it had to pay its creditors today. Agora boasts net cash, so it's fair to say it does not have a heavy debt load, even if it does have very significant liabilities, in total. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Agora's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Agora had a loss before interest and tax, and actually shrunk its revenue by 19%, to zł990m. We would much prefer see growth.

So How Risky Is Agora?

While Agora lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow zł125m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. Given the lack of transparency around future revenue (and cashflow), we're nervous about this one, until it makes its first big sales. To us, it is a high risk play. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for Agora you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Agora, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:AGO

Agora

Primarily engages in publishing magazines, periodicals, and books in Poland.

Slightly overvalued with questionable track record.

Market Insights

Community Narratives